Last Updated on May 8, 2024

If you’ve ever wondered, “How do I become a house flipper?” You’ve come to the right place. Read on to find out what is house flipping, how to start flipping houses, and most importantly — the 9 steps you can take to become a successful house flipper.

What is House Flipping?

One of the first steps in flipping a house is determining your budget. Most buyers work by the 70% Rule, meaning that a property should be purchased for at least 70% of its ARV, less any repairs required. This takes into account the condition of the house, home insurance, utilities, and property taxes. It also accounts for unexpected issues like vandalism or theft.

Another crucial step is securing a loan for the project. This loan allows you to take advantage of your biggest asset – your home. Of course, the drawback is that it eats into your profits from the flip. For this reason, it’s important to carefully compare the rates of home equity loans with those of personal loans.

House flippers often move in and out of deals quickly. This allows them to avoid debt and interest payments that can come with a home purchase. The downside to this strategy is that most conventional lenders won’t finance a house flip.

In addition, they must pay property taxes and mortgage payments while they’re holding the house.

A good property flipper can earn a healthy profit quickly, as well as gain experience in construction and real estate. The process can teach you how to evaluate prospective buyers and sellers. It can also help you learn the real estate market, and even help you get connections with realtors.

How Do I Become a House Flipper?

To become a successful house flipper, you’ll need to develop a solid business plan and develop a strong network of professional contacts. In addition, you should have some knowledge of construction, real estate, and design. You’ll also need to know how to find people who can help you with these skills since you’ll need to work with a team of experts.

Before you can start flipping houses, you’ll need to find the right property. Finding the right one can be a challenge, so you should make sure you have access to financing. The first step is to get pre-approved for a home loan. A good credit score is essential, and you may need to put down up to 20% of the value as collateral. Then, once you have a loan, you’ll need to find a contractor.

You’ll also need to learn about neighborhoods. Different neighborhoods attract different kinds of buyers. For example, some neighborhoods attract young professionals, while families populate others. Knowing your target customer will help you determine which kind of renovations you should make. If you want to target a younger audience, try purchasing properties in a quiet suburban area.

House flipping is a profitable business that requires you to have an eye for properties and a knack for home repairs and renovations. You also need to network with contractors and investors to get started. It takes a lot of time, energy, and money to get started. While it might seem like a good idea, it’s important to remember that house flipping is a high-risk, short-term investment.

Getting a real estate license is another key step. Getting a license will allow you to list properties yourself and not have to pay a realtor to do it. You’ll also have access to the MLS, which is a great resource for finding new properties. These properties are often under contract hours after they’ve been listed.

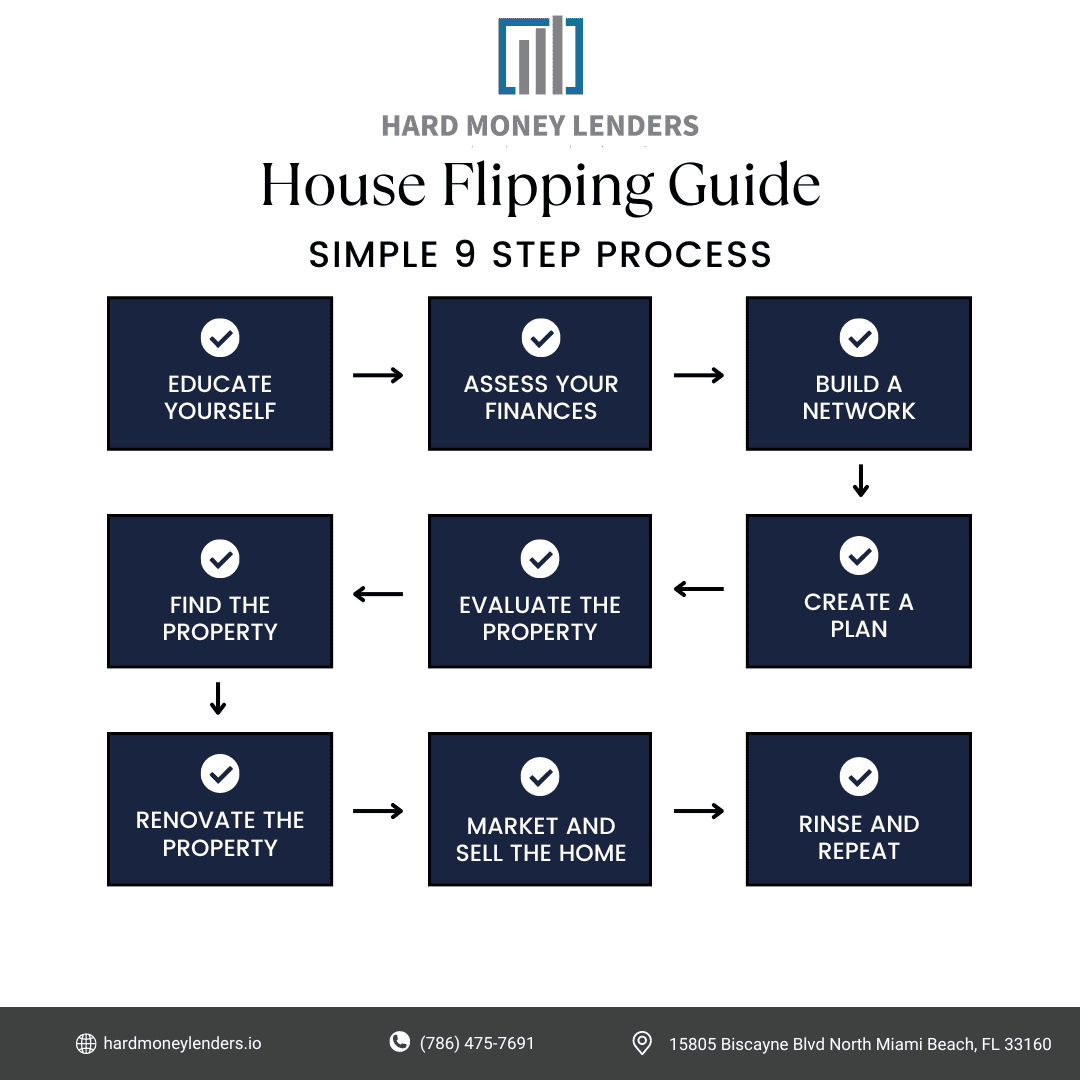

9 Steps to Become a House Flipper

Step 1: Educate Yourself

Embarking on a house flipping journey starts with a solid foundation of knowledge. A successful house flipper possesses a deep understanding of the real estate market, including how to identify undervalued properties, accurately estimate renovation costs, and properly assess the after-repair value (ARV) of homes. This knowledge is crucial for making informed purchasing decisions and ensuring profitability.

How to Gain the Knowledge You Need:

- Books: There are numerous books that cover the fundamentals of real estate investing and house flipping. Look for publications by experienced investors that offer both broad overviews and specific strategies.

- Online Courses: Online platforms offer courses ranging from beginner to advanced levels in real estate investment, property renovation, and financial analysis, allowing you to learn at your own pace.

- Seminars and Workshops: Attending seminars and workshops provides not only valuable information but also networking opportunities with other investors and professionals.

- Mentorship Programs: A mentor who has experience in house flipping can offer personalized guidance, insider tips, and support, helping you navigate the complexities of your first few projects.

Step 2: Assess Your Finances

House flipping is a capital-intensive endeavor. Before you can purchase a property to flip, you need to secure the necessary funds for both the acquisition and the renovation. Understanding your financial capacity and how to leverage it effectively is paramount.

Financing Your Flip:

- Personal Savings: Utilizing personal savings can be a straightforward way to finance a project, though it’s important to ensure you have enough reserves for unexpected expenses.

- Loans: Various loan options exist for house flippers, including traditional bank loans, home equity loans, and hard money loans, each with their own terms and conditions.

- Investors: Partnering with investors can provide the capital needed for a flip in exchange for a share of the profits. This can be an effective way to leverage resources but requires clear agreements and understanding.

- Partnerships: Teaming up with another flipper or a group of investors can spread out the financial risk and allow for larger projects to be undertaken.

Step 3: Build a Professional Network

The success of a house-flipping project often depends on the strength of your professional network. Having reliable contractors, knowledgeable real estate agents, experienced attorneys, and other professionals in your corner can make all the difference.

Creating Your Team:

- Contractors: Quality contractors are worth their weight in gold, capable of executing renovations efficiently and effectively. Vet contractors thoroughly and develop relationships with those who deliver quality work on time and within budget.

- Real Estate Agents: Agents with experience in the flipping market can offer insights into potential properties, market trends, and buyer preferences. They can also assist in selling the renovated property quickly and at a good price.

- Attorneys: Real estate transactions involve complex legal considerations. An attorney specializing in real estate can help navigate contracts, permits, and any legal hurdles that may arise.

- Other Professionals: Depending on your project, you might also need to connect with architects, interior designers, landscapers, and staging companies. Each plays a role in transforming a property and maximizing its market appeal.

Step 4: Find the Right Property

Identifying the ideal property is the linchpin in the house-flipping process. This step requires diligence, research, and sometimes a bit of luck. The location of the property is paramount; it should be in an area with high demand and potential for growth, which can significantly affect the resale value. Other crucial factors include the state of the local real estate market, the community’s desirability, and any future developments planned for the area.

Strategies for Uncovering Potential Deals:

- Auctions: Public auctions, often held for foreclosed properties, can be excellent opportunities to purchase below-market value. However, it’s important to understand the auction process and be prepared for possible bidding wars.

- Foreclosures: Banks or financial institutions selling foreclosed properties may offer them at lower prices to recover the loan amount. These properties can sometimes require significant renovations but offer good profit potential.

- Direct Marketing: Reaching out directly to homeowners who might be considering selling can uncover off-market deals. This approach requires tact and negotiation skills but can lead to mutually beneficial arrangements without competition from other buyers.

- Real Estate Agents: Some agents specialize in investment properties and can alert you to potential flips before they hit the open market.

Step 5: Conduct a Thorough Evaluation

A comprehensive evaluation of the property is essential to avoid unforeseen expenses that could eat into your profit margins. This step involves inspecting the property’s structural integrity, systems (electrical, plumbing, HVAC), and overall condition to identify what renovations are necessary.

Assessing the Property:

- Professional Inspections: Hiring a professional inspector can reveal hidden problems that could significantly impact the budget and timeline of your project.

- Estimate Renovation Costs: Based on the inspection, list out all the renovations needed and estimate their costs. This should include materials and labor, as well as a buffer for unexpected expenses.

- Calculate the ARV: Understanding the potential After Repair Value of the property is crucial. This involves analyzing comparable sales in the area and adjusting for the quality and extent of your planned renovations. The difference between the purchase price plus renovation costs and the ARV should represent your potential profit.

Step 6: Create a Detailed Business Plan

A well-thought-out business plan is your roadmap to a successful house flip. It lays out the financial, operational, and strategic aspects of the project, ensuring that you have considered all angles and are prepared for various outcomes.

Components of a Successful Business Plan:

- Budgets: Include detailed budgets for each phase of the renovation, from acquisition and construction to marketing and sale. Ensure your budget is realistic and includes a contingency fund for unexpected costs.

- Timelines: Develop a timeline for the project, outlining key milestones and deadlines for each stage of the renovation. Factor in buffer time for delays to avoid rushing and compromising the quality of work.

- Risk Management: Identify potential risks to your project, such as market downturns, construction delays, or budget overruns, and develop strategies to mitigate these risks.

- Contingency Planning: Have plans in place for scenarios where the project doesn’t go as expected. This might include alternative financing options, different marketing strategies for the property, or even a pivot to renting out the property if the market isn’t favorable for a sale.

Step 7: Execute the Renovation

The execution of the renovation process is where your planning meets reality, and it’s crucial to focus on making smart, impactful changes that will increase the property’s market value.

Prioritizing Improvements:

- High-Value Additions: Concentrate on renovations known to offer the best return on investment (ROI), such as kitchen and bathroom updates, adding square footage, enhancing curb appeal, and updating aging systems (HVAC, electrical, plumbing).

- Material and Labor Decisions: Select materials that are both durable and appealing to a wide range of buyers, balancing quality with cost-effectiveness. When hiring contractors, seek bids from multiple sources and check references to ensure you’re getting the best work for your money.

- Project Management: Keeping the renovation on schedule and within budget requires diligent project management. Use software tools or apps designed for renovation project management to track progress, expenses, and contractor performance.

Step 8: Market and Sell the Property

With renovations complete, turning your attention to a strategic marketing plan will ensure the property reaches potential buyers and sells for top dollar.

Effective Marketing Techniques:

- Professional Photography: High-quality, professional photos are essential for making a strong first impression online, where most buyers begin their home search.

- Compelling Listings: Create listings that highlight the property’s best features and improvements. Use storytelling to connect emotionally with potential buyers, emphasizing the lifestyle the home offers.

- Open Houses and Virtual Tours: Offer open houses to welcome potential buyers to experience the property in person. Virtual tours can also attract remote buyers, providing a 360-degree view of the home’s features.

- Skilled Negotiation: Prepare to negotiate with buyers to achieve the best sale price. Understand the lowest price you’re willing to accept and be ready to highlight the property’s unique value propositions to justify your asking price.

Step 9: Analyze and Learn from Each Flip

Reflecting on the completion of a flip is as important as the preparation and execution stages. This step is crucial for growing your skills and improving the success rate of future projects.

Post-Project Analysis:

- Review Financials: Compare the project’s budgeted costs versus actual expenses and the projected sale price versus the final sale price. Understanding where estimates were off will help in better budgeting future projects.

- Evaluate Timeline Accuracy: Analyze the projected versus actual project timeline to identify any inefficiencies or delays in the process.

- Gather Feedback: Seek feedback from agents, buyers, and contractors about what was most appealing about the property and what could have been improved. This information can be invaluable for future flips.

- Document Lessons Learned: Keep a detailed record of what strategies worked well and what didn’t, including notes on contractor performance, material choices, and marketing tactics. Use these insights to refine your approach for the next project.

Each step in the house flipping process offers opportunities for learning and growth. By diligently analyzing and applying the lessons learned from each flip, you can continuously improve your strategy, reduce risks, and increase your profitability in the competitive world of real estate investment.

Final Thoughts on How Do I Become A House Flipper

Final Thoughts on How Do I Become A House Flipper

Each step in the house flipping process offers opportunities for learning and growth. By diligently analyzing and applying the lessons learned from each flip, you can continuously improve your strategy, reduce risks, and increase your profitability in the competitive world of real estate investment. Of course, the most important factor to take into account is the risk-reward. In other words, whether the amount of time and money you’re risking would be worthwhile.

Frequently Asked Questions (FAQs) About Becoming a House Flipper

How to Successfully Flip a House

If you want to be a successful flipper, you must learn the details of the process. Flipping houses isn’t just buying and selling a house; you need to understand the market and its trends. This can help you know how much the house can be worth and when it can be sold. You should work with a real estate agent to make sure you’re doing the right things. They will know the current market trends, what repairs are necessary, and when is the right time to sell.

As with any real estate business, you should plan your finances well before you start. First, determine your overall budget. This will allow you to avoid overspending before you’ve even begun to make repairs. Also, determine individual budgets. You must consider the purchase price of the house because it will determine how much you will spend on repairs, landscaping, and more.

Next, research the neighborhood and market. You want to buy a property in a growing area where the property price is low enough to make the cost of renovations worthwhile. You should also find a neighborhood where development projects are in progress and homes are selling quickly. These factors indicate a seller’s market and steady appreciation.

In addition to acquiring a mortgage with a traditional lender, you can also get a loan to fund your flipping project. However, the process can be long and you may miss out on a good property while you’re waiting for the loan to be approved. Another option is to use a cash-out refinance to access your equity. This way, you can lower your monthly payments and free up more funds for the rest of your project.

What mistakes to avoid when house flipping

While house flipping can be a lucrative business, it can also be full of costly mistakes. Common mistakes include not planning or paying too much for renovations. Those mistakes can greatly damage the profitability of a house flip, so it is important to avoid them. You can avoid these mistakes by making thorough research before investing in real estate and relying on the services of a reliable team.

Hiring a professional contractor is essential if you are not experienced in home flipping. They can provide advice on the latest trends and technology. It is also essential to consider the target market and neighborhood before you start working on a house flip. It is also vital to obtain all the required permits. Failing to obtain these permits can result in lawsuits and can cost you money.

Another common mistake is purchasing properties with low-profit margins. If you are new to house flipping, it is essential to research the neighborhood to learn how much houses are worth in the area you’re looking to invest in. An experienced real estate agent can provide you with a neighborhood’s average house price range.

After knowing the local market, apply the “70% rule” to the purchase price of a house. The 70% rule takes the estimated after-repair value (ARV) and subtracts the anticipated repair costs. Once you’ve determined the house’s value, you’ll be able to determine how much you’ll be able to spend on the renovations.

While house flipping is a lucrative business, it is also a very time-consuming process. The initial investment, renovation, and sale of the house are all costly. This is why you should create a budget and stick to it. It is also essential to seek advice from a trusted third party.

Should I house flip?

When deciding whether to buy or flip a house, it’s important to know the local housing market. Typically, you’ll need to find a market where there is low inventory and high demand. Otherwise, you’ll be paying higher carrying costs. These are the costs of owning the house until it’s sold. Fortunately, there are some steps you can take to make your flipping venture a profitable one.

To make a profit on a flip, you’ll have to determine what you’re willing to spend on the property. The purchase price is the amount you paid for the home, including the attached land. Once you know this, you can estimate what you’ll need to spend on the flipping process.

The best houses to flip usually only need minor renovations. These updates will make the property more appealing to buyers. A good rule of thumb is to focus on making renovations that will add value to the house, such as updating the kitchen and bathroom. It’s also a good idea to make sure the home has a nice outdoor space.

After deciding whether to flip a house, you’ll need to secure financing. Most house flips are funded through specialized lenders that offer asset-based loans. When choosing a lender, make sure you know how much you’ll need to borrow, and make sure you have enough money to cover the monthly payments. You may also need to pay property taxes and utilities.

If you’re willing to put in the time and money, you can make a profit on your flip. The key is to be patient, take your time, and learn everything you can about the business. If you’re not able to fix everything yourself, you’ll have to hire professionals to do the work. However, paying these people to work on your flipping project will decrease your chances of making a significant profit. That’s why it’s important that you move into every project informed, with a budget, and experienced in what you are looking to achieve.

How much initial investment is required to start flipping houses?

The initial investment for flipping houses significantly varies, influenced by factors such as the property’s purchase price, renovation scale, and location. Typically, flippers should be prepared with funds to cover not just the acquisition and renovation costs but also carrying costs like insurance, utilities, and property taxes during the flip process.

Investments might range from a modest sum for a minor fixer-upper in a less expensive market to several hundred thousand dollars for more ambitious projects in high-demand areas. Exploring diverse financing options, including traditional loans, hard money lenders, or investment partnerships, is crucial for effectively managing your financial commitment.

Is obtaining a real estate license beneficial for flipping houses?

While not a requirement, possessing a real estate license can offer distinct advantages for a house flipper. Access to the Multiple Listing Service (MLS) provides comprehensive market data and early insight into potential properties, facilitating informed decision-making.

Additionally, holding a license can enhance credibility with clients and industry peers, potentially leading to valuable networking opportunities. However, it’s important to weigh the time and cost of obtaining a license against these benefits, especially if your primary focus is flipping rather than broader real estate transactions.

What is the typical timeline for a house flipping project?

The duration of a house flipping project can span from a few months to more than a year, contingent upon several variables, including the property’s initial condition, renovation complexity, permitting requirements, and the efficiency of your project management.

Developing a realistic timeline, accounting for potential setbacks such as supply chain delays or unforeseen repairs, is essential for maintaining project momentum and minimizing holding costs. Experienced flippers often refine their time management strategies over multiple projects, achieving greater efficiency and predictability in their timelines.

Can flipping houses be effectively managed alongside a full-time job?

Flipping houses as a side hustle is achievable but demands meticulous time management and strategic planning, particularly for individuals balancing the demands of a full-time job. Leveraging the expertise of a skilled team, including contractors, real estate agents, and project managers, can alleviate the hands-on time required, enabling you to focus on high-level decisions and oversight. Additionally, considering projects with fewer renovation needs or partnering with experienced flippers can provide a more manageable entry point into the house flipping market.

Jack Roberts has spent the last 5 years in the Private Money Lending world helping real estate investors secure financing for their non-owner occupied real estate investments. When he’s not thinking about real estate, Adam is an avid Jazz music fan and fisherman.