What are Construction Loans? How to Finance Your Dream Home Explained

When you’re looking to buy a house, it can be hard to find properties that meet all your needs. Whether you’re struggling to find a house that matches your ideal vision, or you simply want to have more control over your soon-to-be house, one great option is to build or renovate your own dream house. This gives you complete control over the features and design of your house. For those looking to take this route, construction loans provide the necessary funds but come with different stipulations compared to traditional mortgages.

In this article, we will explain the different types of construction loans,

- What are construction loans

- How to get a construction loan

- How a construction loan works

- Is it hard to get a construction loan

- How much down for a construction loan

What are Construction Loans?

Construction loans are a unique type of loan or mortgage designed specifically for renovating a property or building a house.

Construction loans are a unique type of loan or mortgage designed specifically for renovating a property or building a house.

Unlike standard home loans, construction loans have higher interest rates and shorter term periods. They’re typically disbursed in stages based on construction progress and require detailed plans and frequent inspections.

Construction loans can help you pay for renovations or building costs. Generally, the funds from a construction loan are given to the contractor that is building or renovating your home, rather than being paid to you (the borrower) directly.

Types of Construction Loans

There are four main types of construction loans.

Construction-to-Permanent Loans

These loans start out as a construction loan but will switch to a traditional mortgage once construction is finished. These construction loans are sometimes referred to as “single-close” construction loans because you only need to apply and close once for both the construction loan and the mortgage. This helps you avoid paying multiple different closing costs! If your construction is planned out already and you want to confirm your interest rates at closing, construction-to-permanent loans can be a relatively simple option.

Construction-Only Loans

Unlike construction-to-permanent loans, construction-only loans are often called “two-close” construction loans, because these loans are entirely separate from a mortgage. As a result, you will have to get approved and pay closing fees twice, once for the construction loans and once for a mortgage. Construction-only loans are meant to be paid in full once construction ends, as they are relatively short-term.

Alternatively, you can try to refinance your loan into a mortgage. If you have large amounts of cash on hand or aren’t ready to decide on mortgage terms just yet, construction-only loans can be a good way to fund the building of your house in the meantime. However, keep in mind that this strategy may add extra time, effort, and money to your project.

Renovation Construction Loans

If you’re buying a house that needs major renovations but can’t afford to finance those renovations right away, consider a renovation construction loan. These loans tie the cost of renovations into the mortgage, so that your mortgage is based on the increased value of your home after renovations are finished.

In this situation, the money is paid in installments, and the lender will have to approve all plans for the renovations. This can help you get started on renovations immediately, rather than trying to finance them later. Renovation construction loans are usually a better way to pay for renovations than personal loans because you will have longer to pay off the loan and you can get a lower interest rate on it (depending on the risk involved with your renovations).

If you’re interested in renovation construction loans, consider looking into the USDA’s Single Family Housing Guaranteed Loan Program or the FHA’s 203(k) loan.

Owner-Builder Construction Loans

Are you a contractor planning on doing the renovations for your home yourself? If so, you may qualify for an owner-builder construction loan, which is a special type of loan designed for when the owner is the person completing the construction. Whereas most construction loans pay funds out to the contractor, rather than the borrower, owner-builder loans will pay draws directly to the owner of the property. If you are a licensed contractor with previous experience, this could be a great option!

However, if you have little demonstrable experience as a contractor, you unfortunately may not qualify for this loan. For some tips on finding an excellent contractor, see here.

If you’re still confused by these types of loans, feel free to contact Hard Money Lenders for more information! Our staff is flexible and can help you understand which type of loan best fits your personal situation.

Challenges in Obtaining Construction Loans

Securing a construction loan can be a complex process fraught with several hurdles:

- Detailed Plan Scrutiny: Lenders thoroughly evaluate the construction plans to minimize risks. They assess the feasibility and detailed budgeting of the project to ensure that the plans are realistic and financially viable. Such scrutiny often requires adjustments to the plans to meet lender specifications.

- Higher Interest Rates: Construction loans typically come with higher interest rates compared to traditional mortgages. This is due to the temporary nature of the loan and the perceived higher risk before the asset is fully built. Borrowers need to budget for these higher costs.

- Large Down Payments: Lenders often require substantial down payments for construction loans—sometimes 20-30% of the project’s total cost. This high upfront cost acts as the borrower’s commitment to the project and a means of reducing the lender’s risk.

- Lender’s Oversight: During construction, the lender will conduct periodic inspections to ensure that the project meets the timelines and budget forecasts. This oversight can impact the disbursement of funds and delay the project if the lender finds issues.

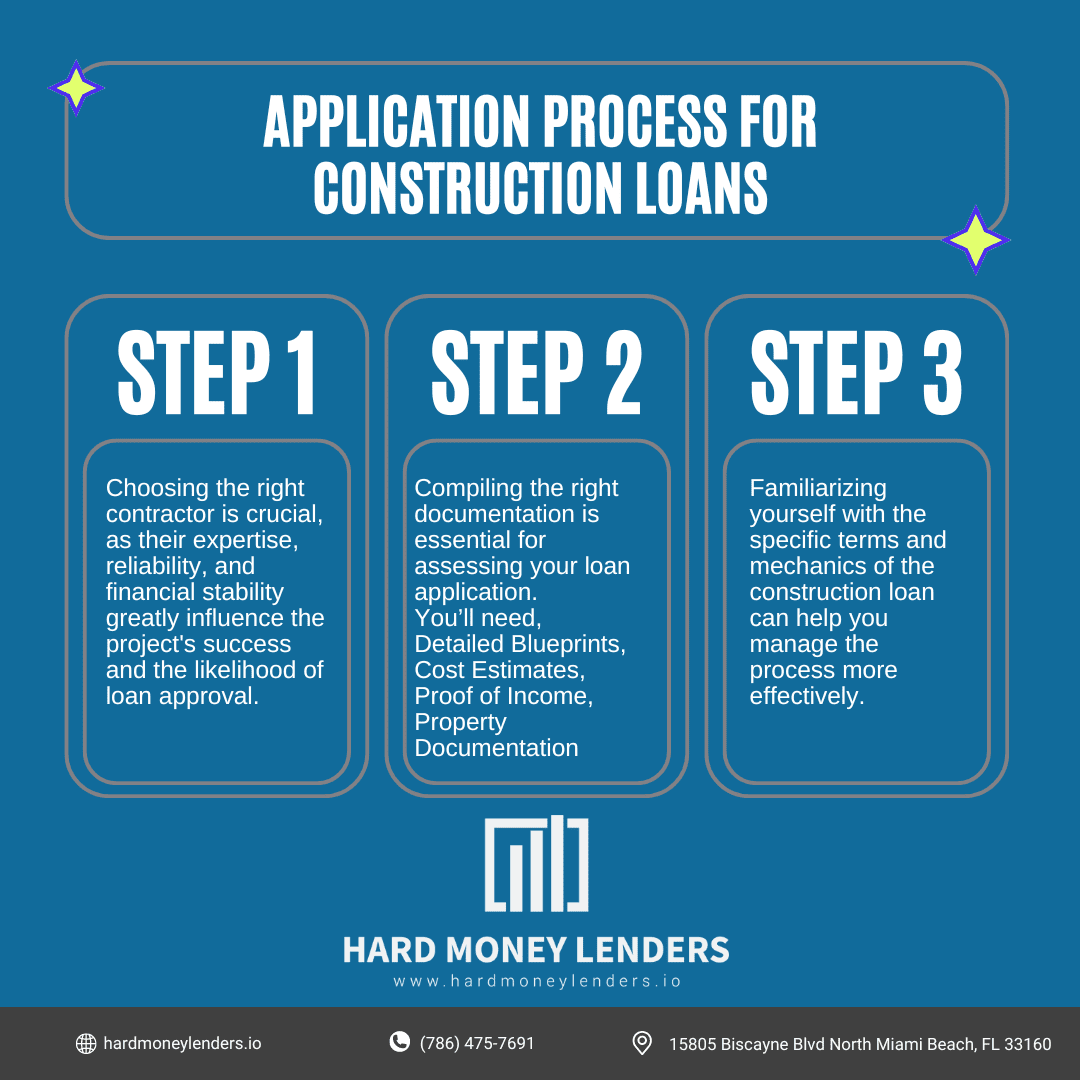

Application Process for Construction Loans

Applying for a construction loan is a multi-step process that demands thorough preparation and understanding of the lending criteria. Here’s a more detailed look at each step involved in securing a construction loan:

Applying for a construction loan is a multi-step process that demands thorough preparation and understanding of the lending criteria. Here’s a more detailed look at each step involved in securing a construction loan:

Step 1: Select a Qualified Contractor

Choosing the right contractor is crucial, as their expertise, reliability, and financial stability greatly influence the project’s success and the likelihood of loan approval.

- Verify Credentials: Ensure the contractor is licensed, insured, and has a good standing in the industry. Check their track record for completing projects on time and within budget.

- Assess Compatibility: Your contractor should have experience with projects similar in scope and budget to yours. They should also be familiar with local building codes and permitting requirements.

- Gather References: Ask for and follow up with references. Previous clients can provide insights into the contractor’s work ethic, communication style, and ability to manage the unexpected.

Step 2: Gather Necessary Documents

Compiling the right documentation is essential for assessing your loan application.

- Detailed Blueprints: Provide comprehensive architectural plans that outline the design and specifications of the project. These should include floor plans, elevations, and detailed drawings.

- Cost Estimates: Submit a detailed cost breakdown prepared by your contractor. This should list all expected costs associated with the project, including labor, materials, permits, and contingency funds.

- Proof of Income: Demonstrate your financial ability to manage the loan. This includes tax returns, W-2s, pay stubs, and any other documentation that verifies your income.

- Property Documentation: If you already own the land or property, include a copy of the deed, current mortgage statement, and any other relevant property documents.

Step 3: Understand the Terms

Familiarizing yourself with the specific terms and mechanics of the construction loan can help you manage the process more effectively.

- Loan Disbursement Schedule: Understand how the funds will be released. Construction loans typically disburse funds in phases, following inspections that verify the completion of specific stages of construction.

- Interest Payments: Know whether you will be required to make interest-only payments during the construction phase and how interest is calculated.

- Inspection and Draw Process: Learn how inspections are conducted and what criteria must be met before subsequent draws from the loan can be released. This ensures that the project aligns with the timeline and budget agreed upon in the loan terms.

- End Loan Transition: For construction-to-permanent loans, understand the conditions under which the loan will convert from a construction loan to a permanent mortgage, including any additional requirements or inspections.

Tips to Qualify for a Construction Loan

Choose your Contractor Carefully

As we’ve discussed, construction loans can be risky for lenders, and so it makes sense that they would be cautious about who they offer these loans to. One key aspect of obtaining a construction loan is finding a trustworthy contractor who will complete the work on time and stick to the budget.

Lenders will likely want to personally approve your builder and may want to review information such as their work history, materials list, budget, blueprints, and a contract with a timeline for construction. Always verify that your contractor is licensed and legitimate ahead of time. Reviewing these documents in advance for any issues will help you avoid running into problems when a potential lender wants to investigate them. If you haven’t found a contractor yet, some lenders will have their own lists of qualified contractors that they have already approved to be worked with.

Make Sure You Meet Down Payment Requirements

If you’re curious about how much to put down for a construction loan, we’re here to help! Most new construction loans require a down payment somewhere between 20% and 30%.

This differs greatly from traditional mortgages, where plans such as the FDA’s homebuyer program can help you get a down payment as low as 3.5%. However, renovation loans often require less, typically between 3.5% and 10%.

This is because renovation loans already have some sort of house to act as collateral (even if it’s in bad shape), whereas new construction loans lack collateral.

Figure Out Your Debt-to-Income Ratio

Your debt-to-income ratio is the total amount you pay each month towards your debt divided by the amount of income you take in during that month. To calculate your debt-to-income ratio, multiply that number by 100 to turn it into a percentage.

The lower your debt-to-income ratio is, the better. This shows lenders that you will have an easier time paying off the debt. The maximum debt-to-income ratio most lenders will offer is 45%, though some will only consider 35% or lower.

If you plan to apply for a construction loan in the future, try to pay off or reduce as many of your debts as possible before doing so. This will not only help you have an easier time getting a loan, but can also help you get a better rate on the loan.

Make Sure Your Credit Score is in Good Standing

Typically, lenders like to see a credit score of at least 670 or higher for construction loans, though some prefer scores like 740 or above. A high credit score demonstrates that you have a history of repaying your debts, making you seem more trustworthy.

If you have a low credit score, you might want to start considering alternative methods of financing, such as hard money loans. You should also make sure that there aren’t any inaccuracies or errors bringing down your credit score; if there are, make sure to file a dispute so they can be removed. Having a higher credit score will help you get a better rate on a loan. If your credit score is too low, you can sometimes increase your credit limits to help raise it, but be careful not to take on more credit than you can pay back.

“Make sure there aren’t any inaccuracies bringing down your credit score.”

Have a Repayment Plan

Lenders like to know how you plan on paying back the loan before they are willing to loan you money. Will you pay in cash? Will you refinance the loan once construction is over? These are important questions that will show lenders you intend to follow through and pay back your loan.

All of these factors are important in being able to get a construction loan, though the exact specifications may vary based on your lender and the amount of money you intend to borrow.

Alternatives to Construction Loans

For smaller renovation projects or unique financing needs, exploring alternatives to construction loans can be beneficial. Here’s a more detailed look at some options:

Home Equity Loans

Home equity loans are a popular choice for funding renovations without the complexities of a construction loan. These loans leverage the equity you have built in your home to provide a lump sum of cash upfront, which can be used for extensive renovations that add value to your property.

- Advantages: The interest rates for home equity loans are typically lower than those for personal loans due to being secured against your property. This makes them cost-effective for substantial, value-adding renovations.

- Considerations: It’s important to assess the amount of equity currently available in your home, as borrowing more than you have equity can lead to financial strain. Also, since your home is used as collateral, there is a risk of foreclosure if repayments are not managed properly.

Personal Loans

Personal loans offer flexibility and quick funding for smaller renovation projects. They are unsecured loans, meaning they don’t require your home as collateral.

- Advantages: Approval processes for personal loans are usually faster than for home equity loans, making them ideal for projects that need to start promptly. They also don’t put your home at risk since they’re unsecured.

- Considerations: The trade-off for the convenience and lower risk of personal loans is higher interest rates compared to secured loans. Additionally, loan amounts might not be as high as those offered by home equity loans, which could limit the scope of renovation projects.

Fix-and-Flip Loans

Fix-and-flip loans are tailored for real estate investors looking to renovate and sell a property quickly. These are typically short-term loans that cover both the purchase price of the property and the cost of renovations.

- Advantages: These loans are designed to be quick to fund and repay, aligned with the fast-paced nature of flipping houses. They often fund a significant portion of the purchase and renovation costs.

- Considerations: To secure a fix-and-flip loan, investors often need to demonstrate a proven track record of successful flips due to the higher risk associated with these loans. The costs can include higher interest rates and origination fees, reflecting the short-term, high-risk nature of the loan.

Final Thoughts on Construction Loans

Final Thoughts on Construction Loans

Construction loans are a great option for those looking to build or renovate their dream home. However, it’s important to understand the different types of financing options available and the challenges involved in obtaining them.

By doing your research and working with a reputable lender, you can secure the funds you need to bring your dream home to life.

Remember to always have a detailed plan in place and be prepared for frequent inspections to ensure your project stays on track. With the right approach, a construction loan (or another type of financing option) can be the key to building the home of your dreams.

FAQs About Construction Loans

How do I find a construction loan lender?

Having an excellent loan lender can go a long way towards making sure your construction loan process runs smoothly. Finding mortgage lenders that offer construction loans can be difficult, so you may have to do some research in your area to find options, particularly depending on what type of construction loan you’re interested in. Hard money lenders can often be a better option than banks, as they are able to offer better rates and have more flexibility. Here at Hard Money Lenders IO, we offer new construction loans in which we cover 100% of your construction and fund up to 60% of the cost of the land.

Once you’ve found several potential lenders, you can compare factors such as their rates and terms, down payment requirements, and closing costs. When you find one you like, it’s important to get prequalified. If you find out that you don’t qualify for a loan, it’s important to know that early on, as this can save you money on drawing up blueprints and detailed plans.

Don’t worry if it takes longer to close a construction loan than you expect. These loans are more complicated because there are three parties involved and they account for many future circumstances, so they generally take longer to close than traditional mortgages do.

Try to find a lender who is experienced in construction loans. One way to do this is to ask around for recommendations from anyone you know that has recently been a house. Having an experienced lender can go a long way in simplifying the process, particularly if you are new to construction loans or homebuying.

For example, here at Hard Money Lenders, we have many years of experience with construction loans and can provide invaluable advice to anyone interested in buying property in Florida due to our knowledge about the region.

Can I get a construction loan if it’s my first time buying a house?

Luckily, first-time homebuyers can obtain construction loans! Just like a traditional mortgage, everyone must start somewhere when it comes to buying a house. As long as you have a good credit score, a low debt-to-income ratio, and the ability to make a down payment, you should still qualify for a construction loan. If you are going to be buying your first house and seeking a construction loan in the near future, now is a good time to start saving up and preparing to do so! At Hard Money Lenders IO, we accept applicants of all experience levels for construction loans.

Are there loan options other than construction loans?

Construction loans are best for building your own house from scratch or completing major renovations. If you are looking to fund minor repairs or renovations on your house, you might prefer a home equity loan or a personal loan. If you are interested in renovating a house not for personal use, but to resell, consider a fix and flip loan. For more information about fix and flip loans, check out our guide here.

What can I use my construction loan to pay for?

Construction loans can be used to cover permits and fees involved with building, labor, materials, closing costs, land, and any other urgent expenses that may arise during construction processes. You can also adjust the terms of a construction loan to best fit your specific needs based on your planned construction and expenses that may apply.

Is it hard to get a construction loan?

You’re probably wondering if it’s hard to get a loan to build a house. Some lenders are hesitant to offer new construction loans because the house hasn’t been built yet, and so the property can’t be used as collateral the way houses typically are in a mortgage. Therefore, don’t be surprised if a lender wants to see detailed plans for construction, elaborate proof of your finances, and verification that your builder is trustworthy. These loans are on the risky side for lenders, which is why they usually have higher interest rates and larger down payments than traditional mortgages.

What is the difference between a construction loan and a regular loan?

Traditional mortgages are usually designed to last 15-30 years and have relatively low down payments and interest rates. Construction loans usually last about 1 year and have higher down payments, unless you obtain a construction-to-permanent loan. Interest rates for construction loans are usually a shifting rate based on an agreed-upon index, and most lenders will let you pay only the interest during the construction phase.

Furthermore, whereas most loans and mortgages are an agreement between the borrower and the lender, construction loans involve a third party: the contractor (unless you are applying for an owner-builder loan).

Unlike traditional loans, which are paid in a lump sum, construction loans are paid in draws, or installments, to the contractor completing the work. These installments are paid out proportionally to key stages of construction. To keep an eye on construction and make sure the funds are being used appropriately, most lenders will require an inspection before paying out each installment. This way the contractor or builder is only given money based on the amount of work that has been completed so far.

What can I use my construction loan to pay for?

Construction loans can be used to cover permits and fees involved with building, labor, materials, closing costs, land, and any other urgent expenses that may arise during construction processes. You can also adjust the terms of a construction loan to best fit your specific needs based on your planned construction and expenses that may apply.

Is it hard to get a construction loan?

You’re probably wondering if it’s hard to get a loan to build a house. Some lenders are hesitant to offer new construction loans because the house hasn’t been built yet, and so the property can’t be used as collateral the way houses typically are in a mortgage. Therefore, don’t be surprised if a lender wants to see detailed plans for construction, elaborate proof of your finances, and verification that your builder is trustworthy. These loans are on the risky side for lenders, which is why they usually have higher interest rates and larger down payments than traditional mortgages.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.