Last Updated on May 2, 2024

With real estate seeing a massive interest in recent years, many don’t want to miss out on the investment opportunity. It can, though, be a challenge to raise capital for a real estate development, especially if you’re new and don’t know where to start. If this sounds like you then this article is a must read. You’ll discover how to raise money for real estate development and some of the best ways to raise capital for real estate investment.

From hard money lenders to crowdfunding to traditional financing, we’ll cover all the options available to you for raising money for real estate development. We’ll also discuss the steps needed to securing real estate investment capital, including developing a solid business plan and networking with potential investors. With the right approach, you can be sure to secure the capital you need to make your real estate development dreams a reality.

What Is Real Estate Development?

However, real estate development requires much hard work, knowledge, and capital which are all reasons why it’s important to understand the industry’s ins and outs before diving in.

There are many real estate development projects including residential, commercial, and industrial.

Residential Development

Residential development includes everything from single-family homes to multi-family properties like apartments and condos.

Commercial Development

Commercial development includes office buildings, retail centers, and restaurants.

Industrial Development

Industrial development includes factories, warehouses, and similar properties.

Real estate development projects can range in size and scope from small-scale renovations to large-scale new construction projects. The steps involved in a real estate development project will depend on the type of project you’re working on and the available resources.

Steps A Real Estate Development Project Include

Researching and Identifying Potential Development Opportunities

This includes identifying properties that have the potential for development and determining their value.

Developing A Business Plan

A business plan is crucial to any real estate development project. It should include details on the project you’re planning, the costs involved, and your expected return on investment.

Securing Financing

Real estate development requires a significant amount of capital. There are many ways to secure financing for a real estate development project, including traditional loans, equity investment, and owner financing.

Obtaining Necessary Permits and Approvals

While it varies depending on the project you’re working on, you need to attain various permits and approvals from local, state, and federal agencies. This can be time-consuming, but it’s important to ensure you have all the necessary approvals before moving forward with your project.

Managing The Construction Process

Once you’ve secured financing and obtained all necessary approvals, the next step is to manage the construction process. This can include coordinating with contractors, overseeing the work, and ensuring the project stays on track and within budget.

Marketing and Selling The Finished Product

Once your real estate development project is complete, the next step is to market and sell the finished product. This can include working with real estate agents, advertising the property, and negotiating with potential buyers or renters.

As you can see, real estate development is a complex and multifaceted process. It requires a significant amount of capital and a solid understanding of the industry. But taking into consideration the above, real estate development can be a highly lucrative and rewarding pursuit.

How To Raise Money For Real Estate Development Projects?

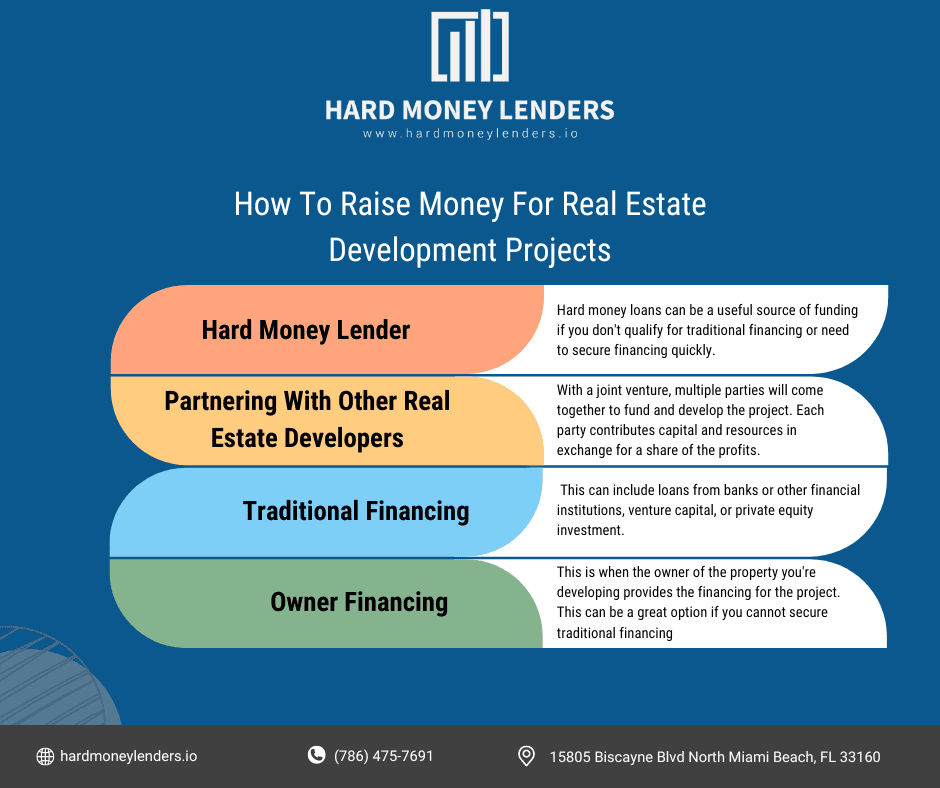

Hard Money Lender

If you’re looking to raise money for your real estate development project, one option you might consider is a hard money lender. These private individuals or companies provide short-term loans to real estate investors. Hard money loans can be a useful source of funding if you don’t qualify for traditional financing or need to secure financing quickly.

To get a hard money loan, you’ll typically need to present a detailed business plan and financial projections for your project, along with collateral such as a mortgage on the property. The lender will also assess your creditworthiness and experience in real estate development.

Partnering With Other Real Estate Developers

Another option for raising money for your real estate development project is to look for partners or investors through a joint venture arrangement. With a joint venture, multiple parties will come together to fund and develop the project. Each party contributes capital and resources in exchange for a share of the profits. This can be a great way to share the risk and rewards of the project, as well as bring different skills and expertise to the table.

To find potential partners for a joint venture, you can network with other real estate professionals, attend industry events, or look for opportunities through online platforms. It’s important to carefully vet any potential partners and to negotiate a clear and fair agreement that outlines the terms and conditions of the joint venture. You might also want to consider working with a lawyer or financial advisor to help structure the deal.

Crowdfunding

Crowdfunding is a popular way to raise money for all sorts of projects, including real estate development. With crowdfunding, you can pitch your project to many people and ask them to contribute small amounts towards your goal. Several crowdfunding platforms are available, including Kickstarter, Indiegogo, and GoFundMe. Each platform has its own set of rules and requirements.

Traditional Financing

If you have a solid business plan and a good credit score, you may be able to secure traditional financing for your real estate development project. This can include loans from banks or other financial institutions, venture capital, or private equity investment.

To secure traditional financing, you’ll need to develop a strong business plan of your project to pitch to potential lenders or investors. This can be time-consuming, but will be worth it in the long run if you can secure the capital you need.

Owner Financing

Another option for raising money for real estate development is owner financing. This is when the owner of the property you’re developing provides the financing for the project. This can be a great option if you cannot secure traditional financing or if the owner is willing to take on the investment risk in exchange for a share of the profits.

Government Grants

If your real estate development project aligns with certain government priorities or initiatives, you may be able to secure funding through grants. These grants are typically awarded to projects that offer a public benefit, such as affordable housing, community development, or environmental sustainability.

To apply for a government grant, you’ll need to research available grants and submit a proposal outlining your project and how it meets the eligibility criteria. The grant application process can be competitive, so developing a strong proposal and following all the guidelines and requirements is essential.

How To Secure Real Estate Investment Capital

Now that we’ve covered some ways you can raise money for real estate development, let’s discuss how to secure investment capital. This can be challenging, but can increase your chances of success.

Build A Strong Network

One of the key ways to secure real estate investment capital is by building a strong network of professionals and potential investors. This can include real estate agents, mortgage brokers, lawyers, and other industry professionals who can help you identify potential investment opportunities and connect you with the right people. It’s also a good idea to attend industry events, such as real estate conferences or networking groups to meet potential investors and learn about the latest trends and opportunities in the market.

Create A Solid Business Plan

Another important step in securing real estate investment capital is to create a solid business plan. This should outline your investment strategy, including the types of properties you plan to invest in, the target market, and your exit strategy. It’s also a good idea to include financial projections, such as your expected return on investment and the timeline for repaying any loans or investors. A well-written business plan will help you demonstrate the potential of your investment to potential investors and lenders.

Explore Different Financing Options

As described above, there are many ways to finance a real estate investment, including traditional loans, construction loans, hard money loans, and crowdfunding. It’s important to explore your options and determine which is the best fit for your investment strategy. For example, traditional loans may be a good option for a long-term investment, while hard money loans may be more suitable for a short-term flip.

Consider Using Collateral

Another way to secure real estate investment capital is by using collateral, such as another piece of property or a stock portfolio to secure a loan or investment. This can help you negotiate better terms and potentially secure a larger loan or investment. However, it’s important to consider the risks of using collateral, as you could lose the asset if you default on the loan or investment.

Present A Strong Pitch

Finally, when you’re ready to pitch your project to potential investors, it’s important to be confident and well-prepared. Practice your pitch beforehand, have a clear and concise presentation, and be ready to answer any questions that may come up. The more professional and confident you appear, the more likely you are to secure investment capital.

How Do Real Estate Developers Find Investors?

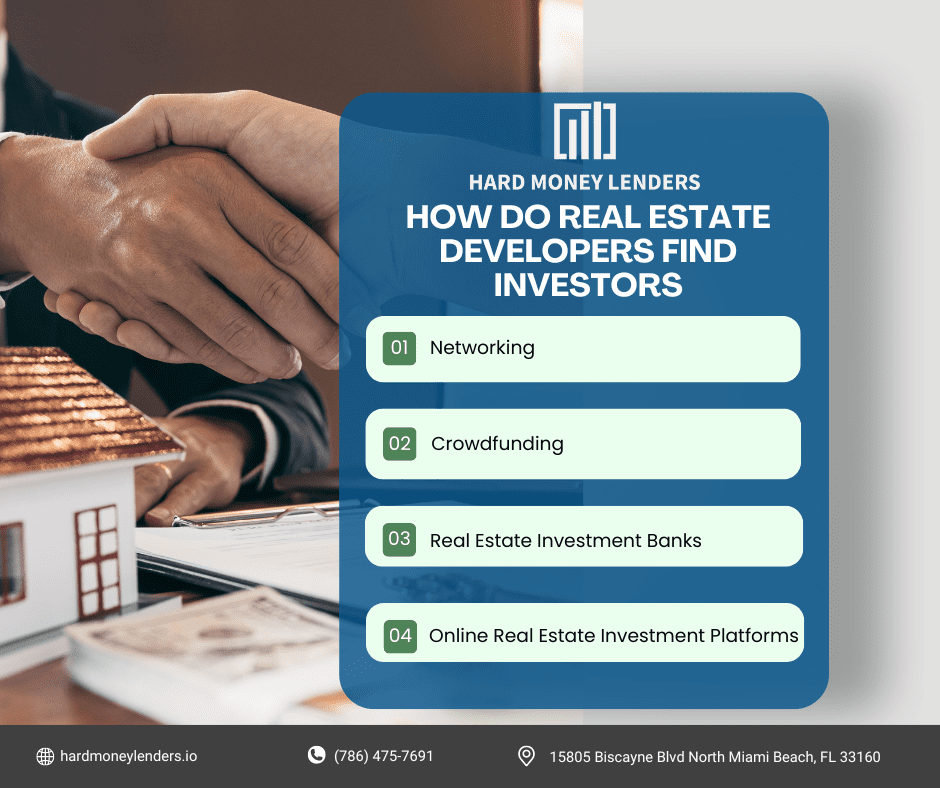

Networking

Networking is key to finding investors for your real estate development project. Attend industry events, join real estate investment groups, and connect with potential investors.

Crowdfunding

Crowdfunding platforms like Kickstarter and Indiegogo can be great options for finding investors for your real estate development project. You can raise the capital you need by pitching your project to many people and asking for small contributions.

Real Estate Investment Banks

Hiring a real estate investment bank can be a great way to find investors for your project. These firms specialize in connecting real estate developers with potential investors and can help you secure the capital you need.

Online Real Estate Investment Platforms

Several online platforms connect real estate developers with potential investors. These platforms allow you to create a profile for your project and pitch it to many potential investors.

How Do Real Estate Development Companies Make Money?

A real estate development company makes money by acquiring land and developing it into residential, commercial, or industrial properties that are then sold or leased to generate revenue. There are several different business models that a real estate development company can use to make money, each with its own set of advantages and disadvantages.

Residential Properties

One common business model is to acquire land and develop it into residential properties, such as single-family homes or apartment buildings, which are then sold to individuals or families.

Example

A real estate development company may purchase a piece of land in a rapidly growing area and build a new housing development that includes both single-family homes and townhouses. The company earns money from the sale of each property and may also charge additional fees for things like landscaping or upgrades.

Commercial Properties

Another business model is to acquire land and develop it into commercial properties, such as office buildings, retail centers, or warehouses, which are then leased to businesses.

Example

A real estate development company may purchase a piece of land near a busy commercial area and develop an office complex that includes multiple buildings. The company earns money from the rent paid by the businesses that lease space in the complex.

Real estate development companies generate revenue by acquiring land, developing it, and then selling or leasing the resulting properties. The business model used will depend on the specific goals of the company and the type of property being developed. Whether it’s through residential or commercial properties the key to success for a real estate development company is identifying profitable opportunities and effectively managing the development process.

How Do I Get Into Property Development With Little Money?

Starting a career in property development can seem intimidating, especially if you have a limited amount of capital to invest upfront. However, you can use a few strategies to get started, even with a limited budget.

Partner With A Developer or Investor

One option is to partner with a developer or investor with more financial resources. You can bring your skills and expertise to the table, and they can provide the capital needed to get the project off the ground. This is a great way of gaining experience and learning the nuances of the industry, while having the backing of someone with more financial resources.

Build Portfolio

Another option is to start small and gradually build your portfolio. Rather than tackle a large, expensive development project immediately, you could start by buying a small fixer-upper property and renovating it. This can be a more manageable way to gain experience in property development and help you build up the skills and knowledge needed to tackle larger projects in the future.

Alternative Financing Options

Finally, consider using alternative financing options, such as crowdfunding or private loans. These options provide the capital needed to get your project off the ground without requiring a large upfront investment.

Starting a career in property development with little money requires creativity and outside-the-box thinking. But with the right strategies it is possible to begin building a successful career in the industry.

Conclusion

In this ultimate guide, we hope we have answered your questions surrounding how to raise capital for real estate. We’ve discussed raising money through a hard money lender, partnering with other developers, crowdfunding, traditional financing, owner financing, and government grants. We’ve also discussed securing real estate investment capital, including developing a solid business plan, networking with potential investors, and presenting a strong pitch.

No matter where you are in your real estate development journey, options for securing the capital you need are available. With hard work, persistence, and a good understanding of the industry, you can raise the money you need to make your next real estate development well on its way. We hope this guide has provided you with some valuable insights and ideas to get you started.

FAQs

FAQs

What is a typical profit-sharing structure for a real estate development joint venture?

A typical profit-sharing structure in a real estate development joint venture can take several forms, but it’s typically designed to align with each partner’s level of capital contribution, expertise, and risk exposure. One common approach is an equal split of profits after all invested capital has been returned. However, more complex arrangements are also prevalent.

For instance, a waterfall distribution model may be used where profits are divided into tiers, with the first tier focused on returning all invested capital. Subsequent tiers distribute remaining profits with a larger percentage going to the partner who took on more risk by providing most of the equity investment. Developers who contribute land instead of cash may negotiate a higher profit percentage to account for that contribution of capital.

Another model pays out a preferred return to the investment partners first, up to an agreed percentage, before splitting remaining profits between the partners. This incentivizes both operating expertise and capital provision. Overall, the structure aims to be fair in compensating partners respective to their resource commitments while still motivating all parties to maximize the project’s success.

How do I find reputable and qualified investors for a real estate development project?

Finding the right investors requires tapping into both online and offline networking channels within the real estate domain. For an offline approach, join local real estate investment clubs or associations to build connections with prospective investors. Attending major industry conferences or participating in webinars can also facilitate in-person introductions.

Online, leverage professional platforms like LinkedIn to join relevant groups and build your network. There are also specialized crowdfunding platforms focused on real estate investment opportunities. These can help broadcast your project to a wider pool of accredited or institutional investors.

Regardless of the channel, conduct thorough due diligence on any investor’s background. Review their history, get references from previous partners, and evaluate their financial capacity. Transparency from the outset about the risks, projected returns, and overall investment thesis is critical for attracting and retaining qualified investors.

Many successful real estate developers have found their initial investors were people already within their personal or professional networks who believed in their capability to execute on projects. As you build a track record, your reputation can precede in attracting new investment partners.

When considering a hard money loan, what factors should I use to compare different lenders?

When vetting hard money lenders, evaluate these key aspects to ensure you secure optimal financing terms:

- Interest Rates and Fees: Look beyond just the stated interest rate. Understand all the potential fees like points, origination charges, underwriting fees etc. Calculate the annual percentage rate (APR) to get a true overall cost comparison.

- Repayment Flexibility: Hard money loans are typically interest-only for a short term period. Assess how rigid or flexible the lender is regarding repayment schedules based on your expected project timeline and exit strategy.

- Speed and Responsiveness: Some hard money lenders can provide funding incredibly quickly while others take weeks. If speed is critical for your project, prioritize lenders who have a reputation for fast turnaround times.

- Lender’s Experience: Look at the lender’s history – how long they’ve operated, what types of projects they typically fund, and their underwriting guidelines. More experienced lenders may offer better terms.

- Customer Service Approach: Read reviews and get a sense of the lender’s customer service philosophy. Are they easy to communicate with, provide guidance along the way, or is it an adversarial approach?

Overall, getting multiple quotes and doing your due diligence on reputability is crucial when securing a hard money loan, as terms can vary significantly between lenders.

How do real estate developers raise money?

Real estate developers leverage a diverse range of capital sources to fund their acquisition, construction, and operations costs:

- Private Equity/Venture Capital: Developers often partner with private equity firms or real estate funds that invest equity capital into promising projects in exchange for an ownership stake.

- Joint Ventures/Syndications: Pooling resources with other real estate firms, investment groups, or high net worth individuals via a joint venture structure allows developers to share risk while raising substantial capital commitments.

- Commercial Bank Loans: Traditional lenders provide construction loans, acquisition loans, lines of credit and permanent mortgages backed by the underlying real estate asset.

- Hard Money Loans: Private lending sources offering short-term, asset-backed loans at higher interest rates to fill interim financing gaps or facilitate quick closings.

- Mezzanine/Subordinated Debt: This additional layer of debt financing is subordinate to senior loans but provides needed capital while keeping equity ownership intact.

- Crowdfunding: Online investment platforms like CrowdStreet allow developers to market investment opportunities to accredited or institutional investors and raise equity or debt capital.

Successful developers create an optimized capital stack utilizing a blend of these various sources most suitable for each project’s needs, scale, risk profile and hold period.

How is money made in real estate development?

Developers earn profits from real estate projects primarily through three key mechanisms:

- Value Creation Through Physical Enhancement: The core profit driver is taking an undeveloped, underzoned or undermanaged real estate asset and improving it through new construction, renovations, re-positioning or re-entitling the property. These enhancements increase the property’s market value, allowing the developer to sell it at a premium over their total cost basis.

- Income Cash Flows: For projects with revenue-generating components like multifamily rentals or retail leases, developers earn income over the investment holding period. Effective management and marketing can maximize this cash flow.

- Equity Appreciation & Mortgage Currency Appreciation Capital invested into the project appreciates alongside the rising value of the real estate. Additionally, any amortizing debt financing creates increases the developer’s equity ownership over time.

Developers aim to time their exits – whether via sale, refinancing, or cashing out of partnerships – when market conditions are most advantageous to maximize their blended returns from these various profit sources.

What are some common mistakes first-time real estate developers make when raising money?

New developers often fall into several common pitfalls when initially trying to raise capital:

- Unrealistic Expectations on Valuation/Returns: Many first-time sponsors overestimate potential project valuations and underestimate total costs, leading to overly optimistic projections that don’t inspire investor confidence.

- Inadequate Capital Reserves: A failure to budget enough capital reserves and contingencies puts undue strain when unexpected costs arise, such as construction delays, subcontractor issues, regulatory hurdles etc.

- Insufficient Market Research: Backing development plans with only surface-level market data and assumptions about absorption/lease-up periods, rental rates etc. can create shortfalls in project revenues.

- Poor Legal Structuring: Not having solid partnership agreements and investor documentation creates ambiguity around fees, profit shares, liabilities, exit strategies and other key deal points.

- Weak Marketing Effort: Many sponsors underestimate the time and resources required to build credibility and effectively market their capital raise to potential investors through multiple channels.

How can I exit a real estate development project successfully, maximizing my profits?

For a successful and profitable exit on a development project, planning should start from the initial underwriting phase:

Exit Strategies

Properties can exit an investment portfolio through various means – an outright sale, executing a recapitalization with new investment partners, doing an IPO/listing for larger portfolios, or continuing to hold for cash flows. Determine the optimal exit based on asset type, holding period, market conditions and investor return requirements.

Market Cycles & Timing

Position your exit to achieve a sale when market fundamentals are peaking in terms of occupancy, rents, absorption etc. Track supply/demand metrics to forecast optimal periods versus up-cycles or down-cycles.

Marketing & Positioning

Conduct strategic marketing campaigns to investors, brokers or potential buyers well in advance of the targeted exit window. Stage and position the assets to highlight their full revenue optimization.

Tax Planning

Structure the exit plan to maximize tax efficiency across any applicable capital gains, depreciation expenses, carried interest distributions etc.

Professional Representation

Engage top legal counsel, brokers and accounting experts who can properly represent and position the assets, facilitate negotiation and transaction processes for the most favorable deal terms.

Are there any regulatory requirements or reporting obligations for real estate development projects I need to be aware of?

Real estate development is a highly regulated arena with a myriad of specific requirements, processes and reporting obligations depending on the project’s location, scope, and financing sources utilized. Some key areas that developers must pay close attention to:

- Land Use/Zoning: Every municipality has its own zoning laws and procedures governing what can be built where. Developers must ensure projects align with land use requirements and pursue any necessary approvals like re-zoning, variances, conditional use permits etc.

- Building Codes & Inspections: All construction must adhere to stringent local, state and federal building codes focused on structural integrity, fire safety, accessibility and other factors. Projects require permitting and scheduled inspections throughout the construction process.

- Environmental Regulations: Depending on the site’s characteristics and prior uses, developers may need to comply with regulations around site remediation, wetlands protection, stormwater management and more.

- Financing Requirements: Projects utilizing public financing sources like municipal bonds, EB-5 investment immigration programs, low-income housing tax credits etc. have substantial ongoing compliance, reporting and auditing requirements.

- Fair Housing/Labor Laws: Multi-family residential and commercial properties must comply with fair housing laws, while all development faces scrutiny around proper labor practices, workplace safety, etc.

- Securities Laws: If raising private capital from investors, developers must ensure proper compliance with securities regulations around marketing materials, disclosures, periodic reporting and more.

Jack Roberts has spent the last 5 years in the Private Money Lending world helping real estate investors secure financing for their non-owner occupied real estate investments. When he’s not thinking about real estate, Adam is an avid Jazz music fan and fisherman.