How Much Does It Cost to Flip a House?

There’s a lot to consider when entering the world of house flipping. Two of the most common questions among new investors are: how much does it cost to flip a house and will I make a significant profit? To answer these questions and help you create a budget for your first flip, let’s go over a few key factors.

How Much Does It Cost to Flip a House?

Rehab and renovations

Along with the cost of the house, there are costs associated with the rehab of the house, including the materials and hiring contractors to do the work you can’t (or don’t want) to do. Investors new to flipping houses will probably choose to start with single-family properties vs. multi-family properties to cut down on costs for rehab and renovations. Of course, the average renovation costs depend significantly on the current state of the home. A home that just needs some fresh paint and a new appliance or two will be less expensive than a home that needs a new roof, walls, or a complete gut job.

Home renovations usually fall under three categories: cosmetic, moderate, and extensive. Aesthetic or cosmetic repairs are going to be the least expensive to make, but will contribute significantly to the profit you make when selling the home.

Buying a home that just needs some cosmetic repairs and some TLC can drastically improve your return on investment. New investors can learn as they go by starting with a home that just needs a little love, and work their way up to homes that need significant repairs. However, the beautiful thing about house flipping is that with the right tools, resources, and time, you can successfully flip a house regardless of your experience. You’ll probably learn a lot from trial and error, but that’s all part of the fun, right?

The end goal is to get as much for the property as possible without putting a ton of money into it. Doing things like replacing cabinet hardware or giving an interior room (or two) a new coat of paint can give the home an upgraded feel and increase the purchase price. When it comes to buying new appliances, don’t forget to factor in the cost of delivery and labor to get them installed properly.

Moderate repairs include things like renovating the kitchens and bathrooms or painting the exterior. These things will require the knowledge and experience of a licensed contractor, which means your labor costs will be higher than for cosmetic repairs. Homes that need these types of repairs will probably be cheaper to buy, but remember to consider the time that it’ll take to complete these renovations and what costs will be carried over during that time.

Homes that are in need of another bathroom or have serious issues with the roof or the foundation will be tempting to purchase because the acquisition price is so low. Consider the money, time, and commitment before investing in a property that needs extensive repair work.

The longer it takes you to flip a house, the more you’ll pay in carrying costs, which include utilities, financing, and property taxes. As you become more experienced, the time period between purchase and sale will decrease, and so will the costs. Along the way, you’ll learn the tips and tricks to save time and money. But if you are new to the game, avoid getting stuck with a property that takes forever to renovate and ends up costing you more.

Insurance and utilities

There’s the cost of the home, the cost to make the renovations, and then there are taxes, insurance, and legal costs. It’s necessary to buy property insurance when you’re investing in a fix and flip. Property insurance varies greatly by location, so it’s important to figure out the average cost in your area and work that into your budget as well. Contractors need water and lights in order to do their jobs, so it’s imperative that you get the utilities for the home up and running as soon as possible to avoid delays. To get an idea of what this will cost you, you can contact the previous owner for a breakdown of the average monthly utility bills.

Marketing

Once the fixing is done, the flipping can get underway. Getting the word out that you’ve got a recently renovated property for sale may not be as easy (or cheap) as you think. While word of mouth, “For Sale” signs in the yard, and social media are great places to start, you may want to consider adding specific marketing techniques to the budget. One of the most popular ways to get the word out is by working with a realtor. Realtors do a lot of behind the scenes work so that you can find qualified buyers without spending a lot of time. You’ll have to pay them for their services, of course, but it could be worth it if you don’t have the time, experience, or network to advertise your property effectively.

Doing the math

Understanding that there are a variety of different factors that contribute to the cost of fixing and flipping a house is one thing, figuring out how to work your specific budget around your unique situation — that’s something else altogether.

Some investors pay cash for their first properties, but this is not realistic for everyone. If you’re planning to finance your investment, there are a few things you need to know. First, hard money lenders are in the business of lending money to real estate investors. Unlike traditional mortgage companies or banks, hard money lenders loan money based mainly on the property value. This is a great option when you need money quickly and want a loan that is a little more flexible than a traditional loan.

After Repair Value

Once you get your financing in order, there are more numbers to crunch. Having a solid idea of your after-repair value (ARV) will help you set a realistic budget to flip a house. This is the final value of the home, after you’ve worked all your magic and completed all the upgrades. A good way to figure out your ARV is to check out the competition. Seek out comparable homes in the area that are similar to your property in size, location, and upgrades. Determine how much they’ve sold for in the last three months, and this will give you a good idea of what the price tag at the finish line will look like in your situation. The ARV is the total of the purchase price plus the cost of repairs. After you’ve determined the selling price of the home, you’ll be able to budget accordingly, including your renovation costs.

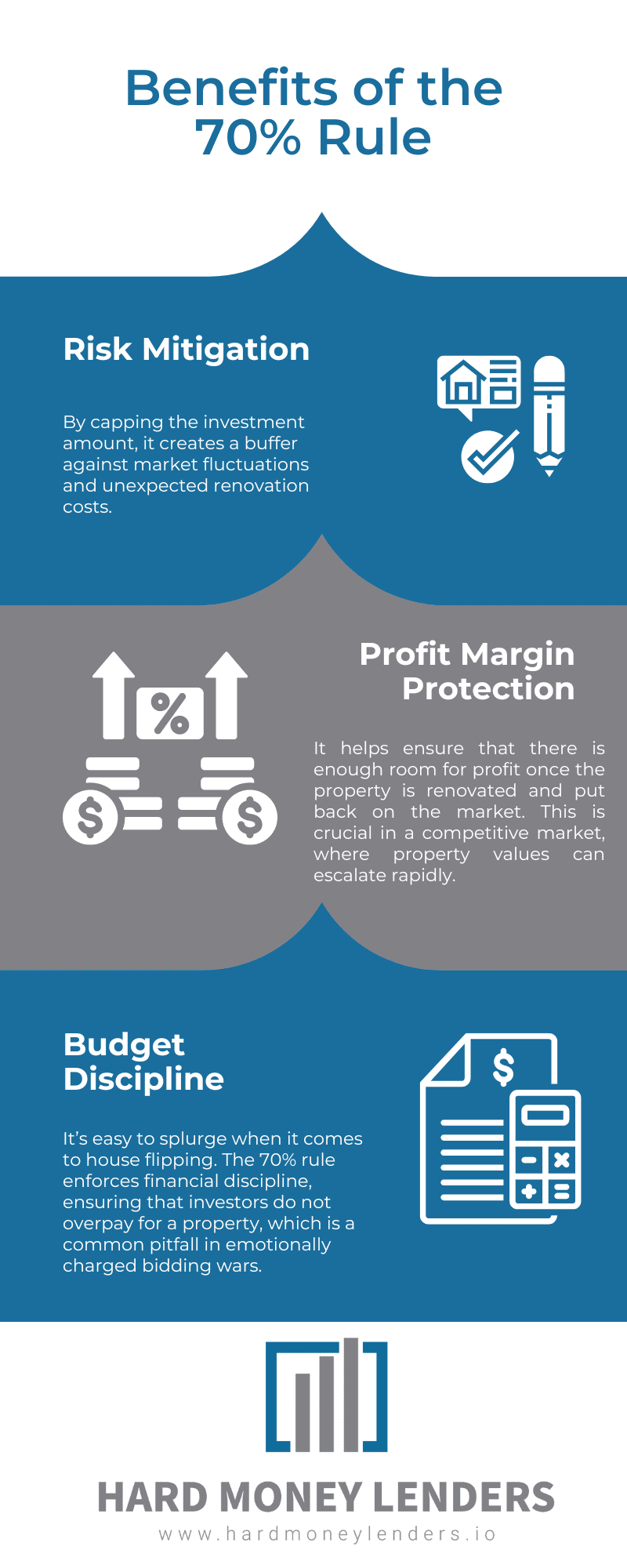

The ARV can also help you determine the best price to bid on a property. The rule of thumb is to bid up to 70% of the expected sales price. To calculate the best price to bid on a fixer-upper, follow this formula:

best bid price = (ARV x 70%) – cost of repairs

This means if you find a property that has an ARV of $150,000 and you figure it’s going to need $30,000 worth of repairs, the highest price you should be willing to pay for the property is $75,000. This will provide a buffer when it comes to the repairs, marketing, and other costs.

Determining Your ROI When Flipping A House

So is flipping houses profitable? If done correctly, absolutely. There is a reason why so many people find excitement, purpose, and wealth in this particular real estate investing strategy. Investors are always focused on the end goal: return on investment. There are a few different ways to calculate your ROI when it comes to fix and flip investments:

The out-of-pocket method

This method takes into consideration the money you spend out of pocket to fix and flip the property. If you are financing the home, the down payment, plus the cost of renovations, is what you use to determine the out of pocket amount.

Example:

Let’s say you put $15,000 down toward the purchase of a house and anticipate spending $30,000 in repairs. Your out of pocket costs are $45,000. If, after all of the upgrades, the property is worth $180,000, you would have $135,000 in equity ($180,000-$45,000=$135,000).

When you divide your equity by the total value of the home, you get a percentage of 0.75 or an ROI of 75%. That may seem like a pretty good deal on paper, but you have to remember that the percentage is so high because, in this example, the amount of cash you are putting towards the project up front is high. This method takes into account all of the out-of-pocket expenses while also relying on the leveraging of financing to come up with a (usually) higher ROI than the cost method.

The cost method

Another way to calculate your ROI is to simply divide the equity you have in a home by the sum of all costs. This method requires factoring in all costs that come with the acquisition of the property and the rehab.

Example:

Suppose you purchase a rental property for $130,000 and spend $12,000 in repairs. Your total investment would be $142,000. If you rent out your property for $1,100 a month, you’ll earn $13,200 over the course of a year. Now factor in property tax and insurance ($200 each a month or $2,400 annually, in this example). You’d figure out your ROI this way:

Your net operating income is your rental income minus expenses, which in this case would be $13,200-$2,400=$10,800.

Your ROI is your net operating income divided by your total investment, which would be $10,800/$142,000 or 7.6%.

In order to flip houses successfully, you have to estimate how much you need going in and how much each step is going to cost you. From making the smartest bid on a property to calculating everything from labor costs to utilities, creating a well-thought-out budget before you get started is critical to your success.

Acquisition Costs and Financing Fees

Property Purchase Price

The cost to acquire the property is the initial major expense in house flipping. This price varies greatly depending on the location, property condition, and market conditions. It is crucial to research comparable properties in the area to make an informed bid. Tools like the MLS (Multiple Listing Service) and real estate websites can help you gather data on recent sales prices and market trends.

Financing Costs

If you’re not paying cash for the property, financing your flip will incur additional costs. These may include:

- Loan Origination Fees: Lenders charge these fees for processing the loan application. They typically range from 1-2% of the loan amount. This fee covers the administrative costs of creating the loan.

- Interest Payments: Depending on the loan terms, interest payments can add up significantly over the holding period. Traditional mortgage rates might be lower, but hard money loans, which are often used for flips due to their flexibility and speed, usually come with higher interest rates ranging from 8-15%.

- Private Lender Fees: If you use private lenders or hard money loans, you may face higher interest rates and additional fees. These can include points (percentage points of the loan amount) paid upfront, which are common in hard money lending. For instance, a 2-point fee on a $100,000 loan would cost you $2,000.

Closing Costs

Title Insurance and Escrow Fees

When purchasing a property, obtaining title insurance is essential to protect against any ownership disputes. Escrow services manage the transaction funds, ensuring both parties meet the agreed terms. These fees are typically a percentage of the property’s purchase price. Title insurance can cost around 0.5-1% of the purchase price, while escrow fees might range from 1-2%, depending on the service provider and location.

Attorney Fees

Legal advice is crucial to navigate the complexities of property acquisition and renovation contracts. Attorney fees should be factored into your budget to cover the review of contracts, closing documents, and any legal issues that arise during the project. Typical attorney fees can vary but often fall between $500 and $1,500 for basic real estate transactions. Complex issues or additional legal work may increase these costs.

Permit and Inspection Fees

Building Permits

Renovation projects require various permits depending on the scope of work. Permit costs vary by location and the extent of the renovations. For example, a permit for a simple electrical upgrade might cost $50-$200, while permits for extensive structural changes can run $500-$2,000 or more. Ensuring all necessary permits are obtained is crucial to avoid fines and delays in your project.

Inspection Fees

Hiring professional inspectors before purchasing and during renovations can identify potential issues early, preventing costly surprises. Inspection fees can include:

- General Home Inspections: Typically cost between $300 and $500.

- Pest Inspections: Usually cost around $50 to $150.

- Specialized Inspections (e.g., structural, electrical): Costs can vary significantly, often ranging from $200 to $500 per inspection.

Investing in thorough inspections helps ensure you address all potential issues, contributing to a smoother flipping process and protecting your investment.

Holding Costs

Property Taxes

Property taxes are a recurring expense that you’ll need to cover while you own the property. The amount varies based on the property’s assessed value and the local tax rates. These taxes can be a significant cost, especially if you hold the property for an extended period. To estimate your property taxes, you can contact the local tax assessor’s office or use online property tax calculators. Budgeting for these costs helps ensure that you won’t be caught off guard by a large tax bill.

Utility Costs

During the renovation period, you’ll need to maintain utilities such as electricity, water, and gas. These services are essential for contractors to perform their work and to keep the property in good condition. The cost of utilities can add up, especially if the renovation takes several months. To get an accurate estimate, contact the previous owner or the utility companies to understand the typical monthly costs. Ensure these expenses are included in your overall budget to avoid financial strain.

Selling Costs

Real Estate Agent Commissions

If you choose to work with a real estate agent to sell your flipped property, their commission will typically be a percentage of the final sale price. This commission usually ranges from 5-6%. While this might seem like a significant expense, a good real estate agent can help you sell the property faster and often at a higher price, which can offset their commission. Be sure to account for this cost when planning your budget and determining your potential profit margins.

Staging Costs

Staging a property can significantly enhance its appeal to potential buyers, often resulting in a quicker sale at a higher price. Staging costs can vary widely depending on whether you hire a professional stager, rent furniture, or purchase new items to showcase the home. Professional staging can range from $1,000 to $3,000 or more, depending on the size of the home and the level of service. Budgeting for staging is essential as it can provide a good return on investment by making the property more attractive to buyers.

Miscellaneous Costs

Marketing Expenses

In addition to real estate agent commissions, there are other marketing expenses to consider. Effective marketing strategies can include professional photography, virtual tours, and online advertising to attract potential buyers. Professional photography can cost between $200 and $500, while virtual tours and online advertising can add several hundred dollars more to your budget. These expenses are crucial for ensuring your property reaches a wide audience and sells quickly.

Contingency Fund

Unexpected issues are common when flipping houses, so it’s wise to allocate a contingency fund. This fund should be at least 10-20% of your total budget to cover unforeseen expenses such as additional repairs, increased material costs, or unexpected delays. Having a contingency fund ensures that you have the financial flexibility to handle any surprises without derailing your entire project. This proactive approach can save you from significant stress and financial strain, ensuring your flipping project stays on track.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.