Last Updated on March 15, 2024

Cash only seems like a relatively self-explanatory real estate term: you can only pay cash for the property, and no financing is accepted. However, while that’s technically true, “cash only” has much deeper implications for real estate investors. So, what does cash only really mean in real estate? Below, we detail everything you need to know about “cash only” and everything you need to know about it.

Understand What “Cash Only” Means in Real Estate

When we talk about a “cash only” sale in the context of real estate, we’re referring to a specific type of transaction. In such a sale, the seller stipulates that they will only accept payment in full, in cash, at the time of closing.

This requirement explicitly excludes traditional financing methods, such as mortgages or loans obtained by the buyer from a bank or other financial institution.

The term “cash” in this sense is somewhat metaphorical; it doesn’t mean physical cash is exchanged. Instead, it means that the buyer must have access to sufficient funds to cover the entire purchase price and associated costs upfront, typically transferred via electronic means or a cashier’s check at closing.

This method of transaction signifies a streamlined process, devoid of the hurdles and time consumption usually associated with mortgage approvals, underwriting, and the potential for last-minute financing issues.

By requiring cash payments, sellers ensure that buyers are not only serious but also financially capable of completing the transaction quickly and without the need for lender intervention.

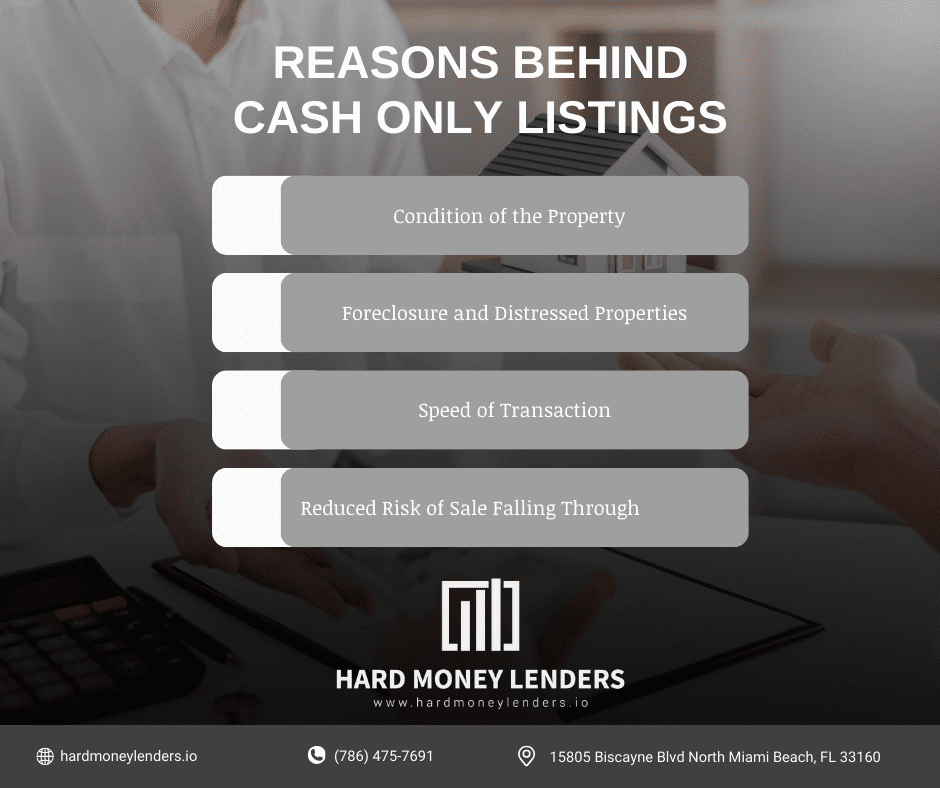

Reasons Behind “Cash Only” Listings

The preference for “cash only” listings among sellers and agents is driven by a variety of strategic considerations, each aiming to simplify or expedite the sale process. Here are the primary reasons why a property might be listed as “cash only.”

- Condition of the Property: Homes that require extensive repairs or renovations often do not qualify for traditional mortgages. Lenders typically want the collateral for their loan — the property itself — to be in good condition. Properties that are severely damaged, have structural issues, or need major updates might fail to pass inspections required by conventional lenders, making cash sales a more feasible route.

- Foreclosure and Distressed Properties: Properties in foreclosure or those considered distressed sales are more commonly sold for cash. These properties are usually priced below market value to encourage quick sales, often attracting investors who are capable of making immediate cash offers. Additionally, the complexity and potential legal entanglements associated with these properties can deter traditional financing options.

- Speed of Transaction: A significant advantage of cash sales is the speed with which they can be completed. Without the need to wait for mortgage approval, property appraisal, and other lending requirements, a cash sale can close in a matter of days or weeks. This rapid turnaround is particularly appealing to sellers who are looking to sell quickly due to personal circumstances, financial needs, or investment strategies.

- Reduced Risk of Sale Falling Through: Cash sales eliminate the risk of a transaction collapsing due to financing issues. In deals reliant on mortgage approvals, there’s always a chance that the buyer’s financing will be denied, delayed, or withdrawn, jeopardizing the sale. Cash transactions, by their nature, provide a level of security and certainty that both parties often find attractive.

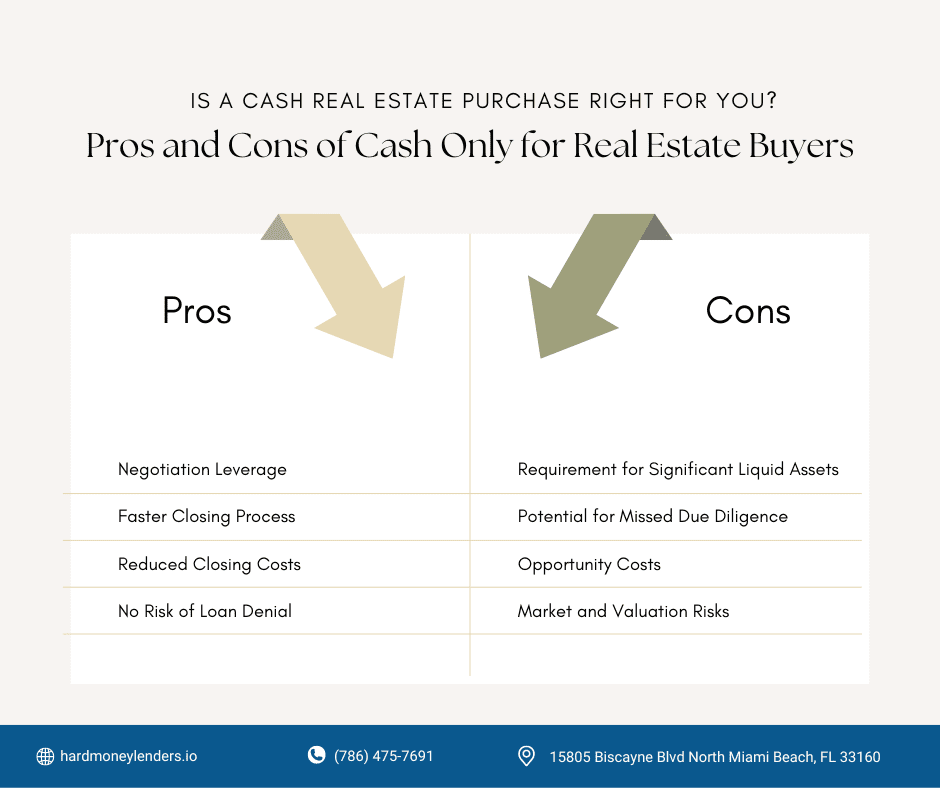

Advantages of Cash Sales for Buyers

Cash sales in the real estate market offer a plethora of benefits that can significantly enhance the buying experience and outcome for purchasers. Here’s a closer look at the distinct advantages:

- Negotiation Leverage: Buyers who can pay in cash generally hold a stronger bargaining position. Sellers, drawn to the speed and certainty of cash deals, may be more willing to negotiate on price. This can result in the buyer securing the property at a lower cost than might be possible in a financed purchase, where the seller has to consider the potential for loan approval delays or failures.

- Faster Closing Process: One of the most appealing aspects of cash purchases is the rapidity with which transactions can be completed. Without the bureaucratic entanglements of mortgage applications, underwriting, and final approval processes, cash transactions can close remarkably quickly—sometimes within a week. This swift timeline is not only convenient but can also be crucial in hot markets where speed can be the difference between securing and losing out on a property.

- Reduced Closing Costs: Cash buyers often face lower closing costs. Without lender-imposed fees, such as loan origination charges, appraisal fees, and certain administrative costs, the overall expense of closing can be significantly reduced. Additionally, cash buyers can sidestep the cost of mortgage insurance, a requisite for some financed purchases.

- No Risk of Loan Denial: Cash purchases eliminate the anxiety and uncertainty associated with mortgage approvals. Buyers don’t have to worry about the deal falling through due to not securing financing, which can offer significant peace of mind throughout the buying process.

Challenges and Considerations for Cash Buyers

Despite the clear benefits, opting for a cash purchase comes with its own set of challenges and considerations that buyers must be prepared to address:

- Requirement for Significant Liquid Assets: The most daunting challenge for many potential cash buyers is the necessity of having enough liquid assets to cover the entire purchase price and any additional expenses such as closing costs, taxes, and insurance. This requirement can limit the pool of buyers who are able to take advantage of cash deals, as it requires a substantial amount of readily accessible funds.

- Potential for Missed Due Diligence: The allure of a quick close can sometimes lead cash buyers to expedite or overlook important steps in the buying process. Skipping or glossing over comprehensive property inspections, appraisals, and other due diligence measures can result in unforeseen issues after the sale is complete. Structural problems, legal complications, or other costly surprises can emerge, which might have been identified with a more thorough examination.

- Opportunity Costs: Utilizing a large portion of one’s liquid assets for a cash purchase also entails opportunity costs. The funds used for the property purchase are no longer available for other investments, which could potentially offer higher returns. Buyers need to weigh the immediate benefits of a cash purchase against the long-term financial implications of tying up significant capital in a single investment.

- Market and Valuation Risks: Paying cash doesn’t insulate buyers from market fluctuations or from paying above market value. Without the lender-required appraisal that accompanies financed deals, cash buyers must be diligent in ensuring the property is worth the agreed-upon price, necessitating a keen understanding of the market and independent valuation efforts.

Navigating the realm of cash purchases in real estate requires a balance between leveraging the undeniable advantages and carefully managing the inherent challenges. By approaching these transactions with eyes wide open, informed by thorough research and preparation, cash buyers can maximize the benefits while mitigating the risks.

Advantages for Sellers in Cash Real Estate Transactions

- Quicker Closing Process: One of the most significant benefits for sellers in a cash transaction is the ability to close quickly. Without the wait for mortgage approvals and bank processing, cash deals can close in a fraction of the time required for financed purchases, often within a week or two. This rapid process is especially beneficial for sellers looking to offload the property swiftly due to relocation, financial necessity, or other personal reasons.

- Reduced Risk of Sale Falling Through: Cash sales virtually eliminate the risk of the sale falling apart due to financing issues. In transactions reliant on buyer financing, there’s always a possibility that the buyer’s loan application will be denied or delayed, which can disrupt or derail the sale. Cash offers provide a level of certainty and reliability that is highly appealing to sellers.

- Simplified Selling Process: Cash transactions streamline the selling process by bypassing many of the formalities and requirements associated with mortgage lending. This simplification can reduce the seller’s stress and workload, making for a smoother, more straightforward sale experience.

- Potential for a More Competitive Market: Properties advertised as cash only can attract a specific subset of buyers—typically investors or individuals with significant liquid assets—often leading to a more competitive bidding environment. This competition can potentially drive up the sale price, especially in hot markets or for properties with unique appeal.

Drawbacks for Sellers in Cash Real Estate Transactions

- Potentially Smaller Buyer Pool: By limiting the sale to cash-only buyers, sellers might be narrowing the potential buyer pool. Many prospective buyers rely on financing to purchase homes, so a cash-only stipulation could exclude a significant segment of the market, potentially reducing the number of offers received.

- Lower Sale Price: While cash transactions can lead to a quicker sale, sellers might find that cash buyers expect a lower price in exchange for the liquidity and certainty they bring to the table. This expectation can sometimes lead to a lower sale price than might be achieved in a traditional financed sale where buyers are competing with mortgage-backed offers.

- Missed Opportunities for Market Exposure: A rapid cash sale might mean the property spends less time on the market, potentially limiting its exposure to a broader audience. In some cases, extended market exposure could have led to higher offers or more favorable terms for the seller, particularly in rising markets.

- Overlooking Non-Cash Offers with Strong Potential: Sellers focusing exclusively on cash offers might overlook financed offers that are equally strong or even superior in terms of sale price and buyer commitment. Some financed buyers are willing to pay more for a property they love and may also agree to cover additional costs or meet seller-specific conditions.

What Qualifies as Cash, and Where Can You Get Cash?

In general, cash buyers have many advantages over other buyers. A cash deal is a lot easier since there is no appraisal needed, and cash buyers can close much faster than buyers who rely on traditional financing.

A buyer is usually never literally buying a home with cash. They are just using their own funds and not using financing. Some people might get cash from a third party. They can find a company to buy a home with cash or tap into a retirement account.

However, the best way to get cash for a cash-only property is through hard money loans.

What is a Hard Money Loan?

Normally, hard money loans would not qualify as cash. It is a loan and requires an approval process, much like traditional financing. However, hard money loans have a much easier and less stringent approval process.

Hard money loans are also known as last resort loans, and are mainly used for real estate transactions. Their biggest advantage over traditional financing is their very fast speed of approval.

Hard money loans can be approved within a couple of days, while traditional mortgage loans can take at least a month to be approved. This is incredibly advantageous in a seller’s market, where demand is rapidly outpacing supply and there are a lot of potential buyers and bids for the same property.

Mostly, hard money loans are used for fix and flips, and repairs of distressed properties, which is exactly what cash only properties need.

The reason hard money loans can be approved so much faster than mortgage loans is they do not rely on the financial position of the applicant.

Hard Money Loans Use Property As Collateral

Hard money loans are based on the property, and hard money lenders determine the rates and terms of a hard money loan through the projected after-repair value of the home. Hard money lenders still look at credit, but only to see if the borrower meets a minimum requirement like 600.

Since they use the property as collateral, lenders must be prepared for scenarios where borrowers default on the loan, which means the lender takes on the property. This is a much less lengthy and expensive process than a foreclosure.

However, hard money loans also have significant cons given the risks they present to both the lender and the buyer. Hard money loans come with higher interest rates than traditional mortgage loans.

As of 2024, the average interest rate for a 30-year mortgage has hovered around 7% and 8%. However, the average interest rate for a hard money loan is between 9% to 15%, and in some cases higher.

Hard money loans also have much shorter repayment periods than traditional financing. They usually need to be paid off within a year, which is a much shorter timeframe than a 30 or 15-year mortgage.

Lastly, hard money loans typically have lower loan-to-value (LTV) ratios than traditional loans. This means hard money loans cover less of the price of the home than mortgage loans, and require larger down payments as a result.

For cash only homes, hard money loans can qualify as cash. Most sellers see it as cash because it’s not traditional financing and a hard money loan is not from the bank. Hard money loans are the perfect fit for cash only homes because they provide the money very quickly and can close the deal quickly.

Zen Business says hard money loans may still encounter barriers to being counted as cash. First, they have a financing process and are subject to denial.

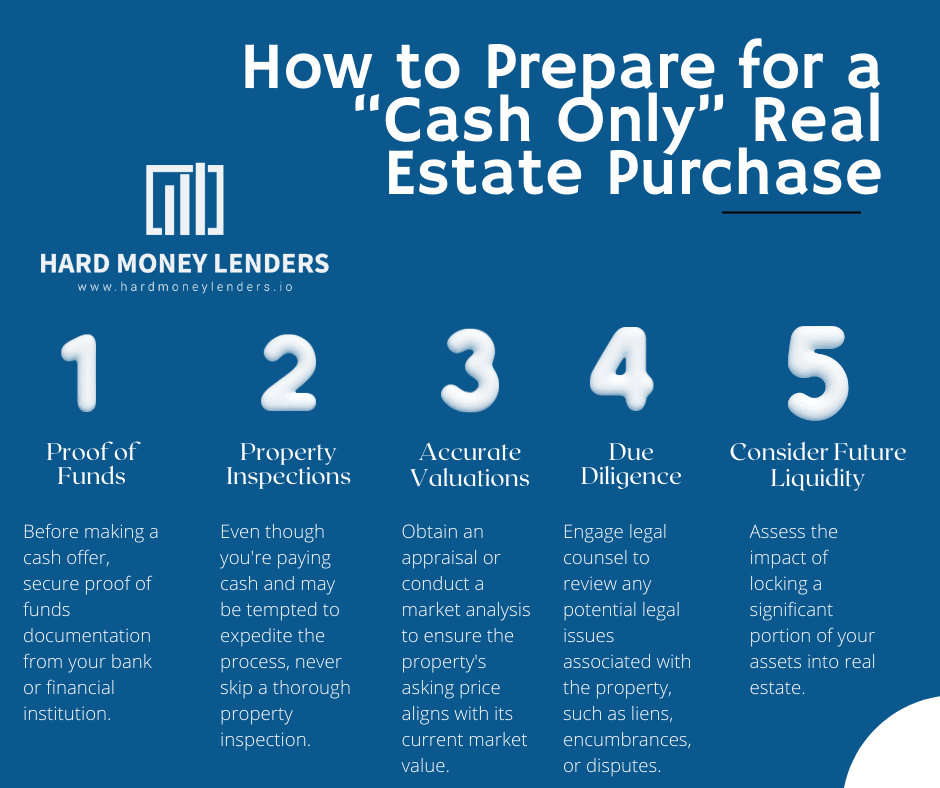

How to Prepare for a “Cash Only” Real Estate Purchase

Preparing for a ‘cash only’ purchase in the real estate market requires careful planning and thorough due diligence to ensure a smooth and successful transaction. Here are steps prospective cash buyers should consider:

- Proof of Funds: Before making a cash offer, secure proof of funds documentation from your bank or financial institution. This document serves as evidence to sellers and real estate agents that you have the necessary funds available to complete the purchase. It adds credibility to your offer and can give you a competitive edge in negotiations.

- Comprehensive Property Inspections: Even though you’re paying cash and may be tempted to expedite the process, never skip a thorough property inspection. Hiring a professional inspector to evaluate the property can uncover hidden issues such as structural damage, pest infestations, or outdated electrical systems. Understanding these potential problems ahead of time can save you significant money and headaches down the line.

- Accurate Valuations: Obtain an appraisal or conduct a market analysis to ensure the property’s asking price aligns with its current market value. This step is crucial in avoiding overpaying for a property. An accurate valuation considers comparable sales, the property’s condition, and market trends, providing a solid basis for negotiation.

- Legal and Title Due Diligence: Engage legal counsel to review any potential legal issues associated with the property, such as liens, encumbrances, or disputes. Additionally, a title search will confirm the seller’s right to sell the property and reveal any easements or covenants that might affect your use of the property.

- Consider Future Liquidity: Assess the impact of locking a significant portion of your assets into real estate. Ensure that this investment aligns with your overall financial strategy and that you maintain sufficient liquidity for other expenses or investment opportunities.

Impact of “Cash Only” Real Estate Sales on the Market

Cash-only sales have a multifaceted impact on the real estate market, influencing everything from transaction timelines to market accessibility:

- Setting Transaction Benchmarks: Cash sales often set the standard for how quickly real estate transactions can be completed, establishing expectations for speed and efficiency. This can put pressure on traditional buyers to streamline their financing and closing processes as much as possible.

- Influencing Property Values: In markets with a high volume of cash transactions, especially in investment-heavy areas, cash sales can drive property values. Since cash buyers are often looking for deals and willing to purchase properties as-is, this can lead to a discrepancy in the valuation of properties that require work versus those ready for occupancy.

- Limiting Buyer Pool: By specifying ‘cash only’, sellers limit potential buyers to those who have significant liquid assets, excluding many first-time buyers and individuals who would typically finance their home purchase. This limitation can affect the overall accessibility of the market, particularly in areas where cash sales are prevalent.

- Accelerating Gentrification: In some urban areas, a surge in cash purchases, particularly by investors, can accelerate gentrification, pushing property prices up and potentially displacing long-term residents who cannot compete with cash offers.

- Creating Investment Opportunities: For investors and buyers with the necessary resources, cash-only sales present unique opportunities to acquire properties quickly, often at a lower cost. This dynamic can encourage investment in underdeveloped or distressed properties, potentially revitalizing neighborhoods.

The prevalence of “cash only” sales reflects broader trends in the real estate market, including the increasing role of investors and the shifting dynamics of property ownership and investment. Understanding these trends is crucial for both buyers and sellers navigating today’s real estate landscape.

Questions People Asked Us Related to Cash Only in Real Estate

Why might a seller insist on a cash-only deal?

Sellers might opt for cash-only sales for various compelling reasons. Firstly, cash transactions typically close faster since they bypass the lengthy mortgage approval processes. Secondly, they minimize the risk of a sale falling through due to the buyer’s financing being denied at a late stage. Additionally, properties that require significant repairs or are in a condition that might not meet the criteria set by mortgage lenders are often listed as cash only. This approach can also be attractive for sellers looking to liquidate assets quickly due to personal circumstances or to capitalize on investment opportunities.

How do cash only purchases benefit buyers in the real estate market?

Buyers who can afford cash-only purchases reap several benefits. A notable advantage is the potential to negotiate a lower purchase price due to the appeal of a quick and guaranteed sale, which is particularly attractive to sellers in urgent need of liquidating their property. Cash transactions also circumvent the lengthy and uncertain mortgage approval process, allowing for a swifter property transfer. This rapid closure can be especially advantageous in competitive real estate markets, where the ability to close quickly can set a buyer apart from others.

What steps should be taken to prepare for purchasing a property through a cash-only transaction?

Prospective cash buyers should first verify they have sufficient funds to cover not only the purchase price but also any additional costs such as closing fees, property taxes, and insurance. Obtaining proof of funds from a bank or financial institution is crucial to demonstrate to the seller that you are prepared and serious about the transaction. It’s also essential to conduct a thorough inspection and appraisal of the property. These steps help ensure that the investment is sound and that the property does not have hidden issues that could require significant additional investment in the future.

How do cash-only sales influence the broader real estate market?

Cash-only sales can have a profound impact on the real estate market by potentially accelerating transaction times and setting price benchmarks for similar properties. However, these transactions can also narrow the field of potential buyers to those who possess substantial liquid assets, possibly sidelining average buyers who rely on financing. This limitation can affect market accessibility and diversity, potentially skewing property availability towards investors and away from traditional homebuyers.

If I’m interested in a cash-only listed property but lack immediate funds, what are my options?

For interested buyers without immediate access to the total cash amount, exploring alternative financing options becomes essential.

Options like hard money loans or bridge loans can offer the necessary funds quickly, albeit often at higher interest rates than traditional mortgages. These financing methods are designed for short-term use, providing a solution for buyers to participate in cash-only transactions while potentially refinancing into a more conventional loan arrangement post-purchase.

Is it advisable for cash buyers to skip property inspections and appraisals?

Even in cash transactions, skipping property inspections and appraisals is not advisable. These steps are critical for uncovering potential issues that could affect the property’s value or lead to significant future expenses.

Comprehensive inspections can reveal structural problems, pest infestations, or other defects, while appraisals ensure that the purchase price aligns with the property’s current market value. Diligent due diligence protects the buyer’s investment and informs their negotiation strategy.

Can cash buyers effectively negotiate prices in cash-only transactions?

Yes, cash buyers often possess considerable negotiation leverage in cash-only transactions. The assurance of a quick, finance-free closing is highly attractive to many sellers, particularly those in urgent need of liquidating their property or those who have had previous deals fall through due to financing issues. Cash buyers can leverage their position to negotiate not just on price but also on terms such as the closing date, inclusion of repairs, or other concessions that make the deal more favorable.

As a disclaimer, this article is not intended as financial advice. It is purely intended for informational and educational purposes. Please consult a real estate expert before making any major financial decisions.

Hard Money Lenders IO

We would be remiss not to advertise our own services at Hard Money Lenders IO in getting you the hard money loan you need to buy a cash only property. We fund loans for fix and flips and distressed properties, but we also offer a plethora of resources for your real estate investing journey.

We offer a loan calculator to get a projection of the rates and terms of your hard money loan. We also offer a private money lenders directory so you can compare hard money lenders in your area and find the best possible hard money lender for you, even if you determine we’re not the best partner for your real estate investing journey.

We also offer loans to foreign nationals and new investors, two groups of investors who typically have a hard time qualifying for hard money loans. While we are a Miami, Florida-based company, we think every investor should have access to the best possible loans at their disposal.

Look no further for a partner in researching, financing, and buying your cash only property.

As a disclaimer, this article is not intended as financial advice. It is purely intended for informational and educational purposes. Please consult a real estate expert before making any major financial decisions.

Jack Roberts has spent the last 5 years in the Private Money Lending world helping real estate investors secure financing for their non-owner occupied real estate investments. When he’s not thinking about real estate, Adam is an avid Jazz music fan and fisherman.