Is Hard Money Considered a Cash Offer?

In real estate, a cash offer is incredibly advantageous. It means a potential buyer wants to buy a home without a mortgage loan or any other kind of financing. From a seller’s perspective, these offers are very attractive because they can be closed faster (in a week or two weeks compared to a month at least for a bank mortgage). There is also a risk of a sale falling through due to buyer financing. Below, we go over the intricacies of hard money lending and its standing in real estate transactions, particularly addressing the question: Is hard money considered a cash offer?

Understanding Cash Offers and Hard Money Loans: A Deeper Dive

If you’re looking to purchase a “cash only” property with a hard money loan, then you need to understand what they both mean.

Cash Offers Explained

In real estate, a cash offer represents the pinnacle of transactional simplicity and efficiency. When a buyer presents a cash offer, it means they have the full amount ready to pay for the property upfront, without the need for mortgage approval or loans from financial institutions. This method is highly attractive to sellers for several reasons.

Firstly, it significantly reduces the time from offer acceptance to closing, as there’s no waiting on third-party lenders. Secondly, it diminishes the risk of transaction failure due to financing issues, making the deal more secure from the seller’s perspective. The simplicity of cash transactions also extends to the closing process, often requiring fewer documents and no lender-imposed conditions.

Hard Money Loans Unpacked

Hard money loans offer an alternative route to real estate acquisition, particularly favored by investors and buyers facing challenges in securing traditional financing.

These loans are provided by private lenders or investment companies and are secured by the property itself. Unlike conventional loans, which evaluate a borrower’s creditworthiness and financial history, hard money lenders prioritize the asset’s value and the investor’s strategy for the property.

The appeal of hard money lies in its flexibility and speed. Approvals can be granted within days, enabling rapid action on investment opportunities. However, this speed comes at a cost, including higher interest rates and often a significant down payment, reflecting the increased risk taken on by the lender.

Cash vs. Hard Money Loans

Now, here’s a quick look at the differences between hard money loans and cash.

- Source of Financing: Cash offers come directly from the buyer’s own funds, requiring no external financing, while hard money loans are provided by private lenders based on the property’s value and the borrower’s strategy for it.

- Approval and Closing Speed: Both cash and hard money offers are favored for their quick closing potential. Cash transactions bypass lender-related delays, often closing within a week or two. Hard money loans, though not instant, can close significantly faster than conventional financing options, usually within a few weeks, thanks to expedited lender evaluations.

- Transaction Security and Risk: Cash offers provide a high level of transaction security for sellers, with minimal risk of deal failure due to financial contingencies. Hard money loans, while offering a similar level of confidence in terms of closing potential, carry inherent risks related to the lender’s terms and the borrower’s ability to fulfill the loan requirements.

- Cost Implications: For buyers, cash purchases eliminate the need for loan interest and lender fees, making them a cost-effective choice. In contrast, hard money loans come with higher interest rates and additional fees reflecting the lender’s risk, potentially increasing the overall cost of the purchase.

Understanding these differences allows both parties in a real estate transaction to navigate their options more effectively, ensuring choices that align with their financial strategies and market goals.

Where Can Real Estate Investors Get Cash From?

The biggest barrier to investing in cash-only properties is obvious: getting enough cash. It might also be difficult to get enough cash for a cash offer.

If you don’t have enough money, it can be easy to assume you might not be able to give a cash offer. But this is not true.

There are some instances when a hard money loan can qualify as cash. A hard money loan is otherwise known as a short-term bridge loan or last resort loan, but these are loans not based on the borrowing and credit history of the buyer (like a mortgage loan).

Instead, hard money loans are based on the property. They are short-term, non-conforming loans from private lenders that tie to a “hard” asset instead of relying on the financial position of the applicant.

Hard money loans are great for competitive real estate markets because they can be approved very quickly. Compared to traditional mortgage loans, they can be approved significantly quicker due to being based on the hard money loan not needing a high credit score (even if hard money lenders generally have minimum credit score requirements). They use the property as collateral and the lender takes on the property if a borrower defaults on a hard money loan.

For these reasons, hard money loans are riskier than traditional loans. They have higher interest rates than traditional loans, often around 9% and 15%, potentially more. They also have shorter repayment periods of one to three years, and they also have lower LTV ratios than traditional loans. This means people who use hard money loans have need to put down higher down payments than people using mortgages.

When Do Hard Money Loans Count as Cash?

Simply put, according to New Funding Resources, hard money loans count as cash when the property does not qualify for financing. Usually, the seller tries to get traditional financing first, but when traditional financing does not work, the seller wants cash-only offers.

The property has to be distressed enough that a bank doesn’t touch the property.

In particular, hard money loans are based on the after-repair value of the property. In particular, hard money loans are designed for financing repairs for distressed properties.

Hard money loans are considered cash with distressed and foreclosed properties due to their role in repairing those distressed properties. Hard money loans are considered cash equivalent and can be advantageous in properties with a lot of upside.

The Perception of Hard Money in Cash-Only Real Estate Transactions: An In-Depth Look

Now, let’s dive into how the real estate market perceives hard money offers in relation to the straightforward cash deals, highlighting their comparative advantages and distinct nuances.

Comparing Perceptions

Within the real estate market, the perception of hard money offers versus cash offers can be strikingly similar, particularly from the viewpoint of sellers and real estate agents. The primary reason for this perspective is the comparative advantage both offer types bring in terms of transaction speed and certainty.

Hard money offers, like cash offers, can close quickly, bypassing the protracted timelines associated with mortgage processing and approval. This rapid closure capability is particularly vital in competitive real estate markets where time is of the essence, and sellers are eager to proceed.

Why Hard Money Mimics Cash

Hard money offers mirror cash offers in their ability to streamline the sale process. The expedited approval and funding process associated with hard money loans reduce the sale’s contingencies—especially those related to financing.

In an environment where traditional financing can introduce delays or uncertainties (due to stringent lending criteria, appraisal requirements, and the potential for buyer disqualification), hard money offers present a compelling alternative. Sellers appreciate the reduced risk of deal fallout, a common concern with financed purchases, making hard money offers nearly as attractive as their cash counterparts.

The nuances between cash offers and hard money loans are significant, yet their impact on real estate transactions converges in several key areas. Both facilitate quicker transactions, offer a level of certainty attractive to sellers, and enable buyers to act swiftly in a competitive market. Understanding these similarities and differences is crucial for participants in the real estate market, whether buying, selling, or advising clients on the best path forward.

Should You Use Hard Money as a Cash Offer?

Whether you should actually use hard money loans as a cash offer is an entirely different question. The answer is you should conduct your due diligence and assess your finances and make the decision for yourself.

If the property is a very competitive cash-only property, where speed of approval is tantamount, then a buyer should use a hard money loan. The speed of approval of a hard money loan needs to justify all the extra costs associated with them.

Other ways to get enough cash for a cash-only property are borrowing from a retirement fund or taking out a loan on another property.

Hard money loans are also sometimes best left to real estate professionals. Professionals with experienced track records of investing know how to renovate and sell a home for a quick profit. They are ideally perfect for fix and flips and property developments, and hard money lenders usually want to see where funds will be used for optimal ROIs (returns on investment).

A Note on Cash-Only Properties

Usually, a cash-only property needs significant work and repairs and real estate investors need to be especially careful when putting so much money down on an investment. There is no guarantee a hard money lender will give you a loan, since the lender also needs to think about whether the property can pay off the hard money loan in case the investor defaults on the loan.

When finding a hard money lender, know you will be taking on significantly more risk than with traditional financing. Hard money loans are not the best option if you don’t have a good exit strategy.

For a cash-only property, hard money loans can put you at an advantage over other investors, but it’s still important to trust lenders, like us, who can close quickly and give you the best rates. In cases outside investing in cash-only properties, however, hard money loans do not count as cash, so it’s also important to do your research on the property itself and what the seller requires.

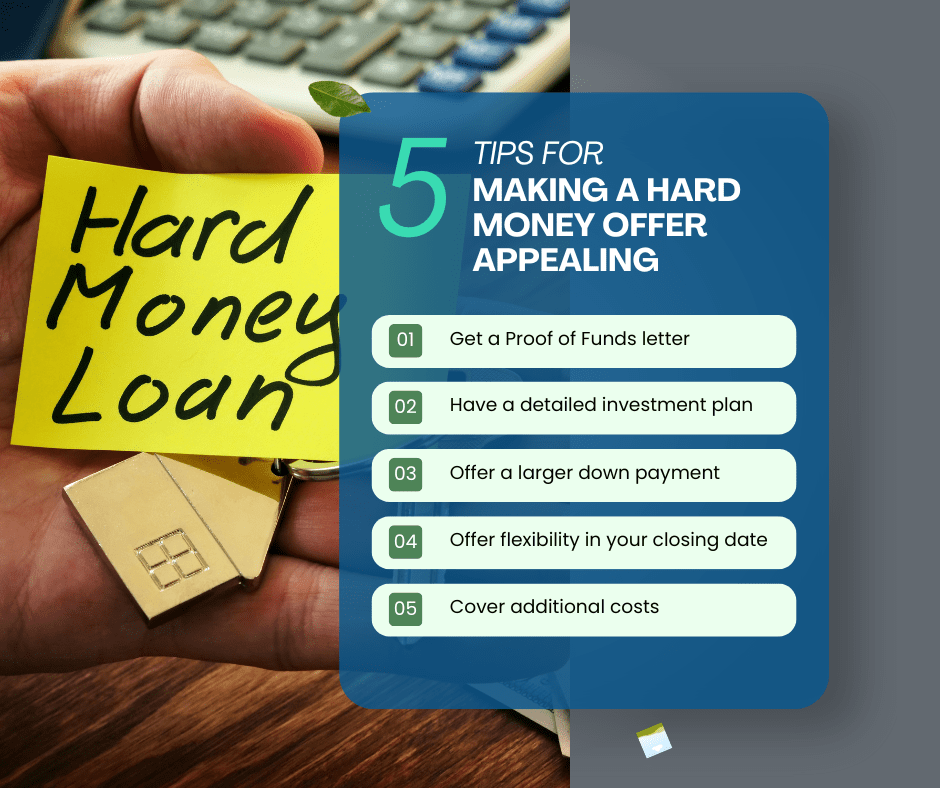

Tips for Making a Hard Money Offer Appealing

Below, we’ve compiled expert tips designed to help both buyers and sellers maximize the potential of hard money offers, ensuring a smoother, more successful real estate experience.

For Buyers

- Proof of Funds and Pre-Approval Letter: Beyond demonstrating financial readiness through proof of funds, obtaining a pre-approval letter from your hard money lender can add an extra layer of credibility to your offer. This shows sellers that not only do you have access to the necessary funds, but you also have a lender willing to back your purchase promptly.

- Detailed Investment Plan: Present a clear and detailed plan for the property to the seller, showcasing your intentions, timeline for improvements or resale, and how it aligns with using hard money financing. This can help sellers see the seriousness of your offer and the feasibility of a quick and successful transaction.

- Offer a Larger Down Payment: If possible, propose a larger down payment to signal your commitment and financial stability. A substantial down payment can sometimes offset the perceived risk associated with hard money loans from the seller’s perspective.

- Flexible Closing Dates: While hard money offers are prized for their speed, offering flexibility in your closing date to accommodate the seller’s needs can make your offer more attractive. This demonstrates your willingness to work with the seller for a mutually beneficial transaction.

- Cover Additional Costs: Offer to cover certain seller costs, such as closing fees or inspection costs, to make your hard money offer stand out. This gesture can make your proposal more appealing by reducing the financial burden on the seller.

For Sellers

- Verify the Lender’s Track Record: Research the hard money lender’s history, focusing on their track record with similar real estate transactions. Look for reviews, testimonials, and any regulatory actions against them. A reputable lender with a solid history adds confidence to the transaction.

- Request Proof of Previous Successful Deals: Ask the buyer for examples of previous successful real estate transactions financed through hard money. This will give you a clearer picture of the buyer’s experience and reliability in closing deals with hard money.

- Insist on Transparency: Require full disclosure of the loan terms from the buyer, including interest rates, points, fees, and the repayment schedule. Understanding the specifics of the buyer’s financing can help assess the risk and seriousness of their offer.

- Legal Consultation: Consider consulting with a real estate attorney experienced in hard money transactions. They can offer valuable advice, review the proposed terms, and ensure that your interests are protected throughout the transaction.

- Open and Clear Communication: Maintain open lines of communication with the buyer and their lender throughout the process. Clarify expectations, timelines, and any contingencies early on. Effective communication can prevent misunderstandings and facilitate a smoother transaction.

By adhering to these tips, both buyers and sellers can navigate the intricacies of hard money offers more effectively, ensuring that these transactions are beneficial and secure for all parties involved.

Final Thoughts

By now you should know the answer to the question, “Is hard money considered a cash offer?” Now, both cash and hard money offers have their place, each with specific advantages that can suit different investment strategies and market conditions. By carefully considering the unique aspects of each option, buyers and sellers can make decisions that align with their financial goals and transactional preferences, ensuring successful and satisfactory real estate deals.

Want to Get A Hard Money Loan?

At Hard Money Lenders IO, we give loans to real estate investors, entrepreneurs, new investors, and foreign nationals. We help with rental property loans, fix and flip loans, construction loans, and bridge loans.

We provide a free consultation, brokers to pair you with your real estate investment journey, and a hard money loan calculator to help you project the terms and rates of your hard money loan. For a cash-only property, our brokers and consultants will help you figure out whether you should use a hard money loan at all and whether the cash-only property is worth investing in.

Even if we’re not the best fit for you, we have compiled a private lenders’ directory of the best and most reputable hard money lenders in your area. The directory has a research and expert-backed list of the best hard money lenders for your particular state and city. These hard money lenders will give you the most advantageous LTV ratios and interest rates, and loan amounts in your local area.

Lastly, we help new real estate investors find hard money loans and assist them with doing so. It can be very difficult for new investors to get hard money loans, but we have compiled a list of the best hard money lenders for new investors, as well.

Here at Hard Money Lenders IO, we want to make hard money loans and real estate investing as accessible as possible to everyone, even people who consider themselves unable to receive financing from most hard money lenders. With our assistance, you might be able to secure enough funds for the cash-only property of your dreams.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.