Last Updated on May 16, 2024

If you’re looking for a way to generate income in real estate without a whole lot of money, micro-flipping might be the answer. The process of buying and selling properties quickly is becoming more popular among investors looking for an easy way to make money. Learn how to do it right here! Below, we’ll teach you everything about micro-flipping, why it’s done, and how to get started with your project. You’ll also learn some tips that can help you ensure that your project goes smoothly from start to finish.

We Will Talk About

- What is micro-flipping in real estate

- Why should you be interested in it

- The process of micro-flipping real estate

- What are the risks and challenges to consider when micro flipping

- Micro Flipping vs Wholesaling Real Estate

- Frequently Asked Questions About Micro Flipping

What Is Micro Flipping in Real Estate?

Micro-flipping involves some risks, primarily risk for financing issues if trying to use cash not owned by you or your business. When flipping real estate, it’s best when there is no personal credit risk involved, which would allow an investor access to liquidity at any time without high-interest rates.

Why Should You Be Interested in Micro-flipping?

There are several good reasons to consider this kind of investment strategy. For one, it’s very quick and easy because you’ll only have to make a few repairs instead of major renovations that might take months. Micro-flipping can be a great source of income for those who don’t have much time but want to earn big profits in a short amount of time.

Investing in this way can also be a good asset to have on your tax records, as you might be able to write off the repairs you make before reselling the property and earning a profit. One other great reason is that micro flipping is fairly low risk, especially if you work with an experienced real estate agent and have a backup plan if your project doesn’t make as much money as you expected. A micro flipper can also achieve fairly quick returns on investment.

4 Reasons to Consider Micro-Flipping Real Estate

- Speed: One of the most appealing aspects of micro-flipping is the rapid turnaround. Unlike traditional real estate investments, which can involve lengthy renovations and selling periods, micro-flipping typically focuses on properties that need minimal repairs. This allows investors to quickly refurbish and sell properties within weeks, capitalizing on market movements and demand spikes.

- Profit Potential: Micro-flipping can yield significant returns in a relatively short timeframe. By targeting underpriced homes in promising locations and quickly enhancing their value through cosmetic updates, investors can sell them at a premium. This quick flip process relies on swift decision-making and understanding market trends to maximize profit margins.

- Tax Benefits: Investors may benefit from tax deductions for expenses related to property repairs and improvements. These expenses can reduce the taxable income derived from flipping activities, making it a financially efficient investment strategy. It’s advisable to consult with a tax professional to accurately track and claim these benefits.

- Low Risk: With the right approach, micro-flipping can be a lower-risk real estate investment. By choosing properties that require less capital for repairs and focusing on quick sales, investors can potentially minimize the usual risks associated with real estate investments, such as market volatility and long-term financial commitment. Moreover, working with experienced real estate agents and advisors can further mitigate risks and streamline the process.

The Process of Micro-flipping Real Estate

Micro-flipping begins with initial planning and research. It’s best to investigate several properties before deciding on a particular purchase, ensuring that it doesn’t need too much expensive work done or major renovations that might not be worth the cost.

Research and Planning

- Property Selection: Identify undervalued properties that can be quickly resold for a profit. These are typically homes that require only light cosmetic repairs, making them ideal for a rapid turnaround.

- Market Analysis: Conduct a detailed analysis of the local real estate market to ensure there’s robust demand for the types of properties you’re targeting. This involves understanding key demographic trends, economic conditions in the area, and specific buyer preferences that can influence the saleability of your properties.

- Financial Assessment: Create a comprehensive financial plan that outlines all potential costs associated with the micro-flipping process, including purchase prices, repair costs, holding costs if any, and the anticipated selling price. This financial blueprint is essential for setting realistic investment goals and budgeting effectively.

Making Repairs

- Cost-Effective Improvements: Focus on making repairs that are not only affordable but will also offer the greatest impact on the property’s market value. Prioritize quick fixes like painting, minor landscaping, updating fixtures, and other simple enhancements that can dramatically improve curb appeal.

- Efficient Project Management: Opt for a project management approach that emphasizes speed and efficiency. You can choose to handle repairs yourself if you have the expertise, or you can hire skilled contractors with a proven track record for quick and quality work. The goal is to complete these repairs quickly to avoid prolonged holding periods that can increase costs.

- Quality Control: Maintain high standards during the repair process to ensure all improvements meet market expectations and regulatory requirements. This attention to detail will help avoid future liabilities and make the property more appealing to potential buyers.

Listing and Selling

- Effective Marketing: Employ a robust marketing strategy that utilizes multiple channels to maximize exposure. List the property on popular online real estate platforms, leverage social media for broader reach, and possibly engage traditional real estate agents who understand the local market dynamics.

- Pricing Strategy: Set a competitive price that attracts buyers while ensuring you meet your profitability targets. Consider strategic pricing that might be slightly lower than the market rate to encourage quick offers, balancing fast sale needs with the desire to maximize returns.

- Negotiation Skills: Prepare to negotiate effectively with potential buyers. Strong negotiation skills are crucial in securing a deal that meets your financial expectations while also being attractive enough to close quickly.

Closing and Repeating

- Analyzing Outcomes: After selling the property, take the time to analyze every aspect of the transaction to identify successes and areas for improvement. Look at the financial results, assess how long it took to sell the property, and gather feedback from buyers to refine your approach for future flips.

- Scaling Up: If the strategy proves successful, consider scaling your operations to handle multiple properties simultaneously or expand into new geographical markets. This growth can lead to greater profits and more opportunities in different segments of the real estate market.

- Continuous Learning: Stay informed about the latest trends and changes in the real estate market. Continuous education will help you adapt to new challenges and leverage emerging opportunities in micro-flipping.

- Iterative Improvement: View each micro-flip as a learning opportunity. With enough practice and refinement, you can increase the frequency of your flips, potentially leading to substantial profits. This repetitive cycle of learning and applying is key to mastering micro-flipping.

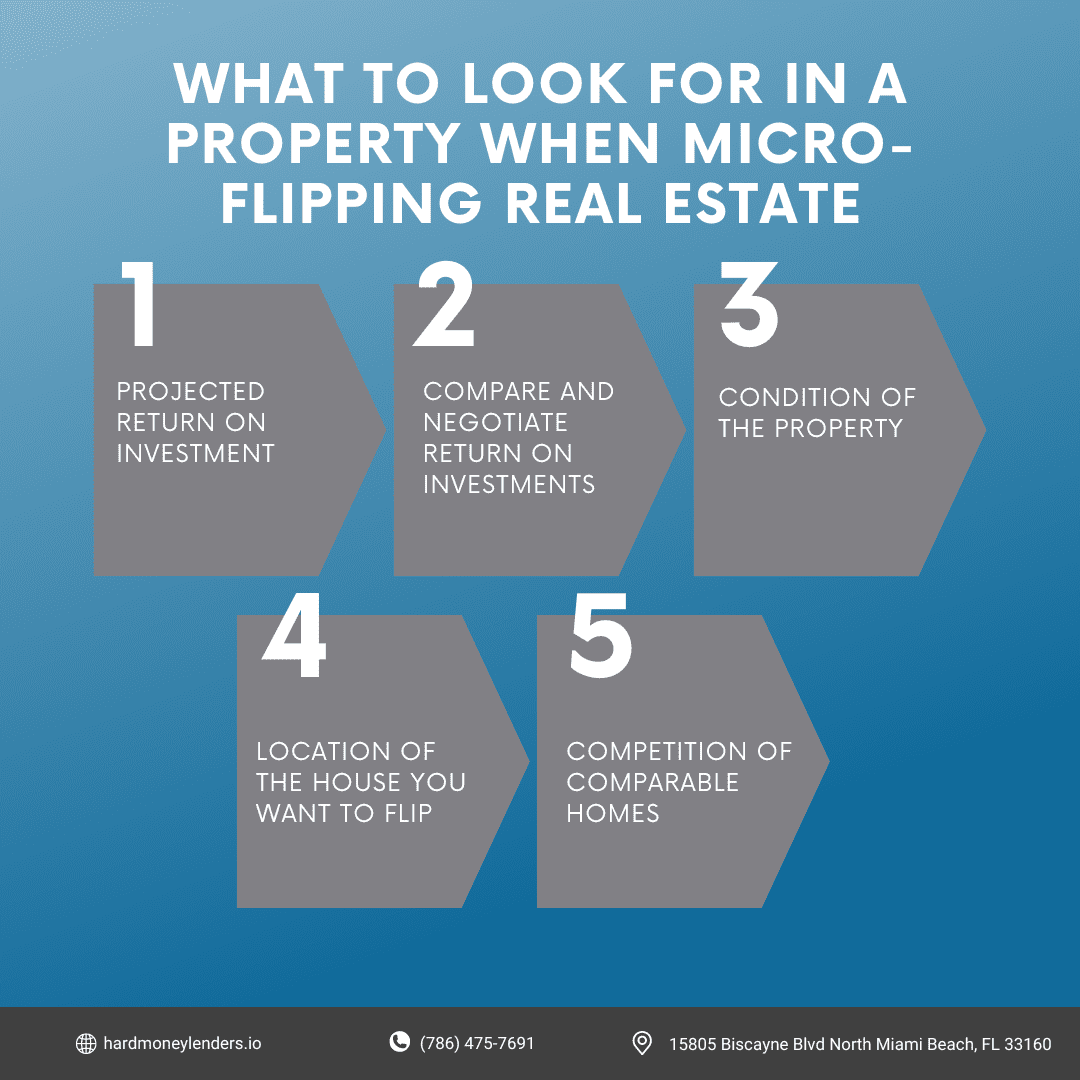

What to Look For in A Property When Micro-Flipping Real Estate

Projected Return on Investment

Calculate how much money you’ll be able to make from a given property after all costs have been covered. This includes repairs, marketing, and profit.

Negotiating

Don’t pay too much for a property. Look at its projected ROI and compare it to what you’d expect another property to make in the same area—if one would give you 20% ROI and another only 10%, go with the first one.

Condition

Always look at the physical condition of a property before buying it. This will include everything from roof damage to foundation cracks and more. That way, you will know how much it will cost to repair before taking on the investment.

Location

If you want to sell your property quickly, ensure that it’s in a highly demanded area with high foot traffic. The location should also be fairly close to public transportation options if possible.

Competition

If there are many other housing options in the area, don’t expect to sell your house immediately. Instead, lower the price until you find a buyer who wants it. If you’re able to keep these tips in mind when searching for a fixer-upper property, you’ll be well on your way to micro-flipping success!

The Risks and Challenges to Consider When Micro Flipping Real Estate

Now that we know how micro-flipping works, it’s time to discuss some of the risks and challenges that might come into play when putting this strategy into motion.

Not Able to Sell

Micro-flipping has its risks, including the possibility that you might not be able to sell the property for as much as originally expected despite all your efforts in making it look nicer. This is a risk with any real estate purchase or sale, so don’t worry too much if you notice a dip in expected value. Plus, if you work hard to find the right property and negotiate well when buying, it’s possible to make up for small projected returns through sheer effort—and that’s what matters most in this business.

Time/Money Ratio

Another concern is whether or not your time will be worth investing in micro flipping. Since you’ll be spending a good deal of time on each property, you should factor in compensation for your hours. Of course, the challenges associated with this strategy will always vary depending on how willing you are to fix up properties before reselling them. If you’re content with leaving that responsibility to someone else, then micro-flipping might not be the strategy for you.

Finding a Fixer-Upper Property

One other issue micro flippers have to overcome is the problem of finding a fixer-upper property. Unfortunately, these aren’t always easy to come by, and you’ll have to do some research before investing your time and money in the project. As long as you know what you’re getting into when it comes to micro flipping, you can make up for any losses as long as you work hard and find the right property for your needs.

Micro Flipping vs. Wholesaling Real Estate

Now that we’ve gone over micro-flipping basics let’s talk about how it stacks up against wholesaling.

What Is Wholesaling in Real Estate?

In the simplest explanation, the wholesaler is the person who finds a home with a seller, takes over negotiations with that seller for a buyer at their asking price. The wholesaler then finds another buyer who is interested in the house at a higher price. The wholesaler contracts the home with both of them and keeps whatever money falls between the gaps for themselves. This process seems pretty simple, but there are many other factors involved that people don’t often think about, such as lead generation, finding a motivated seller, working with buyers and sellers at the same time while keeping track of whom to transfer deals too, filling out all the correct paperwork (which can be very confusing). The process also requires a significant amount of money if you are going to do it right. Most wholesalers need at least ten thousand dollars to start.

What are the Differences Between Wholesaling and Micro-Flipping Real Estate?

Let’s take a look at the list of differences we’ve compiled through our experience:

The Middleman

The first difference is that a wholesaler is a middleman between you and the seller. So you are not having to deal with fixing any properties because your wholesaler does it for you, but it takes away some of your profits in the end. The amount of profit depends on whether or not you have negotiated a contracted price. If you act as the middleman for your buyer and seller, you will receive a certain amount of money from them, usually around 5% to 10% of the total sale price.

The Flipper’s Responsibility

Micro-flipping is different in that you are responsible for every aspect of the process. First, you must find properties, see what repairs they will need, and fix them yourself. There is no one to help you with anything at all. The entire process is up to you, which means more responsibility and less freedom for you in the end.

The Type of Property

Wholesalers handle properties that are usually empty or partially finished inside. They don’t have to worry about multiple rooms needing different renovations and repairs because the houses are often vacant, so it’s a lot easier for them to handle. Micro-flippers have to deal with this aspect of property renovation and all the other factors we mentioned earlier to make their profit.

The Difficulty

Another difference is that wholesaling is far less complicated than micro-flipping. Most people can learn how to wholesale in a month or two, and they can do it with almost no money at all. Micro-flippers must work their way up from the bottom of the ladder by learning the business through experience. It takes time to understand fully so you can make smart business decisions to make your profit.

The Start-Up Costs

Since wholesalers don’t have to deal with fixing property issues at all, they only need enough money for lead generation and marketing, which means they can start with almost no money at all. Micro-flippers must factor in the cost of repairs before they even touch one single property. This is what sets the two processes apart and makes micro-flipping a more expensive process in the end.

The Risk

Wholesalers are much less likely to lose their money than micro-flippers since they don’t have to risk anything at all on projects. Instead, they make money by working with sellers or finding other wholesalers to work with. Micro-flippers are the ones who take all the risk by investing their money into property renovations, so it’s more likely that they will lose everything and walk away empty-handed.

The Final Verdict

Micro-flipping is getting popular as a way to make money in real estate. And it’s not just for the rich and famous! With our Ultimate Guide, we hope you will be able to take advantage of this trending strategy too. We also want you to know that any business venture has risks and challenges, so don’t think of micro-flipping as an easy get-rich scheme either. Micro-flipping isn’t all sunshine and roses, but if done right, it can yield high profits in just a few months of work!

Looking for a Loan for Micro-Flipping?

We’re here to help you get the cash you need fast! Whether it’s an investment property or your first flip, we can provide the funding. Our Hard Money loans are quick and easy, with no credit checks and no collateral needed. You don’t have to be rich to invest in real estate! With our competitive rates and flexible terms, we ensure that your money is working as hard as possible for you.

Stop worrying about where the next payment will come from – let us take care of all those worries so that you can focus on making more money instead of spending it all on interest payments.

Frequently Asked Questions About Micro Flipping

Frequently Asked Questions About Micro Flipping

Is Micro Flipping Legit?

This is a very common question that we receive on our blog and in emails from readers. People want to know if it’s possible to make money with this business model, or are they simply setting themselves up for failure? The truth is that micro-flip investing is completely legitimate, and you can turn a profit by following the right steps.

What Do I Need to Get Started in Micro Flipping Real Estate?

To begin the micro-flipping process, you must first have enough money and resources to fix a property. That means spending money on repairs, renovations, and other costs that come with flipping houses for a profit. It would be best if you also were willing to deal with these issues without giving up and stopping the process. Many factors stand in your way and make things difficult, but you must learn to push through them and accomplish what you started to do.

How can I get started with micro-flipping?

To start micro-flipping, follow these steps:

- Educate Yourself: Learn about real estate markets, flipping processes, and the financial aspects involved. Resources include online courses, real estate seminars, and books.

- Market Research: Analyze local real estate markets to identify areas with high potential for quick sales. Look for properties that are undervalued and in high demand.

- Financing: Determine how you will finance your purchases. Options include personal savings, loans, or investment partners.

- Build a Network: Connect with real estate agents, contractors, and other flippers. A strong network can provide valuable insights and services.

- Start Small: For your first flip, choose a property with minimal repair needs to manage risks and gain experience.

- Legal and Regulatory Compliance: Understand the legal and regulatory requirements in your area to ensure compliance throughout the buying and selling process.

Is micro-flipping profitable?

Yes, micro-flipping can be profitable, but it depends on several factors:

- Market Conditions: Profitability is closely tied to market dynamics. Flippers must understand and react to local housing market trends.

- Property Selection: Choosing the right properties is crucial. Profitable flips often involve properties that are purchased below market value and require minimal refurbishment.

- Cost Management: Keeping repair and renovation costs low while maintaining quality is vital for maximizing returns.

- Sales Strategy: Effective marketing and negotiation strategies can lead to quicker sales and higher prices.

- Experience: As flippers gain more experience, they can optimize their processes and decision-making to increase profitability.

Is It Harder Than Wholesaling Real Estate?

All investments are inherently more difficult than wholesaling because you have to put a lot of effort and energy into the process without any promise of success. Micro-flipping is more difficult than wholesaling because you have to deal with a lot more variables along the way, from finding properties that will need good renovation jobs to market your services and convincing people to hire you for their house flipping needs.

How Much Money Can I Make as a Micro Flipper?

This question is mostly based on the amount of money that you’re willing to invest in the process. The more you spend, the higher your profit margins will be at the end, and vice versa. However, it’s important to understand that this business model is a long game, and you have to be willing to sacrifice your time and energy for it to work. You won’t see an instant return on your investment, but you can build up a good living for yourself once you get the hang of things.

Is It Easy to Get Started Micro-Flipping?

Some people find it easier to get into this business model than others, but that’s always going to be relative. The only way you’ll know for sure is by trying out the process and seeing how far you can get with it in a certain amount of time.

What kind of real estate software do you need?

The answer depends on the level of automation you want. The more work you want to do, the more you’ll need. Many agents don’t use any software. But, you can use Mashvisors Chatbots to do almost everything. They have databases with real-time housing prices and rent. Moreover, with their property assessment tool, you can enter an address to discover the value of any property in the USA (even commercial).

How much does it cost to start micro-flipping?

It can be as little as $5,000. But you have to spend more money on marketing etc. So, the total investment is closer to $10k or $15k per deal. However, it’s one of the least expensive businesses to start.

What’s the biggest mistake people make when micro-flipping?

They are failing to spend enough money. Unfortunately, most people don’t have enough capital to renovate a property properly, so they always lose on deals.

Can Micro-Flipping Lead to Real Estate Investments and Other Profitable Ventures?

Some people use micro-flip investing as a stepping stone to bigger and better investments. For example, they fix up lots of properties to have enough money saved up to move on and invest in real estate businesses that make money.

Jack Roberts has spent the last 5 years in the Private Money Lending world helping real estate investors secure financing for their non-owner occupied real estate investments. When he’s not thinking about real estate, Adam is an avid Jazz music fan and fisherman.