Last Updated on February 28, 2024

Flipping real estate contracts remains a lucrative business that allows you to make money from existing real estate contracts. In 2024, understanding the nuances of flipping real estate contracts is more crucial than ever. If you’re keen on diving into this investment strategy, you’re in the right place. Whether you’re a seasoned investor or new to the game, this guide is your go-to resource for mastering the art of flipping real estate contracts in the current market environment. Now, let’s take a look at how to be successful at flipping real estate contracts in 2024

What is a real estate contract?

A real estate contract is a legal document that describes the sale and purchase of a property. The seller and the buyer must sign it. A real estate agent can also sign this document on behalf of the client. The parties in a real estate contract must agree to all of its terms and conditions.

Real estate contracts often include clauses that state what will happen if a party fails to meet its obligations. This creates clear expectations and helps avoid court proceedings. In addition, some real estate contracts include addendums or riders that specify additional details of the contract. For example, a rider may state that there are rules and regulations that the buyer and seller must abide by.

A real estate contract must be easy to understand by all parties. It should use everyday language to avoid ambiguity. It should also include an expiration date. This is important because many real estate contracts are time-sensitive. In some situations, a failure to meet an expiration date will result in a breach of contract.

A real estate contract is an essential part of the execution of a real estate transaction. It protects both the seller and the buyer and forms the basis of any legal action that might result from the transaction. Real estate contract laws vary by state, so be sure to seek the advice of an attorney.

A real estate contract also covers a wide variety of other details that affect the sale and purchase of a property. It must be signed by persons with legal capacity. Real estate agents commonly use standardized forms to cover all the bases.

What does it mean to flip a real estate contract?

Essentially, flipping a real estate contract is the process of entering into an agreement to buy a property at a given price and intending to sell the contract to another buyer at a higher price before the deal closes.

This is accomplished through diligent planning and proficiency in market research for identifying trends and values of properties in your area.

There’s no need for a spectacular credit score or a significant down payment in order to enter into a contract, making it attractive to many who aspire to invest in properties.

As long as you know the local market well, you can profit by flipping real estate contracts. Unlike buying a short-term rental property or investing in foreclosures, you typically don’t need to have a great credit score to get into this business.

Moreover, you don’t have to put down a large down payment to flip a property. As long as you find a willing buyer, you can sell the property for a profit.

If you are interested in flipping real estate contracts, you should consider getting a real estate license. This way, you will not be accused of brokering a property without a license. A real estate license will allow you to set up a back-to-back closing or double closing of a property. This isn’t illegal, but you should consider getting one to prove your credibility and potentially secure more deals.

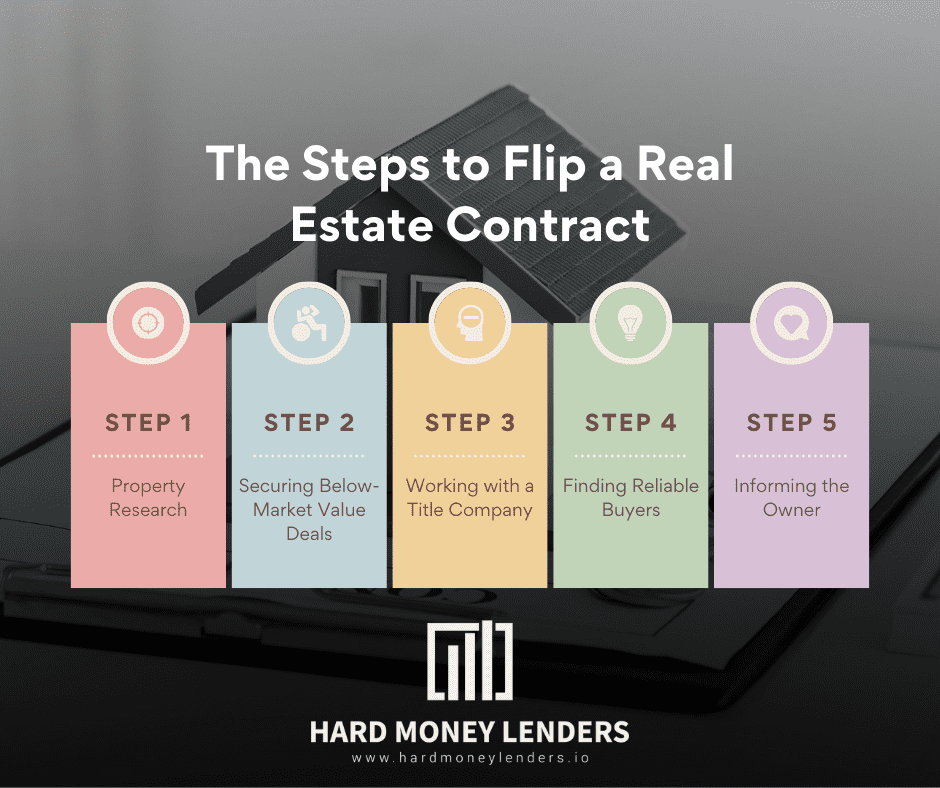

The Steps to Flip a Real Estate Contract

- Property Research. Diligent research is essential. This includes finding properties with potential, like those owned by delinquent homeowners, and analyzing comparable homes in the area to ensure the sale price will attract end buyers.

- Securing Below-Market Value Deals. The first step is to negotiate a purchase price with the seller that’s below market value. This often involves convincing the seller of the benefits of a quick sale, sometimes with the help of a real estate attorney to navigate negotiations.

- Working with a Title Company. A title company experienced in contract flipping can be invaluable. They’ll handle lien checks, payment collection from the buyer, and drafting the final settlement, ensuring the process runs smoothly.

- Finding Reliable Buyers. Having a network of interested buyers is crucial. Understanding their preferences and being able to quickly match them with suitable properties can streamline the flipping process.

- Informing the Owner. Communication with the property owner is key. Whether you disclose your intention to flip the contract or present yourself as a partner to an end buyer, it’s important to navigate this step with care and legal awareness.

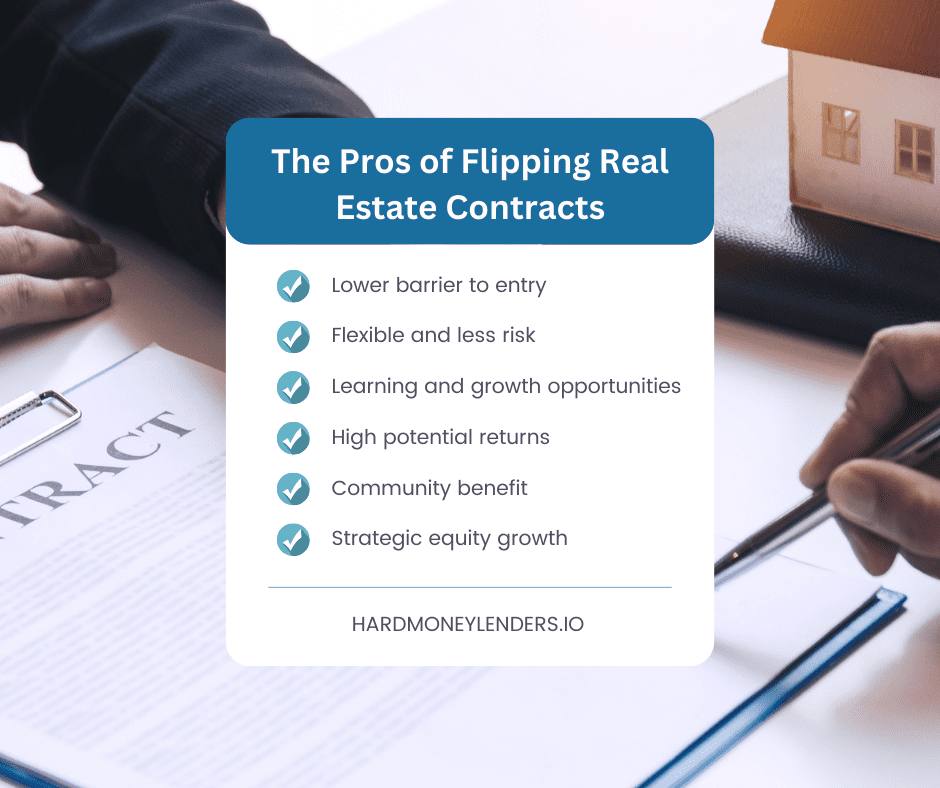

The Pros of Flipping Real Estate Contracts

Lower Barrier to Entry into Real Estate Investment

The leverage flipping real estate contracts bring is actually quite simply a significantly lower barrier to entry for most. Real estate investments typically require substantial down payments and commitments of funds, but contract flipping has room for minimal capital to be upfront. This makes it more accessible to wider public participation in real estate investment.

Flexibility, Less Risk

Real estate contract flipping works with great flexibility, negotiation without ownership of the property. It allows one to focus on getting properties in prime locations, therefore minimizing potential risks. Additionally, including exit clauses or the ability to assign the contract in the negotiation phase further protects the investor, ensuring that he or she is not unduly committed to follow up with the purchase.

Learning and Growth Opportunities

Real estate contract flipping not only gives students the opportunity to better understand the ins and outs of a real estate contract, but it also gives them practical knowledge through hands-on learning. Working with experienced investors helps them gain valuable knowledge into market analysis and understanding.

High Potential Returns

Real estate contract flipping, despite all its challenges, promises potentially large returns to all its participants. Investors have the chance to strategically leverage undervalued properties and use them as the basis of their returns. It not only promises to be a lucrative opportunity for those who are looking for ways to broaden their scope of investment but also promises a very high return.

Community Benefit

There is social benefit that can come with this activity. Flipping a real estate contract can impact and bring about neighborhood regeneration by improving the undervalued or unused properties to boost the appeal of the neighborhood and improve property value.

Strategic Equity Growth

Flipping contracts might be a strategic way of growing equity without the need for time-consuming holding periods associated with property flipping. It helps in enhancing the portfolio’s abilities to turn around quickly to enable reinvestment and more effective expansion.

The Cons of Flipping Real Estate Contracts

Of course, there are drawbacks to flipping real estate contracts. However, the pros outweigh the cons here.

- Market Dependence: Much of success is dependent on market conditions and finding below-market-value deals.

- Legal and Ethical Considerations: Legal and ethical considerations associated with contract flipping are complex and require an understanding of real estate law.

- Risk of Loss: Without proper research or a market, finding a buyer for the contract may not return a profitable sale.

Pro Tips For Flipping Real Estate Contracts in 2024

- Build Strong Relationships: Cultivate a network of sellers, buyers, and real estate professionals to find the best deals and buyers quickly.

- Stay Informed: Stay on top of local market trends, laws, and regulations to adapt your strategies accordingly.

- Leverage Technology: Use real estate platforms and tools for market analysis and to streamline the flipping process.

- Legal Guidance: Consider hiring an attorney to ensure all contracts are sound and your flipping strategy complies with local laws.

Final Thoughts on Flipping Real Estate Contracts in 2024

Flipping real estate contracts is a compelling strategy for those looking to dip their toes into real estate investing without the significant financial outlays typically associated with property purchases. By focusing on motivated sellers and leveraging the right opportunities, investors can flip contracts for a profit, all while navigating the process with legal prudence. With patience, hard work, and a keen understanding of the market, flipping real estate contracts can be a profitable venture in the dynamic world of real estate.

Questions People Also Ask About Flipping Real Estate Contracts

What’s the difference between tax lien investing and flipping real estate contracts?

Tax lien investing and flipping real estate contracts are two distinct strategies within the real estate investment landscape.

Tax lien investing involves purchasing the tax lien certificates of properties where the owners have failed to pay their property taxes. Investors essentially pay the taxes owed to the local government and, in return, receive the right to collect the back taxes plus interest from the property owner. If the owner fails to pay within a specified period, the investor may have the right to foreclose on the property.

Flipping real estate contracts, on the other hand, involves entering into a contract to purchase a property and then selling that contract to another buyer for a higher price before closing. This strategy doesn’t require taking ownership of the property or dealing with tax delinquencies. Rather, it focuses on leveraging market dynamics and negotiation skills to earn a profit from the contract sale.

Is flipping real estate contracts worth it?

Flipping real estate contracts can be worth it for individuals looking for a lower barrier to entry into the real estate market without the significant capital requirements of purchasing properties outright. This strategy can potentially offer the potential for quick profits with less financial risk, provided you have a good understanding of the market and strong negotiation skills. That said, like any investment, it comes with its own set of challenges and risks, including finding suitable properties and buyers, as well as managing the legal and ethical considerations of contract flipping.

How much money can you make flipping real estate contracts?

The amount of money you can make flipping real estate contracts in 2024 varies widely based on several factors, including the property’s location, market conditions, and your ability to negotiate favorable contract terms. Profits can range from a few thousand dollars for smaller deals to tens of thousands or more for larger, more lucrative contracts. Success in this field requires diligent research, a solid network of buyers and sellers, and the ability to act quickly on opportunities.

What is flipping real estate contracts called?

Flipping real estate contracts is commonly referred to as “wholesaling” within the real estate industry. This term reflects the process of acting as a middleman between the seller and the end buyer. Now, the wholesaler (the person flipping the contract) seeks to profit from the price difference without ever taking ownership of the property. Therefore, wholesaling real estate contracts requires a keen sense of market trends and the ability to negotiate deals that provide value to both the end buyer and the wholesaler.

Jack Roberts has spent the last 5 years in the Private Money Lending world helping real estate investors secure financing for their non-owner occupied real estate investments. When he’s not thinking about real estate, Adam is an avid Jazz music fan and fisherman.