How to Take Advantage of Hard Money Lenders

With all the buzz surrounding the real estate market right now, it’s hard not to be interested in getting a piece of the action in a hot market like Miami, Florida! There are many good reasons to invest in real estate, from tax advantages to passive income and more. If you’ve looked into traditional lenders, however, you may find them cumbersome, slow, rigid, and too bogged down by regulations and red tape. Instead of dealing with conventional lenders, many have turned to hard money loans to get fast access to money for real estate investments. Hard money loans are different from conventional loans in many ways: for example, hard money loans have a much faster approval process than conventional loans. Another way that hard money loans differ from conventional loans is that current assets are taken into consideration much more heavily than things like credit and income history. That said, let’s take a look at what hard money loans are and how to take advantage of hard money lenders.

What Are Hard Money Loans?

Hard money loans are short-term loans secured by real estate, typically provided by private individuals or small companies rather than traditional banks or credit unions. These loans originated as an alternative financing option for real estate investors who need quick access to capital and may not qualify for conventional loans due to credit issues or other factors.

Key characteristics of hard money loans include:

Key characteristics of hard money loans include:

- Shorter Terms: Hard money loans usually have terms ranging from 6 months to 3 years, making them ideal for short-term investment projects like fix-and-flip properties.

- Higher Interest Rates: Due to the increased risk taken on by lenders, interest rates for hard money loans are generally higher than those for traditional loans, often ranging from 8% to 15%.

- Collateral Focus: The primary basis for loan approval is the value of the property being used as collateral rather than the borrower’s creditworthiness. This allows investors with less-than-perfect credit or non-traditional income sources to secure financing.

- Quick Approval and Funding: Hard money loans can often be approved and funded within a week, significantly faster than the 30-45 days typical of conventional loans.

Hard money loans are especially useful in hot real estate markets where quick access to capital can make a significant difference in securing profitable deals.

Benefits of Hard Money Loans

Hard money loans offer several benefits that make them attractive to real estate investors, particularly in competitive markets:

- Quick Funding: The ability to secure funding within days rather than weeks is crucial in fast-moving real estate markets. This speed can help investors close deals quickly and stay ahead of the competition.

- Flexible Terms: Hard money lenders can tailor loan terms to fit the specific needs of the borrower. This flexibility includes adjusting interest rates, repayment schedules, and loan amounts to better suit individual investment strategies.

- Less Stringent Approval Criteria: Since hard money lenders focus on the collateral’s value rather than the borrower’s credit history, income, or employment status, more people can qualify for these loans. This is particularly beneficial for investors who may have poor credit or unconventional income sources.

- High Loan-to-Value Ratios: Hard money lenders often offer high LTV ratios, allowing borrowers to secure larger loans relative to the property’s value. This can provide more capital for renovations or other investment needs.

How to Take Advantage of Hard Money Loans

Advantage 1: Speedy Approval

Hard money loans can be a great option for investors that don’t have time to wait around for money to hit their account for a real estate investment in a hot market like Miami, Florida. By the time an investor waits around for a conventional lender’s approval, that deal may already be gone! Hard money loans offer the advantage of speed for investors that need quick access to cash from a trusted lender. Using a hard money loan instead of a conventional loan can give you the edge you need to purchase a great investment opportunity in a hot market before other investors can get access to funds. Speedy approvals are especially useful in the hot fix-and-flip market of today!

Tip: Once you get started with a hard money lender, the approval process can go even faster! By completing many successful investments with a hard money lender, they’ll trust you more and be more willing to give out money quickly for your investment needs.

Advantage 2: Likely Approval

As stated before, hard money lenders are interested in your current assets and the value of the property you’re looking to purchase. Conventional lenders scrutinize things like credit history, employment history, and other factors that many people don’t have solid evidence of. In contrast, hard money lenders are primarily concerned with the money you have, the property you want to buy, and your current level of trustworthiness. If you have some assets in the bank, a solid business plan, and a good property picked out, hard money lenders will be much more likely to offer you approval than a conventional lender would.

Advantage 3: Flexibility

Large institutions have rigid loan policies that don’t come close to suiting the needs of everyone. When it comes to hard money lenders, they’re often much more flexible in tweaking aspects of your loan to suit your needs. Hard money loans are especially useful for investors that may not want to hold the property for the entire loan period. When it comes to hot markets like Miami, Florida, properties are often fixed-and-flipped, bought and sold, and changing hands at a greater velocity than some slower markets. By going with a hard money loan, you’ll gain the added flexibility you need to get the exact loan terms you want for your investment project.

Cons of Hard Money Loans

Hard money loans are amazing tools for use in hot markets like Miami, Florida. A speedy approval process, increased loan term flexibility, and an easier approval process are just some of the many ways you can take advantage of hard money loans in hot markets. At this point, you may be wondering what the downsides are to hard money loans.

Well, the most important downside to consider may be an increased interest rate when compared to traditional loans. For investors with short term fix-and-flip projects, this may not be much of an issue. For long-term mortgage holders, the increased interest rate could have a much bigger impact on the investment, however. Long-term mortgage holders may be advised to use a hard money loan for the initial purchase of their investment, then refinance it to a conventional loan later down the road.

Before going forward with a hard money loan, it’s advisable to thoroughly evaluate your investment opportunity. At Hard Money Lenders, we offer tools that all hard money investors can use to evaluate their projects, such as our Hard Money Loan Calculator and our Fix-and-Flip Calculator.

Key Strategies for Using Hard Money Loans

Identifying the Right Projects

Identifying the Right Projects

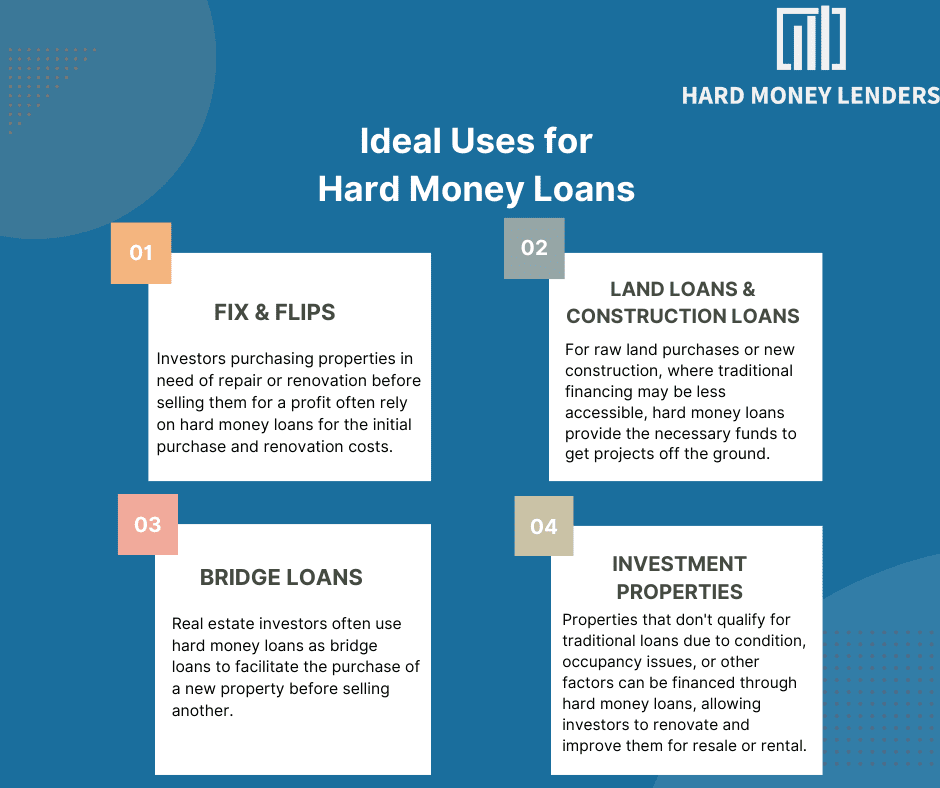

Not all real estate projects are suitable for hard money loans. Identifying the right projects is crucial for maximizing returns and ensuring a smooth investment process. Here are the best types of projects for hard money loans:

- Fix-and-Flip Properties: These involve purchasing a property, renovating it quickly, and selling it for a profit. The short-term nature of these projects aligns well with the shorter terms of hard money loans. The quick turnaround allows investors to repay the loan promptly and reinvest the profits into new projects.

- Short-Term Investments: Projects intended for quick turnaround, such as buying undervalued properties, making minor improvements, and reselling them, benefit from the rapid funding of hard money loans. These investments are perfect for markets where properties can be bought and sold quickly.

- Distressed Property Acquisitions: Properties in foreclosure or in need of significant repairs often can’t be financed through traditional loans. Hard money loans provide the necessary capital to acquire and improve these properties. Once rehabilitated, these properties can be sold for a significant profit.

Tips for Evaluating Potential Properties

- Market Analysis: Study the local real estate market to understand demand, average property values, and trends. Analyzing comparable sales (comps) in the area can help determine the property’s potential resale value.

- Property Condition: Assess the cost of necessary repairs and renovations to estimate the total investment required. Consider obtaining a professional inspection to uncover any hidden issues that could affect your budget and timeline.

- Exit Strategy: Plan how you will sell or refinance the property to repay the loan and achieve your investment goals. Having a clear exit strategy reassures lenders and reduces the risk of financial loss.

- Expected Returns: Calculate the potential return on investment by considering the purchase price, renovation costs, holding costs, and expected sale price. Use tools like a fix-and-flip calculator to project your profits accurately.

Maximizing Loan Benefits

To leverage the benefits of hard money loans effectively, consider the following strategies:

- Fast Acquisitions: Use the quick funding advantage of hard money loans to secure properties rapidly, particularly in competitive markets where timing is crucial. This speed can help you lock in deals before other investors.

- Negotiating Better Deals: With access to immediate funds, you can negotiate better deals with sellers who need to close quickly or prefer cash offers. This leverage can result in lower purchase prices and better terms.

- Renovations: Allocate part of the loan for property improvements that significantly increase its value. This strategy is essential for fix-and-flip projects where the goal is to sell the property at a higher price post-renovation. Focus on renovations that offer the highest return on investment, such as kitchen and bathroom upgrades, curb appeal enhancements, and essential repairs.

- Building Trust with Lenders: Establish a good track record with your hard money lender by successfully completing projects and repaying loans on time. This can lead to more favorable loan terms and faster approvals for future projects. Maintaining a positive relationship with your lender can also open doors to higher loan amounts and better interest rates.

Navigating the Approval Process

Navigating the Approval Process

Preparing for a Hard Money Loan Application

Securing a hard money loan requires careful preparation. Here are the essential steps to ensure a successful application:

- Gather Necessary Documentation: While hard money lenders are less concerned with credit scores and income, they still require documentation that demonstrates your financial stability and experience in real estate. Collect documents such as:

- Bank statements to show available funds.

- Records of previous real estate transactions.

- Property details for the collateral, including any appraisal reports.

- Prepare a Solid Business Plan: A comprehensive business plan shows lenders that you have a clear strategy for the investment. Include:

- A detailed description of the property and its current condition.

- A breakdown of the renovation or improvement costs.

- A timeline for the project from acquisition to completion and sale.

- Market analysis supporting your anticipated selling price or rental income.

- Have a Clear Exit Strategy: Outline how you plan to repay the loan. This could involve selling the property after renovations, refinancing with a traditional mortgage, or renting it out. A viable exit strategy reassures lenders that you have a plan to repay the loan on time.

Understanding Lender Requirements

Hard money lenders evaluate loan applications based on criteria that differ from traditional lenders. Key requirements include:

- Collateral Value: The primary consideration for hard money lenders is the value of the property used as collateral. They will often conduct their own appraisal to determine the loan-to-value (LTV) ratio, typically ranging from 60% to 80%.

- Equity: The amount of equity you have in the property affects loan approval. Higher equity means lower risk for the lender, increasing your chances of approval.

- Borrower Experience: Lenders prefer borrowers with experience in real estate, particularly in projects similar to the one you are proposing. Provide details of your previous projects and successes to bolster your application.

- Viable Exit Strategy: As previously mentioned, having a clear, realistic plan for repaying the loan is crucial. Lenders need assurance that you have a practical and achievable strategy to settle the debt.

Managing Risks with Hard Money Loans

Hard money loans come with inherent risks that borrowers should be aware of and manage effectively:

- High-Interest Rates: Interest rates on hard money loans are significantly higher than those on traditional loans, typically ranging from 8% to 15%. These rates reflect the higher risk that lenders take on. To mitigate this, ensure your project has a high-profit margin to cover the interest costs.

- Short Repayment Terms: These loans usually have terms of 6 to 18 months. To manage this risk, align your project timeline with the loan term and avoid delays in renovations or sales.

- Potential for Losing Collateral: Failure to repay the loan can result in losing the property used as collateral. To avoid this, have backup plans, such as refinancing options or secondary funding sources, in place.

Exit Strategies

Having a clear exit strategy is essential for successfully navigating a hard money loan. Here are common exit strategies:

- Selling the Property: The most straightforward strategy is to sell the property after renovations. Ensure the market conditions are favorable for a quick sale at a profitable price.

- Refinancing into a Conventional Loan: Once the property is improved and possibly increased in value, you can refinance into a traditional mortgage with better terms and lower interest rates. This is a good strategy for long-term holds.

- Renting Out the Property: If selling or refinancing isn’t immediately feasible, renting out the property can generate income to cover loan payments until you can execute another exit strategy.

How to Get Started with a Hard Money Loan

It’s easier than you may think to get started with a hard money loan! If you’re in a hot market like Miami, Florida, hard money lenders should be available to help you with financing through collateral. It’s also advisable to get in contact with a realtor that can help you scout out great investment opportunities in your area.

At Hard Money Lenders, we offer hard money loans throughout the state of Florida to help you with your next investment project!

If you’re based outside of Florida, visit our Hard Money Loan Directory to find a lender that’s right for you.

FAQs

What Types of Properties Are Eligible for Hard Money Loans?

Hard money loans can be used for a variety of property types, including:

- Residential Properties: Single-family homes, multi-family units, condos, and townhouses.

- Commercial Properties: Office buildings, retail spaces, industrial properties, and warehouses.

- Land: Raw land intended for development.

- Mixed-Use Properties: Buildings that combine residential and commercial uses.

Lenders may have specific preferences, so it’s best to check with individual lenders.

How Long Does the Hard Money Loan Process Take?

The approval process for hard money loans is significantly faster than traditional loans. Typically, you can expect:

- Initial Approval: 24 to 48 hours.

- Final Approval and Funding: 5 to 10 days.

This quick turnaround is ideal for investors needing fast access to funds.

What Are the Typical Fees Associated with Hard Money Loans?

Hard money loans often come with several fees, including:

- Origination Fees: Usually 1% to 3% of the loan amount.

- Underwriting Fees: Costs for processing the loan application.

- Appraisal Fees: Fees for property appraisal services.

- Exit Fees: Fees for early repayment of the loan, if applicable.

These fees can vary by lender, so it’s important to compare offers.

Can You Get a Hard Money Loan with Bad Credit?

Yes, hard money lenders primarily focus on the value of the property and available collateral rather than the borrower’s credit history. While a poor credit score may affect the interest rate, it typically won’t prevent you from securing a loan.

What Happens If You Default on a Hard Money Loan?

If you default on a hard money loan, the lender can:

- Foreclosure: Take ownership of the property used as collateral.

- Sell the Property: To recover the loan amount.

Defaulting can also damage your relationship with the lender and make it harder to secure future loans.

How Much Can You Borrow with a Hard Money Loan?

The amount you can borrow depends on:

- Loan-to-Value (LTV) Ratio: Typically, hard money lenders offer 60% to 80% of the property’s value.

- Equity in the Property: More equity can lead to a higher loan amount.

Always check with the lender for their specific borrowing limits.

Are Hard Money Loans Available for Long-Term Investments?

Hard money loans are primarily designed for short-term investments, typically 6 to 18 months. For long-term investments, consider:

- Using the hard money loan for acquisition and initial rehab.

- Refinancing to a traditional mortgage once the property is stabilized.

Can Foreign Investors Obtain Hard Money Loans?

Yes, many hard money lenders offer loans to foreign investors. Requirements may include:

- Proof of property ownership or a purchase agreement.

- Adequate collateral.

- A local representative or management company.

Always check with the lender about specific requirements for foreign investors.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.