Buying A House Under An LLC: What You Should Know

Investors are increasingly resorting to purchasing real estate under a Limited Liability Company (LLC) to leverage the numerous benefits that come with such a structure. This strategy provides significant legal protections, tax advantages, and privacy, making it a smart choice for those seeking to optimize their property investment and management decisions. By understanding these elements, investors can make informed decisions and confidently move forward with their real estate ventures.

What is an LLC?

An LLC, or Limited Liability Company, is a business structure authorized by state law that combines the pass-through taxation of a sole proprietorship or partnership with the limited liability of a corporation. This type of company is highly flexible in terms of management and not restricted to one class of stock, making it a popular choice for many business owners, including real estate investors.

An LLC, or Limited Liability Company, is a business structure authorized by state law that combines the pass-through taxation of a sole proprietorship or partnership with the limited liability of a corporation. This type of company is highly flexible in terms of management and not restricted to one class of stock, making it a popular choice for many business owners, including real estate investors.

In real estate, an LLC operates by holding property titles, separating the personal assets of the company’s members from the assets owned by the LLC. This arrangement not only limits personal liability but can also provide tax advantages and privacy.

Advantages of Buying a House Through an LLC

Advantages of Buying a House Through an LLC

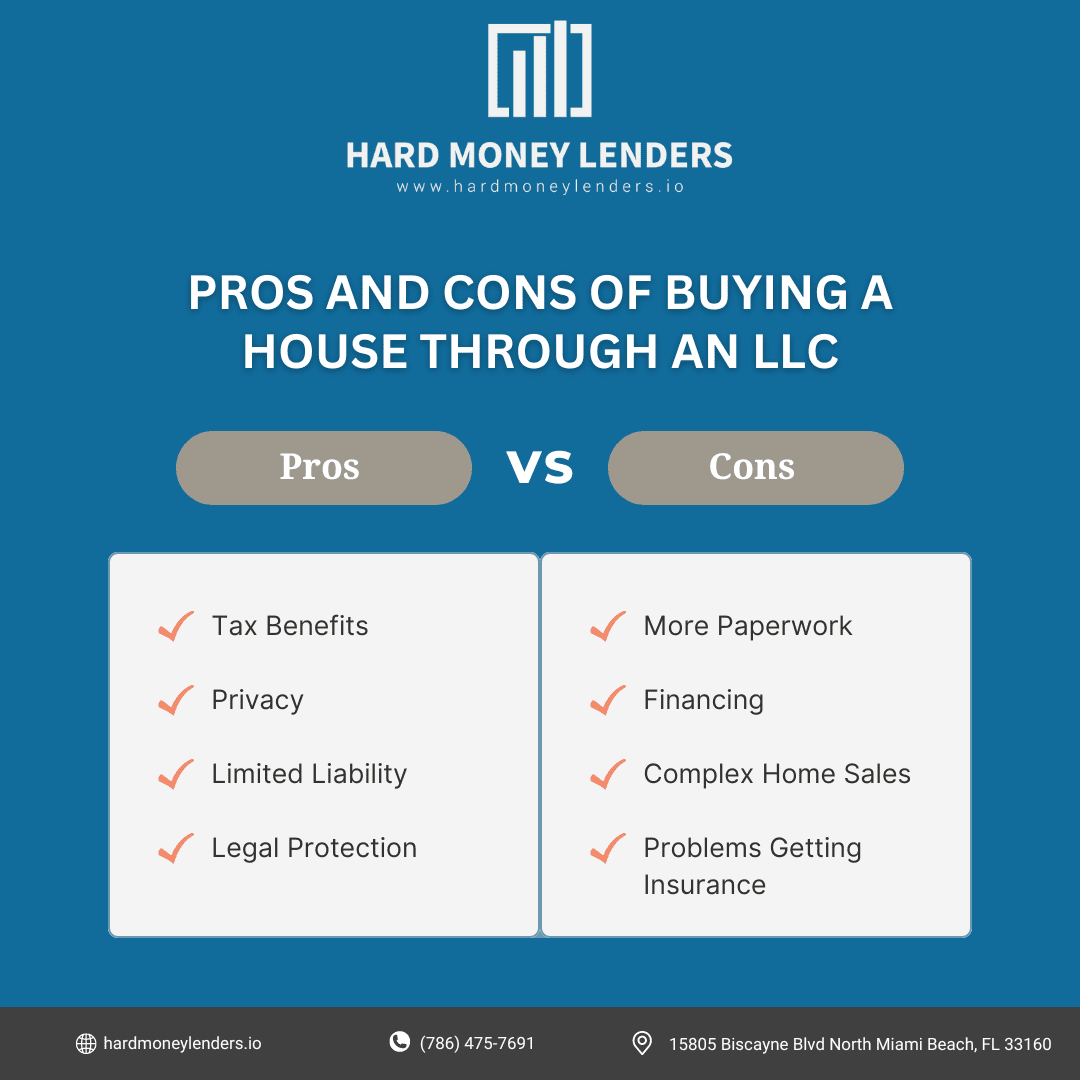

Tax Benefits

There are several tax benefits associated with an LLC. For example, you can deduct the cost of any property-related expenses and any mortgage interest. You’ll want to visit the IRS webpage for more on home mortgage interest

In addition, the profits from your real estate investments will pass through to your individual income taxes rather than be taxed at the corporate level like they would if you were operating as a corporation.

Privacy

Compared to a corporation or partnership, an LLC is much more difficult for others to find information about you. This can be particularly beneficial if you are concerned about preserving your privacy when buying real estate.

Limited Liability

You will be protected from personal liability in certain cases. As long as you don’t take on any personal debt in connection with the property, you won’t be liable for business debts either — unless the creditor can prove that you acted negligently or intentionally wronged them.

Legal Protection

In the unlikely event that you are sued for something related to your LLC, you’ll have more legal protection than if you were operating as a sole proprietor or general partnership. For example, if someone sues your corporation, they can go after its assets. But if someone sues your LLC and wins, they’ll be limited to collecting from the company’s assets unless there’s evidence that you profited from any wrongdoing.

If it all sounds good, I’d hate to be the bearer of bad news as buying a house with an LLC does have its disadvantages as well. Don’t let them discourage you though.

Disadvantages of Buying a Home Through an LLC

More Paperwork

To set up an LLC, you’ll need to complete several documents with your state and federal government, including articles of incorporation and operating agreements. Depending on your state’s requirements, this can take anywhere from a few minutes to several days or weeks.

Depending on your state’s laws, you may also need to file additional paperwork. For example, if you’re in California, you’ll need to file a Statement of Information form within 90 days after the LLC is formed.

Financing

Although there are many banks and private lenders that will work with an LLC, some require additional paperwork and verification before they will lend you the money. If you’re planning on buying a home with cash instead of financing it, this won’t be as much of an issue for you—but if you want to get approved right away, it may be better to go with another type of entity like a corporation or partnership instead.

Selling Home

Many lenders require that homes be owned by individuals, not LLCs or other entities. This means if you want to sell your home and move into something else, you’ll need to transfer the deed back into your name—which could take months or even years if there are any issues with the transfer of ownership during that period.

Insurance

Most insurance companies only offer coverage to individuals or families who own their homes outright. If you’re buying your home with an LLC, they may refuse to offer any coverage at all—or they’ll only offer minimal coverage that won’t provide enough protection against major losses like fire or burglary.

How to Set Up an LLC for Real Estate

Step-by-step Guide on Forming an LLC

- Choose a State for Formation: Select a state where you will register your LLC. Considerations might include the state’s fee structure, taxation, and legal environment.

- Name Your LLC: Ensure the name complies with state regulations and is distinguishable from other LLCs.

- File the Articles of Organization: Submit the necessary documents to the state’s business filing agency, often the Secretary of State.

- Create an Operating Agreement: Although not required in all states, this document outlines the ownership and operating procedures of the LLC.

- Obtain EIN and Open a Bank Account: Apply for an Employer Identification Number from the IRS, and use it to open a bank account specifically for the LLC.

Important Considerations

- Costs: Be aware of the initial and annual costs of maintaining an LLC, which vary by state.

- Legal Compliance: Ensure compliance with local laws, which might include acquiring business licenses or permits.

Financing and Buying the Property

Challenges of Securing Financing as an LLC

Financing real estate through an LLC often presents unique challenges. Lenders typically perceive loans to LLCs as higher risk compared to personal loans. This is primarily due to the limited liability protection that LLCs offer, which can complicate the recourse available to lenders if the loan defaults. Additionally, banks might require more stringent documentation and checks for LLCs to verify the business’s creditworthiness and operational history.

Tips on Negotiating with Lenders

- Provide Strong Financials: It’s crucial to present detailed and comprehensive financial records that demonstrate the LLC’s profitability and cash flow stability. Prepared balance sheets, profit and loss statements, and cash flow forecasts can significantly bolster your credibility.

- Offer a Personal Guarantee: While this might negate some of the liability protections of an LLC, providing a personal guarantee can help in securing financing by aligning your personal financial interests with the success of the project.

- Build a Relationship with the Lender: Establishing a strong relationship with a bank or lender can facilitate negotiations. This might include having prior successful loan repayments or a history of positive banking transactions.

Details on the Process

Once financing is arranged, purchasing the property through the LLC involves transferring funds from the LLC’s account for the transaction, ensuring all contracts and legal documents are in the LLC’s name. This method helps maintain the separation of personal and business finances and reinforces the liability protections.

Requirements For Getting A Mortgage

If you’re thinking about buying a house under an LLC, it’s important to know that lenders are going to want to see some serious financials before they’ll approve your mortgage. You can’t just buy a house using your personal income—you need to have a business plan that shows how you’ll be able to afford it and keep it up.

Here are some things you’ll need to provide when applying for the loan:

- Your Business Plan. This should include how much money is coming in, where it’s coming from, and how many expenses there is each month. It should also include any plans for expanding or growing your business further down the road.

- Balance Sheet. This will show lenders what kind of capitalization rate they’re dealing with when considering whether or not to finance the purchase of real estate under an LLC entity structure.

- Personal Financial Statement. Summarizing all income sources over the past three years along with any outstanding debts owed during this time (including credit card debt).

- Statement of Your Intentions. Such as how much time you plan to spend there and any plans you have for it. This should include details about what type of business you want to operate from your home office, if applicable.

- Detailed List of All Assets. This will be a list of assets owned by you and your spouse, including the value of each property. Lenders will be able to determine how much collateral they have available in case you default on your loan obligations.

For additional information on getting a loan, you can head over to our post Tips on getting a loan for your real estate investment.

Managing the Property Through an LLC

Managing the Property Through an LLC

Handling Property Management

Effective property management under an LLC setup requires meticulous organization and proactive communication. This includes:

- Tenant Management: The cornerstone of property management, it involves handling lease agreements, screening tenants to find reliable occupants, collecting rent, and maintaining positive tenant relations. Effective tenant management reduces turnover rates and ensures steady income flow, which is vital for the financial health of the real estate investment.

- Maintenance and Upkeep: Regular maintenance includes routine checks and addressing repairs promptly to preserve the property’s value and ensure compliance with local housing standards. This not only helps in retaining tenant satisfaction but also in avoiding more costly repairs due to neglect down the line.

- Financial Oversight: Managing the property’s finances involves setting and adhering to budgets, optimizing operational expenses, and ensuring the investment remains profitable. Regular financial reporting and audits are essential to track financial health, identify potential financial issues early, and make informed strategic decisions.

Roles and Responsibilities

Clearly defining the roles and responsibilities within the LLC is essential for effective management:

- Operational Roles: Include roles such as property managers, who handle day-to-day operations and tenant interactions; CFOs or accountants, who manage the financial reporting and budgeting; and maintenance supervisors, who oversee the upkeep of the property.

- Strategic Roles: Generally held by senior members of the LLC, these roles involve making key investment decisions, planning for portfolio expansion, and setting long-term financial goals. This might also include liaising with investors and other stakeholders to report on progress and secure further funding or support if needed.

- Legal and Compliance Ensuring compliance with legal standards and regulatory requirements is crucial when managing real estate through an LLC:

- Compliance with Landlord-Tenant Laws: It’s crucial to stay informed about and compliant with the landlord-tenant laws applicable in the property’s location. These laws govern everything from how much you can charge for a security deposit to how and when you can evict a tenant, impacting how the property is managed.

- Insurance and Liability: Maintaining adequate insurance coverage is essential to protect the LLC from potential liabilities and property damage. This includes property insurance, liability insurance, and, in some cases, additional coverage such as flood insurance, depending on the location.

- Record-Keeping and Documentation: Proper documentation of all transactions, tenant interactions, and business decisions is critical to protect the LLC in the event of legal challenges and to ensure operations are transparent and accountable. This includes keeping detailed records of financial transactions, tenant leases, maintenance requests and completions, and any incidents or inspections.

These structured practices not only help in maximizing the efficiency and profitability of the property but also reinforce the protective benefits of using an LLC as the holding entity.

Final Thoughts on Buying a House Under an LLC

As you can see, you’ll want to consider many things before purchasing your home through an LLC. Taking on this type of purchase structure will make sense for some but not for others.

As a word of advice, don’t rush into making a decision. Whatever you decide to do you’ll want to make sure it is the right one for you.

As to the fathers of the narrative above, while they had made a different decisions on purchasing their home, they both woke up with peace of mind for making that decision. We want the same for you. That’s why if you have any questions, don’t hesitate to reach out to us. As our experts here at Hard Money Lenders are just a phone call away.

Build confidence in why Hard Money Lenders is the right choice for you by reading Why Hard Money Lenders IO?

FAQs

Why do people buy a house under an LLC?

Individuals often use an LLC (Limited Liability Company) to purchase real estate for several strategic reasons. The primary motivation is asset protection; properties owned by an LLC are legally separated from the owner’s personal assets, which safeguards these assets from being targeted in legal disputes related to the property. Moreover, LLCs can provide significant privacy benefits, as the property ownership is registered under the company’s name rather than the individual’s, minimizing exposure in public records. This arrangement is also advantageous for tax planning, allowing owners to potentially benefit from business deductions that are not available to individual homeowners.

What are the cons of owning property in an LLC?

While there are advantages to holding property in an LLC, there are also notable disadvantages. The administrative burden increases as the property owner must comply with corporate formalities, such as filing annual reports and maintaining separate financial accounts to uphold the legal distinction between personal and business finances. These requirements can be cumbersome and sometimes costly, depending on state regulations. Additionally, securing financing for a property owned by an LLC can be more complex and expensive. Banks may perceive loans to LLCs as higher risk, often necessitating personal guarantees from the owners and possibly higher interest rates or more stringent loan conditions.

Why do rich people buy houses under LLC?

Wealthy individuals frequently purchase houses under LLCs primarily for discretion and protection. The use of an LLC helps in shielding the identity of the property owner from the public, providing a layer of privacy that is often sought after by high-net-worth individuals. This privacy can be crucial for avoiding unwanted attention or solicitation. Furthermore, LLCs facilitate easier management and disposition of large property portfolios, offering a structured way to manage assets efficiently and often more favorably in terms of estate taxes and succession planning.

Can I live in a house owned by my LLC?

Living in a house owned by an LLC is legally permissible, but it requires careful handling to maintain the separation between owner and business entity. If the LLC’s owner resides in a property owned by the LLC, it should be treated like any other tenancy, with a formal lease agreement, market-rate rent payments, and proper documentation. This arrangement helps in preserving the liability protections of the LLC by preventing the “piercing of the corporate veil,” where personal and business affairs are intermingled to the extent that the law no longer recognizes them as separate.

Can an LLC be a borrower on a mortgage?

An LLC can indeed secure a mortgage, but it often faces higher scrutiny from lenders than individual borrowers. To mitigate the risks associated with the limited liability offered by LLCs, lenders might require comprehensive financial records, a solid credit history for the business, and personal guarantees from the LLC members. These measures ensure that the LLC is financially sound and that its members are committed to fulfilling financial obligations. The terms of the mortgage may also reflect the heightened risk, potentially involving higher interest rates or more demanding loan covenants.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.