Last Updated on February 28, 2024

Have you been eyeing a piece of land, but the thought, “Is land a good investment in 2024?” lingering in your mind? Well, investing in land has always been seen as a wise financial move, and 2024 is no different. The advantages of buying land as an investment are numerous, ranging from potential long-term growth and value appreciation to diversification benefits and tax advantages. In a world of countless investment options, land stands out as a limited resource that provides stability and tangible asset ownership. Whether you’re looking for a secure long-term investment or a way to diversify your portfolio, land is definitely worth considering in 2024. Here at Hard Money Lenders, we’re all about educating potential real estate investors. Below, you’ll discover why buying land is a good investment in 2024.

What Are The Benefits Of Buying Land?

The land is a good investment and reaps endless benefits when purchased smartly. Here are all the advantages of purchasing vacant land:

- Buying land is cheaper than purchasing a fully-structured property.

- The buyer gets a plain canvas and can do anything they like with the land.

- Maintaining vacant land is way cheaper than a structural property. There are minimal maintenance costs and property taxes and zero mortgage, utilities, and insurance costs.

- It is one of the safest investments you can count on in the long term.

- Tax benefits, which we’ll detail below.

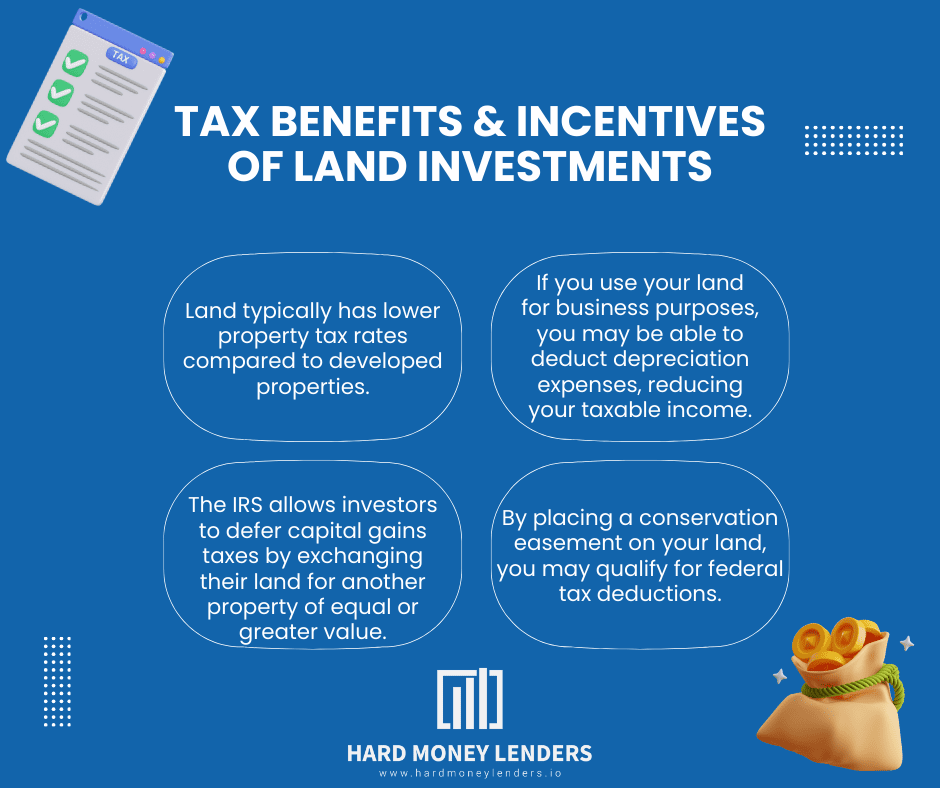

Tax Benefits and Incentives of Land Investments

When it comes to investing in land, there are several tax benefits and incentives that can make it an attractive option. Here are a few key advantages to consider:

- Lower property taxes: Land typically has lower property tax rates than developed properties. This can result in significant savings over the long term.

- Depreciation deductions: If you use your land for business purposes, you may be able to deduct depreciation expenses, reducing your taxable income.

- 1031 exchanges: The IRS allows investors to defer capital gains taxes by exchanging their land for another property of equal or greater value. This can provide a valuable tax advantage when diversifying or upgrading your land holdings.

- Conservation easements: By placing a conservation easement on your land, you may qualify for federal tax deductions. This can be a win-win situation, allowing you to protect the environment while saving on taxes.

- Agricultural exemptions: If your land is used for agricultural purposes, you may qualify for various tax exemptions and benefits, such as reduced property taxes or agricultural tax credits.

Mitigating Risks through Land Investment Diversification

Diversifying your land investments can help mitigate risks and ensure a more stable portfolio. By spreading your investments across different types of land, such as commercial, residential, or agricultural, you reduce the impact of market fluctuations in one specific sector. Additionally, investing in land in different regions or countries can provide geographical diversification, safeguarding against regional economic downturns. Diversification allows you to balance risk and potentially maximize returns, making land investment a more secure and profitable venture in 2024.

What Are The Disadvantages Of Buying Land?

Some drawbacks include legal and regulatory issues, such as zoning rules and building permits. Access to utilities like water, electricity, and sewage may also be a concern, especially in remote or undeveloped areas. Environmental concerns, such as contamination or natural hazards, should also be carefully assessed.

Additionally, the lack of immediate income generation from land investments can be a disadvantage compared to other forms of investments.

Here’s the rundown on the disadvantages of buying land.

- One cannot expect to start earning right away. The return from a vacant land comes much later.

- Building a property on land can be expensive.

- It is hard to evaluate land’s value.

- Zoning and policy changes can impact the value of land.

- If you’re buying land to profit, it may be difficult and take longer than expected.

What to look for when buying land?

When buying land, it’s important to consider various factors to make a wise investment. Look for land with good location and access to amenities like utilities and transportation. Evaluate the zoning regulations to ensure the land can be used for your intended purpose. Conduct thorough research on the property’s history, including any potential environmental issues or legal disputes. Consider the future potential for development and growth in the area. Finally, consult with real estate agents, lawyers, and surveyors to ensure a successful purchase.

Location, Location, Location

Making sure you have the blueprint of future developments and what the local government has in mind for the space can give you the assurance of knowing whether the piece of land you’re looking into buying will increase in value or not.

Pro Tip: For quick and high returns, look for land in areas where housing demands are on a rise. Just know that this would also mean you will have to pay a higher premium. For example, in Florida, there’s been increasing demand for housing in 2023, and it looks like there are no signs of it stopping in 2024

Make Sure You Understand Zoning Laws

Another crucial factor while purchasing land is zoning. It’s recommended to be familiar with the local laws and zoning of the area where you plan to purchase land. Some areas are for commercial use, some for residential, while others are both. Whatever you intend to do with the land, look into zoning beforehand to avoid disappointments later.

Hazards

Before purchasing vacant land, look out for any red flags.

For example, if the sale price offered to you is way less than other properties nearby, that should set the alarm bells off! Find out why from local resources. Maybe it is a flood-prone area or sees many wildfires. Whatever the reason, you must investigate.

Utilities

The basics like having a well-planned sewage system, electric grids, and security cannot be compromised. So make sure you check for public utilities before purchasing raw land.

Easements

Easements are a third party’s right to use your land. Easements do not directly affect your investments but are important.

Future Appreciation In Value

Life is unpredictable. You may not end up living or constructing your dream house on the purchased land. To make the best out of your investment, ensure you invest in a land whose value appreciates in the near future. This brings us to the next topic.

Key Tips To Consider When Considering Land As An Investment in 2024

For individuals considering land investment opportunities, here are some key recommendations to keep in mind:

- Conduct thorough research: Before investing in any land, it is crucial to gather as much information as possible about the location, zoning regulations, potential for development, and market trends. This will help in making an informed decision and maximizing the potential returns.

- Seek professional advice: Consulting with experts such as real estate agents, land appraisers, and financial advisors can provide valuable insights and guidance throughout the investment process. Their expertise can help navigate any complexities and ensure a smooth investment experience.

- Diversify the portfolio: Land investment should be seen as a part of a well-diversified portfolio. By spreading investments across different asset classes, individuals can mitigate risks and maximize their long-term returns.

- Consider long-term investment: Investing in land requires patience, as the real value often appreciates over time. It is important to understand that land investments may not provide immediate returns, but they can be a valuable long-term hedge against inflation and a source of steady income.

- Analyze future growth potential: Analyzing the future growth potential of the area, such as population growth, infrastructure development, and urbanization trends, can help identify land parcels with higher appreciation potential. Taking into account these factors can lead to higher returns on investment.

- Plan for unforeseen expenses: It is essential to factor in potential costs and expenses associated with land investment, such as property taxes, maintenance, and land improvement costs. Having a financial plan in place to cover these expenses can help avoid any financial strain in the future.

- Stay updated on market trends: Continuously monitoring and analyzing market trends and economic indicators can help investors make informed decisions about buying, selling, or holding onto land investments. This ensures that investment strategies remain aligned with the current market conditions.

What causes the land to appreciate in value?

Several factors lead to land appreciation which include the following.

Increase In Demand

An increase in demand leads to a rise in land value because more people are interested in buying land meaning that they have higher prices to offer.

Economic Advancements In The Area

Economic advancements in the area can also lead to increased demand for land, which in turn increases its value. When the economy is doing well and people have more money to spend, they are more likely to buy homes or businesses which require more space. The increase in demand then leads to an increase in land prices.

Changes In Policy

Changes in policy can also lead to an increase in land prices. For example, if the government passes laws that require new developments to be built on previously undeveloped land, this will increase demand for such land and therefore increase its price.

Time

Another factor that can affect land prices is time. The older a piece of property is, the more valuable it tends to be. This is because older properties have had more time to accrue value and interest from potential buyers.

Population Growth

Now, population growth can also cause land prices to increase. As a city or region’s population grows, housing demand increases. This leads to a rise in the value of land, which can be sold or rented out at higher prices.

Local Developments

Local developments can also affect land prices. A new road or housing development, for example, may increase demand for land nearby and therefore drive up its price. Or let’s say a new company like Amazon is going to open up warehouses and offices, that would also drive land prices higher.

What causes the land to depreciate in value?

If your land property can rise, it can fall as well. While demand and supply do affect the value of land, other factors that impact its value include the following.

Hazards/Natural Disasters

The presence of environmental hazards such as floodplains, sinkholes or erosion can make land unusable and thus decrease its value.

Zoning/Policy Changes

Changes in zoning laws or policies can make land unusable. For example, a change in zoning laws could prohibit the construction of homes on a parcel of land.

Changes In Market/Market Crashes

If the market is flooded with land, it can drive down the price. Similarly, a sharp drop in demand for land properties can also lead to a decline in value. Additionally, high-interest rate environments can also cause land prices to drop.

Undesirable Use

If the land has been used for hazardous activities (such as toxic waste dumps or chemical spills), it may not be suitable for other uses. This can decrease its value.

Ways Buying Land Can Make You Rich Expeditiously

So is investing in land a good idea? As a financial decision, you can expect it to be a solid one. Here are a few ways it can make you money:

- You can use the land as a mortgage for loans to start your business.

- You can lease out the land and use that money to invest in other lands. This way you can work your way up to owning multiple properties.

- You can sell the land for higher profits when the time is right and use that to further invest in other properties.

- You can use the mortgage on the land and use that loan to build a house, condotel, short-term rental property, or even an assisted living facility. You can then use this income to accumulate more assets and investments.

Final Thoughts on Why is Land A Good Investment in 2024

Buying land is a great long-term investment. It is lucrative, provides peace of mind with a sense of ownership, banks always welcome your loan requests and its’ low-risk. If you seek a quick return, buying vacant land is not an ideal investment for you. However, if you are looking for long-term gains, there is nothing better than buying land.

We hope our guide will help you make a more informed and sound decision. No matter what you invest in, it is always good to weigh the pros and cons. Doing so can prepare one for all future adversities and even prevent losses in the future.

Remember that with any of your investing needs, we at Hard Money Lenders are here to help. New to investing? Check out our article Real Estate Investing 101

Frequently Asked Questions

Is land a good investment during inflation?

The short answer: potentially. You see, land can be used as a hedge against inflation because it typically holds its value over time, if and only if the growth rates increases faster than inflation.

However, there’s one important detail to keep in mind. Land can be difficult and time-consuming to sell, which means it’s less liquid than other investments like stocks.

Is owning land profitable?

Yes, there are several advantages to owning land. In addition, this type of investment can turn out to be profitable if you make decisions strategically.

Does land appreciate in value?

Land appreciation is 100% possible. Considering all essential factors while buying land, you can see an appreciation in its value.

Is it better to invest in land or a house?

Investing in land and investing in a house has its benefits. It completely depends on the type of return you are seeking. If you seek fast returns, it is better to invest in a house. On the other hand, investing in land can be lucrative if you seek a low-risk, long-term investment.

How do you make money buying land?

When it comes to making money from buying land, there are several ways to capitalize on your investment. One of the most common methods is through appreciation, as land values tend to increase over time. By purchasing land in areas with potential for growth and development, you can benefit from the rise in value.

Additionally, leasing the land for various purposes, such as farming or commercial use, can provide a steady income stream. Another option is to develop the land for residential or commercial projects and sell or rent the properties for profit. Overall, buying land can be a lucrative long-term investment strategy.

Jack Roberts has spent the last 5 years in the Private Money Lending world helping real estate investors secure financing for their non-owner occupied real estate investments. When he’s not thinking about real estate, Adam is an avid Jazz music fan and fisherman.