Last Updated on May 22, 2024

Any market decision should be preceded by a market analysis, and house flipping is no exception! Without comprehensive analysis behind it, house-flipping can be a real gamble. There are many different ways analysis can take place, depending on the specifics of the project and the information needed. In the simplest possible terms, there are a few very compelling reasons to perform a house flipping market analysis. You can…

- Decide whether a given property is a viable candidate for flipping in the first place

- Figure out the potential ARV (After Repair Value) of a home

- Determine a fair price at which to purchase the property

- Discover just how you could make by flipping a property

You may be wondering where to begin, and understandably so.

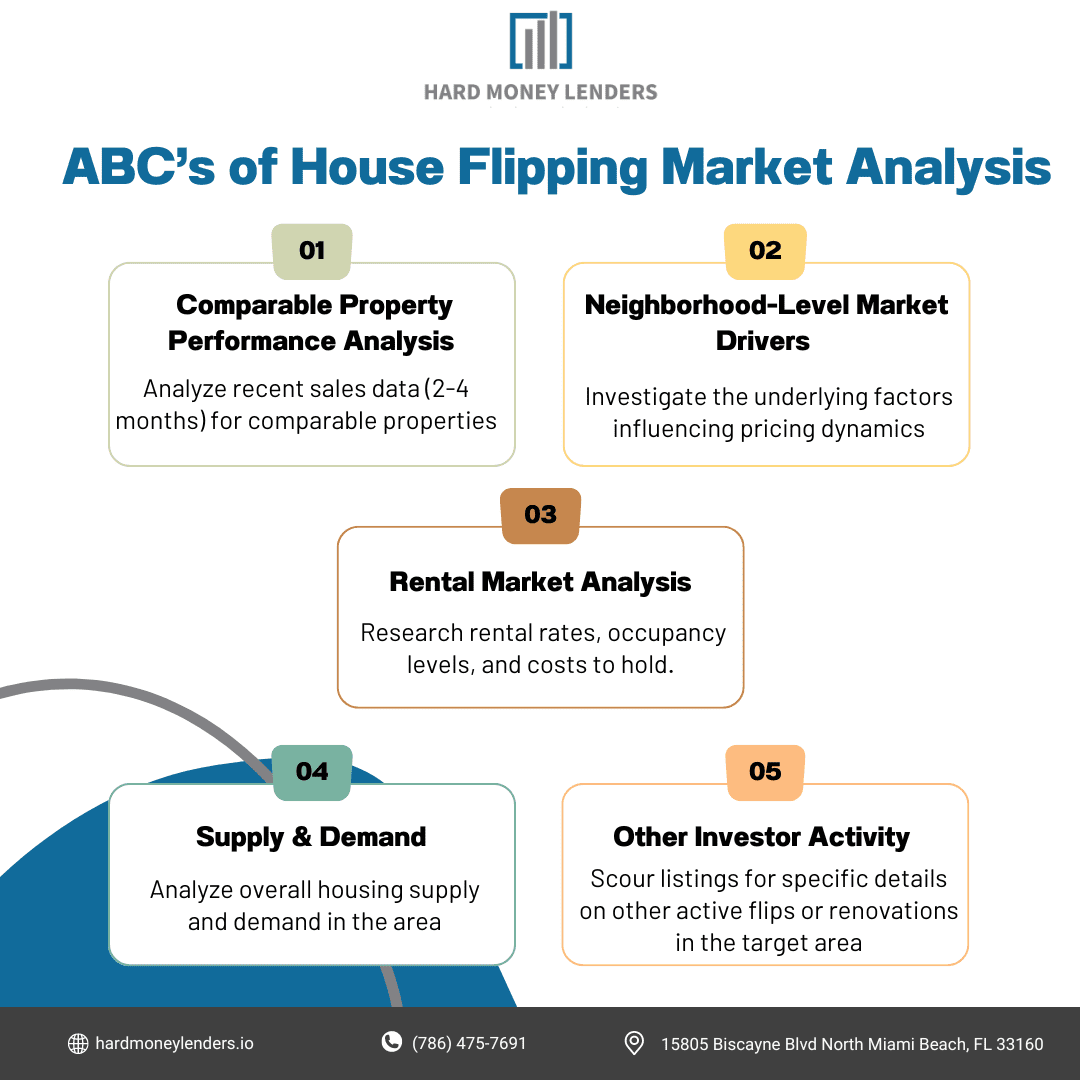

The ABC’s of House Flipping Market Analysis

Comparable Property Performance Analysis

Rigorously analyze recent sales data (2-4 months) for comparable properties in the specific neighborhood and surrounding areas. In slower markets, look back 6-12 months to gather enough data points.

Factors to assess include:

- Home price trends (increasing/decreasing and by how much)

- Days on market (properties selling faster indicates higher demand)

- Sale-to-list price ratios (patterns can signal pricing strategies)

- Reasons for discrepancies between comparable sales

Identify neighborhoods and price tiers where properties are newly appreciating – those could hold the most flipping potential.

Neighborhood-Level Market Drivers

Don’t just look at the numbers – investigate the underlying factors influencing pricing dynamics. Factors like new business developments, infrastructure upgrades, community amenities, school districts, and city plans can all impact future home values.

Rental Market Analysis

Many flippers keep properties as rentals before selling. Research rental rates, occupancy levels, and costs to hold. This data is critical for projecting cash flows and holding costs if you need to rent out a newly flipped property.

Supply & Demand House Flipping Market Analysis

Beyond comps, analyze overall housing supply and demand in the area:

- New residential construction levels

- Percentage of vacant homes

- Inbound/outbound migration patterns

- Job market strength

This bigger-picture view illuminates whether you’re entering a buyer’s or seller’s market.

Other Investor Activity

Scour listings for specific details on other active flips or renovations in the target area. This grounds your expectations for:

- Profitable renovation styles and designs

- Common pitfalls or challenges to prepare for

- Realistic pricing strategies and buyer expectations

The best flippers plug into local expert networks (contractors, brokers, etc.) anddata sources beyond public records. With meticulous market analysis from multiple angles, you can identify not just the right properties to flip but the optimal timelines, budgets, designs and pricing for maximum ROI.

Analyzing the Property Itself

Physical and Structural Assessment

When evaluating a property for flipping, a comprehensive physical and structural assessment is critical. This involves:

- Age of Property: Older homes often come with more charm but also a higher likelihood of systems needing updates. The age can affect everything from the materials used in the home to the style of construction, which may impact renovation choices and costs.

- Condition of Critical Systems: Thoroughly assess the plumbing, electrical, heating, and cooling systems. These are costly to upgrade but essential for the home’s functionality. Use licensed professionals to inspect these systems as they can identify potential issues that may not be visible to the untrained eye.

- Structural Integrity: Check the foundation, roof, and overall structure for any signs of distress such as cracks, water damage, or uneven flooring. Structural repairs can be expensive and time-consuming but are vital for the safety and value of the home.

- Potential Environmental Issues: Identify any susceptibility to flooding, earthquake damage, or other environmental factors. These risks can affect insurance costs and resale value.

Renovation History and Potential Hazards

Knowing the property’s renovation history and any potential hazards is important:

- Previous Renovations: Obtain records of any major renovations or repairs. This information can indicate the home’s condition and reveal how previous issues were addressed.

- Hazardous Materials: Homes built before the 1980s may contain asbestos or lead paint, which pose health risks and require special removal processes. Ensure a thorough inspection to identify these materials before proceeding with renovations.

- Permits and Compliance: Check that all previous renovations were performed with the necessary permits and comply with local building codes. Unpermitted work can lead to legal issues and additional costs to rectify.

The Importance of the Right Renovations for House Flipping Market Analysis

Strategic Investment in High-Value Areas

Kitchens and Bathrooms

Investing in kitchens and bathrooms can dramatically increase a property’s marketability and sale price. For kitchens, consider incorporating modern appliances, stone countertops, and high-quality cabinetry as these elements are often highlighted in home selling points. Efficient layouts that maximize space and functionality are equally important. In bathrooms, focus on modern fixtures, good lighting, and moisture-resistant materials. A well-executed bathroom remodel can return over 60% of the investment.

Energy Efficiency

Improving a property’s energy efficiency is increasingly attractive to today’s environmentally conscious buyers. Installing energy-efficient windows, better insulation, and modern HVAC systems not only appeals to buyers but also benefits the environment and reduces energy costs. These updates can be decisive for buyers who prioritize sustainability and long-term savings.

Aesthetic and Functional Updates

Visual appeal significantly affects a buyer’s first impression. Fresh paint in contemporary, neutral colors, new flooring, and strategic lighting upgrades can transform a space. These changes are relatively affordable and can significantly enhance the property’s appeal. When selecting materials, opt for durability and timeless design to appeal to a wide audience.

Avoid Overpersonalization

Universal Appeal

Focus on renovations that will appeal to the majority of potential buyers. Neutral designs and functional upgrades like added storage or multi-use spaces will attract a wider audience than niche, personalized designs. Avoid bold, trendy colors or custom-themed rooms that might not align with general taste.

Cost vs. Value

It’s crucial to balance the cost of renovations with the potential increase in property value they bring. Not all improvements will offer a good return on investment, particularly in markets with lower overall home values. Utilize remodeling cost versus value reports to determine which renovations are most likely to offer profitable returns. Renovations should enhance the property’s value and appeal without exceeding the ceiling price for the neighborhood.

Analyze your own situation, too

Last but certainly not least, you should always keep in mind how much risk you are willing to accept. Analysis can help you make a very safe investment, but even the safest investment isn’t guaranteed to be profitable. As noted above, markets can be unpredictable.

A comprehensive market analysis should also incorporate a clear picture of your own finances and bargaining position. If you are an inexperienced investor, you’ll likely want to stick to safe markets and conservative estimates.

If you have many years of experience flipping houses, you may be ready to take on relatively risky projects. Never intentionally seek out a gamble or turn down an incredible opportunity, but always be aware of your own comfort level and limitations when investing. Just as you need to account for any unexpected difficulty in the flip itself, you should make sure you have enough resources available that you will remain financially stable even if things don’t turn out as well as hoped.

Don’t Forget to Analyze the Neighborhood

Don’t Forget to Analyze the Neighborhood

The neighborhood and the property itself are the first things that come to mind when analyzing any house flip, but don’t disregard local government entities, homeowners associations, and school zones as well; these regulatory boundaries can seriously impact the profitability of a given property.

It goes without saying that having good schools nearby appeals to many buyers, but keep in mind that you may have to pay special taxes or fees to the local government and homeowners association, as well as make sure to observe local regulations in your renovation planning. For instance, some neighborhoods may have strictly enforced color schemes, and local governments may require the involvement of special agencies whenever working with plumbing or electricity.

You should also check on the local housing inventory, as it serves to indicate demand. If more people are moving into an area than leaving it, it is likely that demand is high and inventory is low. As always, climbing demand translates into climbing profits for the seller.

Tip: Don’t be afraid to ask the area’s Chamber of Commerce or Census Bureau for information on inventory!

Of course, the local economy underlies all aspects of the local housing market. Low unemployment, high wages, and plenty of job openings make for an environment that draws new residents in, and those residents need housing. In a bad economy, low wages and poor job security will serve to dissuade people from making a serious commitment, such as buying a home.

Understanding the Broader Economic Context

Local Housing Inventory and Demand

To effectively analyze the market for house flipping, it is essential to examine the local housing inventory and the demand dynamics in the area. A low supply of homes coupled with high demand typically facilitates quicker sales and can drive up property prices, providing a favorable environment for house flippers. Utilize local real estate reports and data from real estate platforms to track inventory trends. Observing seasonal variations and new housing developments can also provide insights into future market conditions. Engaging with local real estate agents for expert opinions and up-to-date market conditions can offer an edge in understanding the timing for buying and selling properties.

National Economic Indicators

National economic indicators play a critical role in the housing market and, consequently, in house flipping decisions. Key indicators include:

- Interest Rates: Lower interest rates generally increase the affordability of mortgages, which can boost home buying activity, thereby raising property values. Conversely, when interest rates rise, mortgages become more expensive, potentially cooling off the housing market.

- Lending Standards: Tighter lending standards can reduce the pool of potential home buyers, as fewer people qualify for mortgages. Conversely, relaxed lending standards can increase the number of potential buyers, potentially inflating home prices.

- GDP Growth: Strong economic growth often leads to higher employment and incomes, which can boost demand for housing. Monitoring GDP growth rates can provide insights into the overall economic health and its potential impact on the housing market.

- Consumer Confidence: A high level of consumer confidence typically indicates that people feel secure in their financial future and are more likely to make significant purchases like homes. Consumer confidence indices can be a leading indicator of the willingness to buy real estate.

By integrating both local and national data, house flippers can better predict market movements and optimize their investment strategies. This holistic approach to understanding the economic context can help mitigate risks associated with property investment and capitalize on opportunities as they arise.

Final Thoughts on House Flipping Market Analysis

Flipping a house can be a complicated affair, and a thorough analysis is absolutely crucial when deciding if a potential flip is a worthwhile investment. House flipping market analysis analysis should be thorough and holistic, incorporating extensive information on the property, the area, and the market as a whole. Always be conservative, too, especially if your access to the property is limited.

FAQs

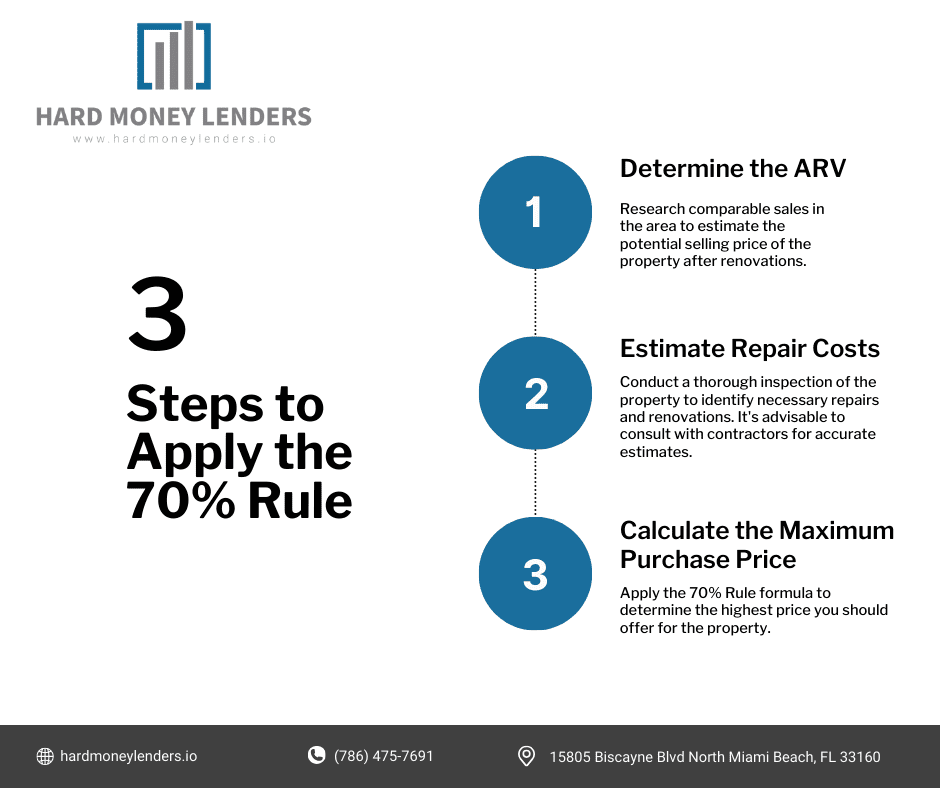

What is the 70% rule in house flipping?

The 70% rule is a guideline that real estate investors often use to help determine the maximum price they should pay for a property, considering the cost of renovations needed to make it marketable.

Essentially, an investor should spend no more than 70% of the After Repair Value (ARV) of the home, minus the costs of the renovations required. This rule helps investors maintain a margin for profit and account for unforeseen expenses, making it a vital tool in risk management and financial planning for house flipping.

How can I accurately estimate the After Repair Value (ARV) of a property?

Accurately estimating the ARV of a property involves detailed market research and sometimes professional appraisals. You should compare the property with similar homes in the area that were recently sold, preferably within the last three months. Pay attention to their size, condition, location, and the features they offer.

Tools like MLS (Multiple Listing Service), real estate websites, and county property appraiser sites can be invaluable. Engaging a local real estate agent or an appraiser can provide expert insights and help refine your ARV estimate based on current market trends and the unique aspects of the home and neighborhood.

What factors should I consider when selecting a property to flip?

Choosing the right property to flip involves evaluating several key factors:

- Location: Look for properties in areas with high demand for housing, good schools, amenities, and low crime rates.

- Condition of the Property: Assess the amount and type of renovation needed and whether it aligns with your budget and skills.

- Market Conditions: Analyze local housing market trends, including inventory levels, average days on market, and price trends.

- Cost of Renovations: Estimate the renovation costs accurately, including materials, labor, permits, and potential unexpected expenses.

- Potential Profit: Ensure the expected resale price after renovations will cover all your costs and provide a satisfactory profit margin.

How do local economic conditions affect house flipping?

Local economic conditions such as employment rates, average income, and major local industry developments can significantly influence the real estate market. Strong economic growth attracts more people to an area, increasing demand for housing and driving up property prices.

Conversely, if the local economy is struggling, it may lead to decreased demand and lower home values. Monitoring these trends can help predict future market movements and guide investment decisions.

Can changes in interest rates impact house flipping investments?

Interest rates directly affect the cost of borrowing money, which can influence the real estate market significantly. Lower interest rates generally make borrowing cheaper, allowing more buyers to afford mortgages, which tends to drive up property prices.

On the other hand, higher interest rates may decrease the number of potential buyers in the market, potentially lowering property values and extending the time it takes to sell a flipped house. Keeping an eye on interest rate trends can help investors time their purchases and sales to maximize returns.

What are some common mistakes to avoid in house flipping?

Common mistakes in house flipping include:

- Underestimating Costs: Many new flippers fail to account for all costs, including purchase price, renovation expenses, holding costs, and selling costs.

- Overestimating ARV: Being overly optimistic about the sale price can lead to losses if the market doesn’t support the expected valuation.

- Ignoring Market Research: Not understanding the local market demand and conditions can lead to poor investment choices.

- Skimping on Quality: Using low-quality materials or workmanship can lead to property devaluation and longer sale times.

- Lack of Adequate Planning: Failing to plan for each stage of the flip can lead to delays, budget overruns, and reduced profits.

How long does it typically take to flip a house?

The time it takes to flip a house can vary widely based on factors such as the extent of renovations needed, the efficiency of contractors, and current market conditions. Typically, a flip can take anywhere from a few months to a year. Efficient project management and having a competent team are crucial to minimizing the time investment.

Jack Roberts has spent the last 5 years in the Private Money Lending world helping real estate investors secure financing for their non-owner occupied real estate investments. When he’s not thinking about real estate, Adam is an avid Jazz music fan and fisherman.