Guide to Hard Money Loans & Lending Companies

At Hard Money Lenders, we understand that hard money loans can be confusing and intimidating to new investors. But, as daunting as they may be, hard money loans are invaluable tools for investors looking to purchase fix-and-flip properties, short-term investments, or multiple properties in a short period of time. There are innumerable advantages to pursuing a hard money loan as an investor, especially in a hot market such as Miami, Florida. It’s worth it to take some time and educate yourself on hard money loans, and that’s why we’ve prepared this guide on hard money loans and lending companies for you! In addition to this article, we’ve also prepared a whole cache of useful articles that investors can use to educate themselves about hard money and real estate investing here.

What is a Hard Money Loan?

A Hard Money Loan is a loan given out by hard money lenders. Hard money loans typically have short terms of 1-3 years, a speedy approval process based on collateral, flexible loan terms, and a higher interest rate than conventional loans. In addition, there are a few more nuances between hard money and “soft money” loans that can be found here!

Why is it Called a “Hard Money” Loan?

Hard Money loans are called “hard money” because they’re funded by private investors instead of traditional banks or lenders. Another reason they’re called “hard” is because the loans are backed by real estate as collateral. Hard Money loans differ from conventional loans because the lender is interested in using your property as collateral once you purchase it. If you are unable to pay back your loan, the property will be seized as collateral.

Advantages of Hard Money Loans

Hard money loans often offer a much speedier approval than conventional loans. Hard money loans can be a great option for investors that don’t have time to wait around for money to hit their account for a real estate investment in a hot market like Miami, Florida. The numerous benefits of real estate ownership have brought about a hot market, and speedy closing can be the difference between securing a deal and getting it stolen from under you.

In addition, hard money lenders are often more flexible and understanding of your unique needs. Hard money loans are funded by private investors who don’t need to adhere to the strict lending policies that large institutions often have. Hard money lenders are sometimes able to make adjustments to the terms of a loan to fit your unique investment needs.

Finally, hard money lenders are more likely to approve your loan when compared to conventional lenders. Hard money lenders use the property you buy as collateral for the loan, so they are less concerned about things like employment and credit history. Conventional lenders will scrutinize things like credit history, employment history, and other factors that many people don’t have solid evidence of. This makes hard money lending a great option for those who are self-employed or foreign nationals.

Uses for Hard Money Loans

Hard money loans are great options for investors looking to pursue fix-and-flip projects or other short term real estate investments. The advantages of hard money loans, including their short duration, flexible terms, and easy approval process, make them an attractive option for real estate investors around the country. Hard money loans see a lot of use in hot markets such as Miami, Florida as well!

Even if you’re not looking to make an investment, hard money loans still have many wonderful use cases. For example, if you’re a foreign national, you may not have the credit or income history needed for a conventional mortgage. In this case, hard money lenders can use your current assets and the home you want to buy as collateral in exchange for a loan. That way, you can still purchase a home without a substantial US employment or credit history! This is just one of many ways that the advantages of hard money loans can be utilized for specialized use cases.

Understanding Hard Money Loan Terms

Interest Rates and Points

- Interest Rates: Hard money loans typically have higher interest rates compared to traditional loans. While conventional mortgages might have interest rates ranging from 3% to 7%, hard money loans often fall between 8% and 15%. These higher rates reflect the increased risk lenders take, given that hard money loans are often used for high-risk investments like fix-and-flip properties.

- Points: Points are upfront fees paid to the lender, calculated as a percentage of the loan amount. For example, if you borrow $100,000 with a 2-point fee, you’ll pay $2,000 upfront. Hard money lenders usually charge between 1 to 4 points. These points increase the overall cost of borrowing but are a common feature of hard money loans due to their short-term nature and higher risk profile.

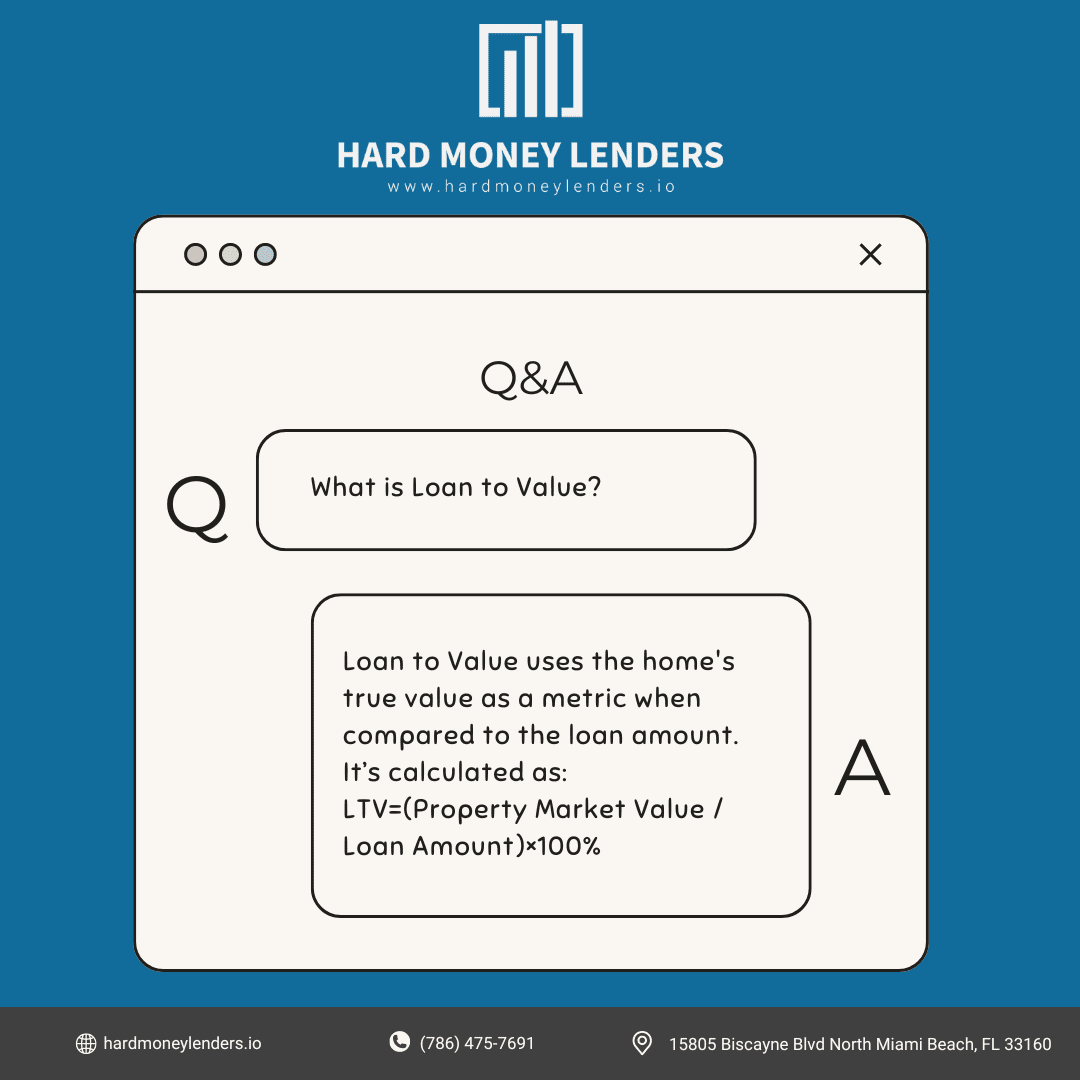

Loan-to-Value (LTV) Ratio

The Loan-to-Value (LTV) ratio is a key factor in hard money lending. It represents the ratio of the loan amount to the value of the property being used as collateral. For example, if you are purchasing a property worth $200,000 and the lender offers you a loan of $140,000, the LTV ratio is 70%.

- Importance of LTV Ratios: LTV ratios in hard money lending typically range from 60% to 70%, though some lenders might go higher depending on the property and the borrower’s experience. A lower LTV ratio means the borrower must contribute more equity, which reduces the lender’s risk. Understanding and negotiating the LTV ratio is crucial as it impacts how much you can borrow and your upfront costs.

Risks and Considerations

High Costs

Hard money loans come with higher costs than traditional loans. The higher interest rates (8% to 15%) and upfront points (1 to 4 points) can significantly increase the overall cost of borrowing. Additionally, these loans often come with additional fees such as:

- Origination Fees: Charged by the lender for processing the loan.

- Servicing Fees: Ongoing fees for managing the loan.

These higher costs reflect the risk that hard money lenders take and the speed at which they provide funds. Borrowers need to carefully calculate these costs to ensure that the investment remains profitable.

Short Repayment Terms

Hard money loans are usually short-term, ranging from 1 to 3 years. This short duration can put pressure on borrowers to complete their investment projects quickly, such as renovating and selling a property.

- Pressure on Borrowers: The short repayment terms mean that borrowers must have a clear exit strategy, whether it’s selling the property, refinancing with a traditional loan, or another method. If the property doesn’t sell as quickly as expected or if renovations take longer than planned, borrowers could face financial strain. They must be prepared to handle the quick turnaround to avoid defaulting on the loan, which would result in losing the collateral property.

Qualifying for a Hard Money Loan

Collateral Requirements

Hard money lenders primarily focus on the value of the collateral, which is typically real estate. Unlike traditional lenders, who scrutinize a borrower’s credit history and income, hard money lenders prioritize the property’s value as security for the loan. Here are the common types of collateral accepted:

- Residential Properties: This category includes single-family homes, condominiums, townhouses, and multi-family units such as duplexes and apartment buildings. These properties are often used for fix-and-flip projects or rental investments.

- Commercial Properties: These include office buildings, retail spaces, industrial warehouses, and mixed-use properties. Commercial real estate is attractive to lenders because it usually generates significant revenue and has a higher value.

- Land: Raw land, undeveloped lots, and parcels slated for future development can also be used as collateral. This type of collateral is less common but can be valuable for specific investment strategies, like construction projects.

Collateral is crucial because it secures the loan, providing the lender with an asset they can seize and sell if the borrower defaults. This security reduces the lender’s risk and enables them to approve loans that traditional banks might reject due to the borrower’s financial profile.

Application Process

Applying for a hard money loan involves several key steps, each designed to ensure that both the borrower and the lender are clear on the terms and the viability of the investment. Here’s a detailed breakdown:

- Initial Consultation: Start by discussing your investment plans and financing needs with a hard money lender. This consultation helps the lender understand your goals and allows you to ask questions about their lending criteria and process.

- Documentation Preparation: Prepare the necessary documents to support your loan application. This typically includes:

- Property Details: Information about the property you intend to use as collateral, including its current condition, location, and market value.

- Proof of Ownership: Documents proving your ownership of the property or your right to purchase it.

- Business Plan: A detailed plan outlining your investment strategy, projected costs, and expected returns. This is especially important for fix-and-flip projects or commercial investments.

- Loan Application: Submit your application along with the required documentation. The application form will ask for personal information, details about the property, and your financial projections.

- Property Appraisal: The lender will conduct an appraisal to determine the property’s market value. This step is critical because the loan amount is often based on the property’s value rather than your personal financial situation.

- Loan Terms Negotiation: Discuss and agree on the loan terms, including the interest rate, points (percentage of the loan amount paid upfront), repayment schedule, and any additional fees. Hard money lenders are often more flexible than traditional lenders, so there may be room for negotiation to better suit your needs.

- Loan Approval and Funding: Once your application is approved, you’ll sign the loan agreement. The funds are then disbursed, typically within days. This swift funding process is one of the key advantages of hard money loans.

Approval Criteria

Hard money lenders use different criteria than traditional lenders to approve loans. Here are the primary factors they consider:

- Collateral Value: The main criterion for approval is the value of the property being used as collateral. Lenders prefer properties with substantial equity and clear market value.

- Equity in the Property: Borrowers usually need to have some equity in the property. This equity acts as a buffer, reducing the lender’s risk and ensuring the borrower has a vested interest in the property’s success.

- Borrower’s Experience: Experience matters, especially for projects like fix-and-flips. Lenders favor borrowers with a proven track record of successful real estate investments. Demonstrating past successes can improve your chances of approval and may even help negotiate better terms.

- Exit Strategy: A clear plan for repaying the loan is crucial. Lenders want to know how you intend to repay the loan, whether through selling the property, refinancing with a conventional mortgage, or another method. A well-defined exit strategy reassures lenders that they will recoup their investment.

Differences Between Hard Money Loans and Traditional Loans

- Speed of Funding: One of the most significant differences between hard money loans and traditional loans is the speed at which they are funded.

- Hard Money Loans: Hard money loans are known for their quick funding process. These loans can often be approved and disbursed within a week. This rapid turnaround is possible because hard money lenders primarily focus on the value of the collateral (the property) rather than the borrower’s financial history. This expedited process is particularly beneficial in competitive real estate markets where the ability to close a deal quickly can mean the difference between securing a property and losing it to another buyer.

- Traditional Loans: Conversely, traditional loans from banks or credit unions typically take much longer to process. The approval and funding process for a conventional mortgage can take anywhere from 30 to 45 days or more. This lengthy timeline is due to the extensive underwriting process, which includes a thorough review of the borrower’s credit history, income, employment verification, and other financial documents. This slower process can be a disadvantage in fast-moving real estate markets where quick access to funds is crucial.

Flexibility in Lending

- Hard Money Loans: Flexibility is another area where hard money loans have a distinct advantage. Hard money lenders are private investors or small lending companies that can tailor their loan terms to meet the specific needs of each borrower. This flexibility includes:

- Customizable Loan Terms: Hard money lenders can adjust interest rates, repayment schedules, and loan amounts to fit the borrower’s situation. For example, they might offer interest-only payments or extend the loan term if the project requires it.

- Less Stringent Approval Criteria: These lenders focus more on the value of the property being used as collateral rather than the borrower’s credit history, income, or employment status. This approach makes hard money loans accessible to a broader range of borrowers, including those with poor credit scores or unconventional income sources.

- Traditional Loans: In contrast, traditional lenders follow stricter guidelines and have less flexibility in adjusting loan terms. Banks and credit unions must adhere to regulatory standards and internal policies, which means they often cannot customize loan terms to the same extent. They require a high credit score, steady income, and a low debt-to-income ratio to approve a loan, making it challenging for some borrowers to qualify.

Documentation and Requirements

The documentation required for hard money loans versus traditional loans also differs significantly:

- Hard Money Loans: The application process for a hard money loan is relatively straightforward and requires minimal documentation. Lenders typically need:

- Property Details: Information about the property being used as collateral, including its value, condition, and location.

- Investment Plan: A clear outline of how the borrower plans to use the property and repay the loan. This might include a business plan for a fix-and-flip project or a rental income projection.

Because hard money lenders base their decision primarily on the property’s value, they do not require extensive financial documentation from the borrower.

- Traditional Loans: The documentation requirements for traditional loans are much more extensive and can include:

- Proof of Income: Pay stubs, tax returns, and bank statements to verify the borrower’s income.

- Credit History: A detailed credit report to assess the borrower’s creditworthiness.

- Employment Verification: Letters from employers and a detailed employment history to ensure job stability.

- Other Financial Documents: Documents such as W-2 forms, investment account statements, and information on other debts and liabilities.

Who Are Hard Money Lenders?

Hard money lenders are private individuals or small companies specializing in short-term, real estate-backed loans. Unlike traditional lenders such as banks and credit unions, hard money lenders prioritize the value of the property being used as collateral over the borrower’s credit history or financial standing. This focus on collateral allows for quicker and more flexible financing solutions, making hard money lenders an attractive option for investors needing immediate funds.

Types of Hard Money Lenders

Private individuals often lend their own money for real estate investments, offering more flexible terms tailored to the borrower’s specific needs. These lenders can negotiate terms on a case-by-case basis, providing a personalized lending experience. Small lending companies, on the other hand, specialize in hard money loans and have a more structured process for loan applications and approvals. They offer predictability and professionalism in transactions. Broker networks connect borrowers with multiple hard money lenders to secure the best terms and rates. By offering access to a broad network of lenders, they increase the chances of finding favorable loan terms.

Finding a Hard Money Lender

Finding a reputable hard money lender involves several steps to ensure you secure favorable terms and work with a reliable partner.

Start by researching online and asking for referrals from other real estate investors. Look for lenders with positive reviews and a track record of successful transactions. Comparing the terms, interest rates, and fees offered by different lenders is crucial. Ensure you understand all costs involved, including any upfront fees or points charged. Verify that the lender is licensed and accredited in your state, as this ensures they comply with local regulations and industry standards.

Lastly, choose a lender who is responsive and willing to answer your questions. Good communication is essential throughout the loan process, from initial inquiry to loan closing. A lender with excellent customer service can provide a smoother, less stressful borrowing experience and help resolve any issues promptly.

Where Can I Get a Hard Money Loan?

At Hard Money Lenders, we offer hard money loans for Florida based real estate projects. We are among the top hard money lenders in Miami, Florida and the surrounding area. If you’re not based in Florida, we’ve also prepared a hard money lender directory so you can find the right fit!

We specialize in helping foreign nationals and investors with purchases that conventional lenders won’t deal with. If you’re based in Florida, we’ll sit down with you to inspect your business plan and investment opportunity. If the deal makes sense, we can move forward with one of our loan programs, or prepare a custom-made one! We deal with the following investments:

- Single Family Fix-and-Flips

- Multifamily Fix-and-Flips

- Fix-and-Occupies

- Commercial, Industrial, Office Properties

- Refinancing

- Construction and Land Leases

- …And More!

Contact Hard Money Lenders and get started on your loan application today.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.